The non-employee director stock option prospectus explains the stock option plan to the non-employee directors. It addresses the director's right to exercise the option of buying common stock in the company, along with explaining the obligations of the non-employee director where taxes and capital gains are concerned.

Puerto Rico Nonemployee Director Stock Option Prospectus

Description

How to fill out Nonemployee Director Stock Option Prospectus?

US Legal Forms - one of many largest libraries of authorized varieties in the USA - delivers a wide array of authorized file layouts you can download or print. While using site, you may get a large number of varieties for enterprise and person functions, sorted by categories, says, or key phrases.You can get the most up-to-date models of varieties much like the Puerto Rico Nonemployee Director Stock Option Prospectus in seconds.

If you already have a monthly subscription, log in and download Puerto Rico Nonemployee Director Stock Option Prospectus from your US Legal Forms catalogue. The Down load option will show up on every single form you perspective. You have access to all previously saved varieties in the My Forms tab of the profile.

In order to use US Legal Forms initially, here are basic directions to obtain started:

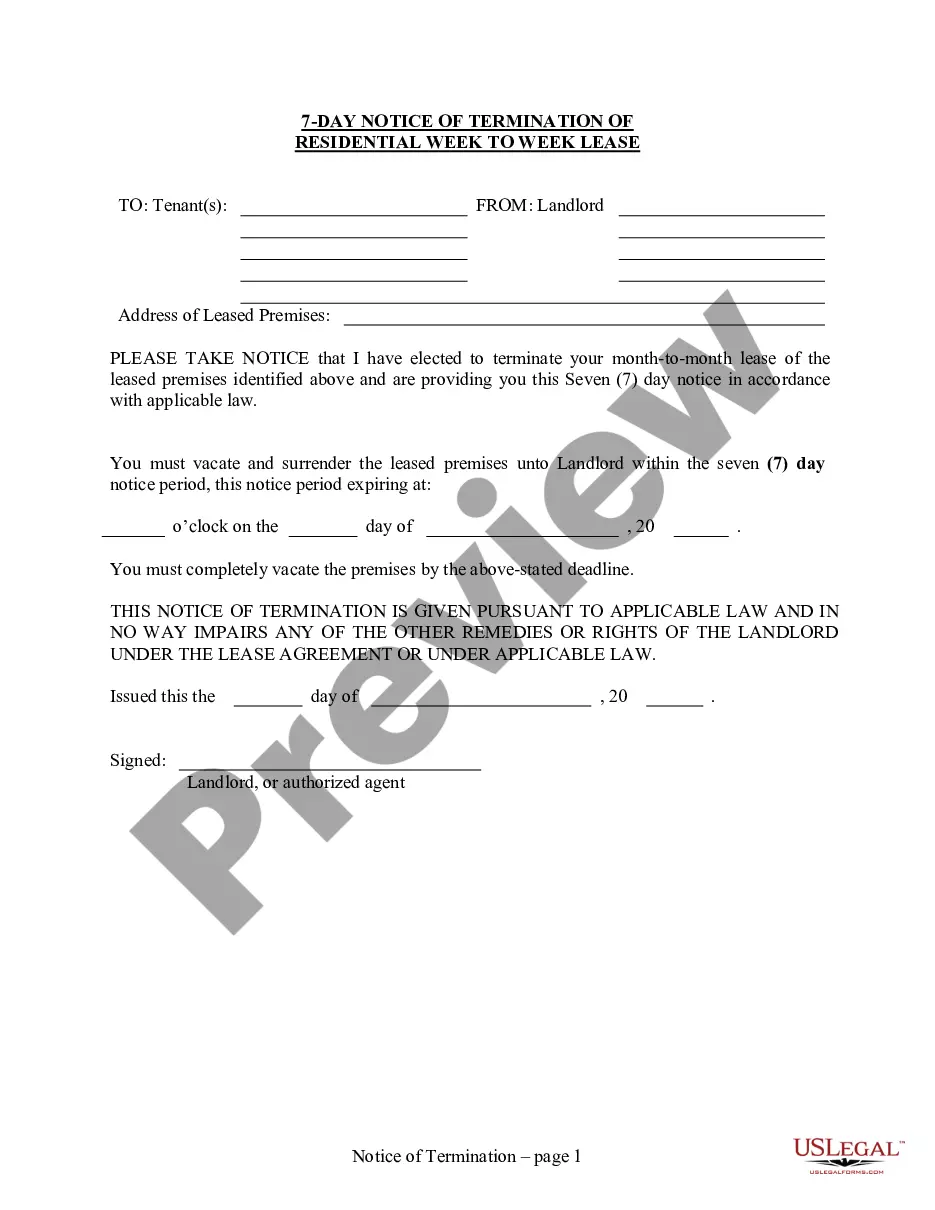

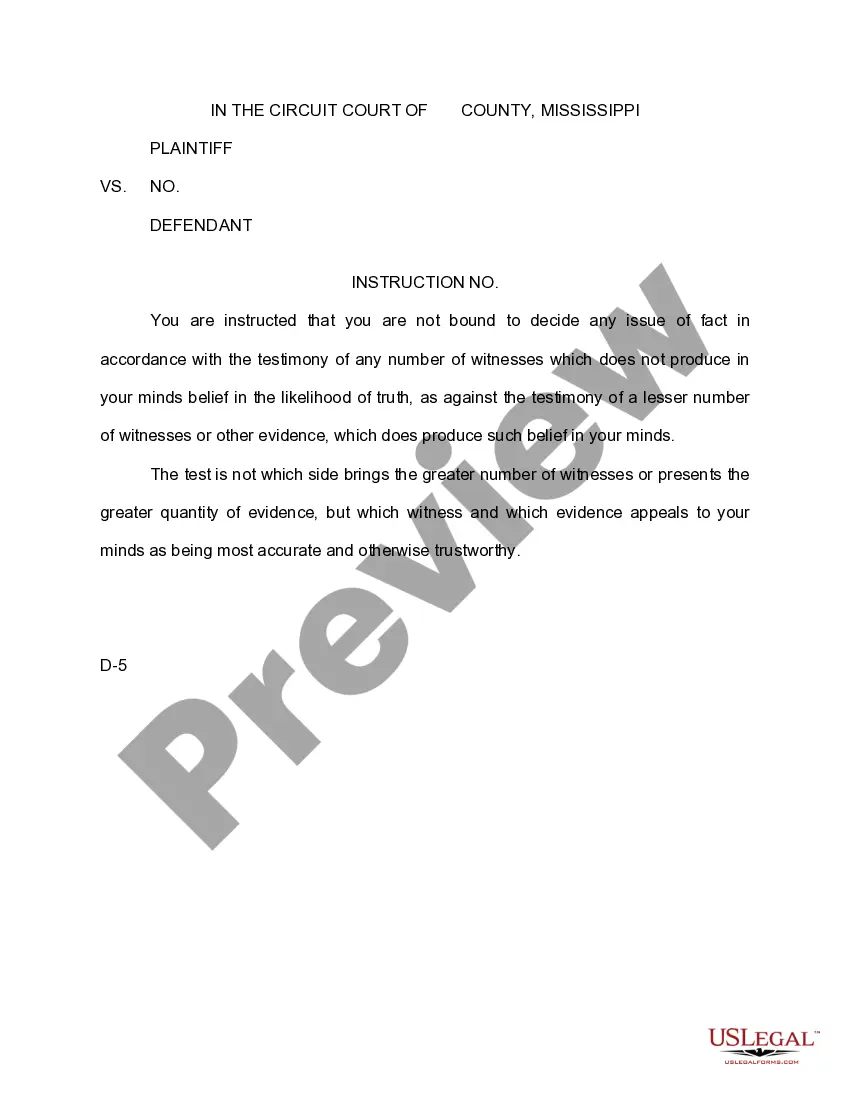

- Ensure you have selected the proper form to your town/county. Click the Preview option to examine the form`s articles. See the form outline to ensure that you have selected the correct form.

- If the form does not satisfy your requirements, use the Look for field towards the top of the display to discover the one who does.

- When you are content with the form, confirm your decision by visiting the Get now option. Then, pick the costs strategy you prefer and supply your references to sign up for the profile.

- Procedure the transaction. Use your credit card or PayPal profile to complete the transaction.

- Select the file format and download the form in your device.

- Make modifications. Fill up, modify and print and indicator the saved Puerto Rico Nonemployee Director Stock Option Prospectus.

Every single format you added to your money lacks an expiration day and is yours for a long time. So, if you wish to download or print one more backup, just proceed to the My Forms area and then click about the form you need.

Obtain access to the Puerto Rico Nonemployee Director Stock Option Prospectus with US Legal Forms, by far the most substantial catalogue of authorized file layouts. Use a large number of professional and express-certain layouts that satisfy your company or person requirements and requirements.

Form popularity

FAQ

A prospectus is a formal document that is required by and filed with the SEC that provides details about an investment offering for sale to the public. This document is used to help potential investors make a more informed decision on whether or not to invest.

A prospectus is filed for offerings of stocks, bonds, and mutual funds. The prospectus can help investors make more informed investment decisions because it contains a host of relevant information about the investment or security.

The prospectus of a company serves the following purposes. (i) Prospectus contains the summary of the company's past history and present operation. (ii) It reflects the future programmes and prospects of the company. (iii) It serves as an invitation to the public to subscribe to the shares and debentures of the company ...

A document issued by a company to invite the public and the investors for subscribing the securities is called a prospectus. The prospectus contains detailed information on the securities. A public company can issue the prospectus to offer its shares and debentures, whereas a private company cannot issue prospectus.

A prospectus refers to a legal document issued by the companies that are offering securities for sale. A public company has to issue a prospectus which is an invitation to the public to subscribe to the capital of the company. It is done for raising the required funds from the public.

A prospectus is a written document that provides all material information about an offering of securities, and is the primary sales tool of the company that issues the securities (called the issuer) and broker-dealers that market the offering for the issuer (called underwriters).

A public company has to issue a prospectus which is an invitation to the public to subscribe to the capital of the company. It is done for raising the required funds from the public.