Puerto Rico Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

You may commit hrs on the web attempting to find the lawful papers template that suits the state and federal requirements you need. US Legal Forms provides a huge number of lawful varieties that happen to be evaluated by experts. It is simple to down load or produce the Puerto Rico Assignment of Overriding Royalty Interest (No Proportionate Reduction) from the services.

If you already possess a US Legal Forms profile, you can log in and click the Acquire option. After that, you can full, modify, produce, or indication the Puerto Rico Assignment of Overriding Royalty Interest (No Proportionate Reduction). Each lawful papers template you get is your own property for a long time. To have another backup of any obtained develop, go to the My Forms tab and click the related option.

If you work with the US Legal Forms website initially, stick to the basic guidelines listed below:

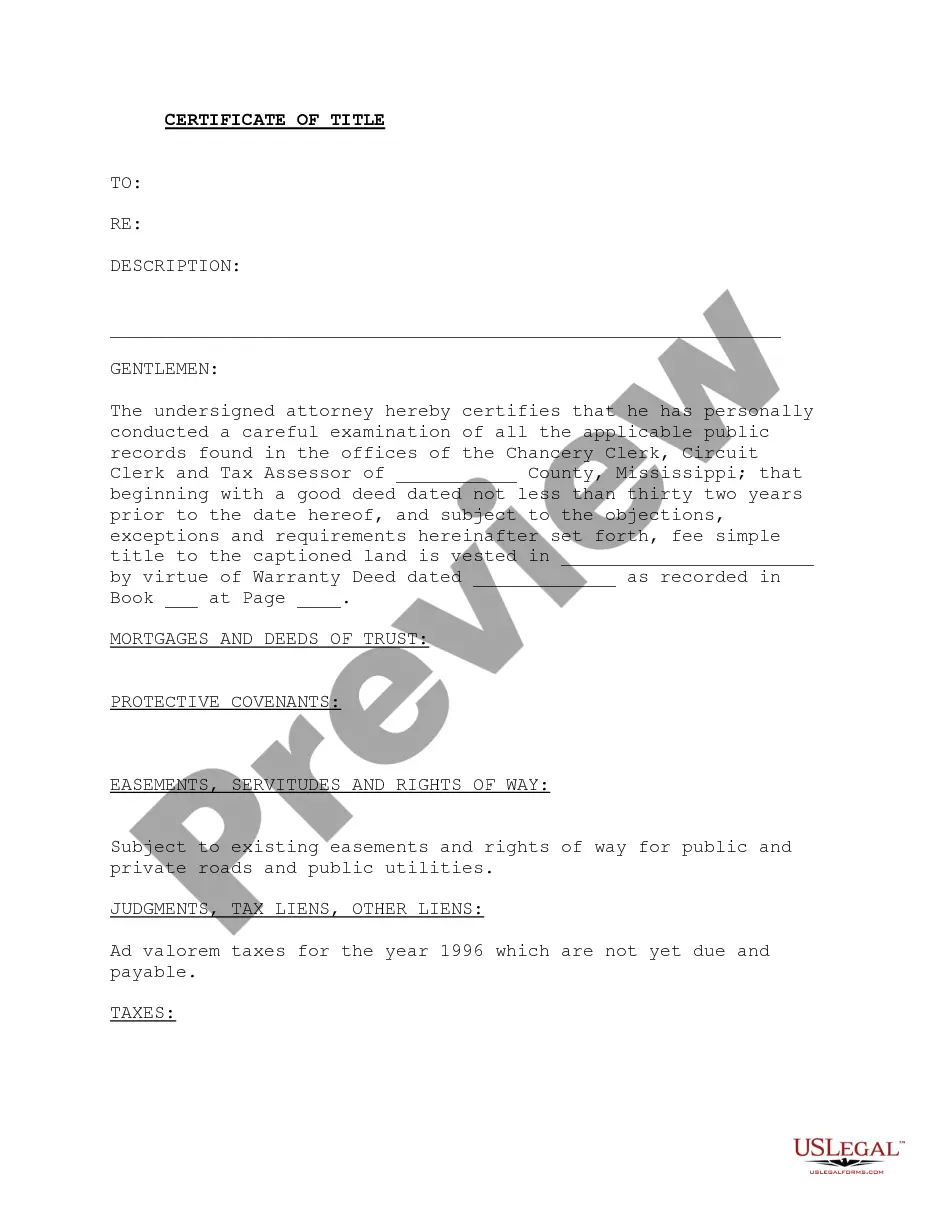

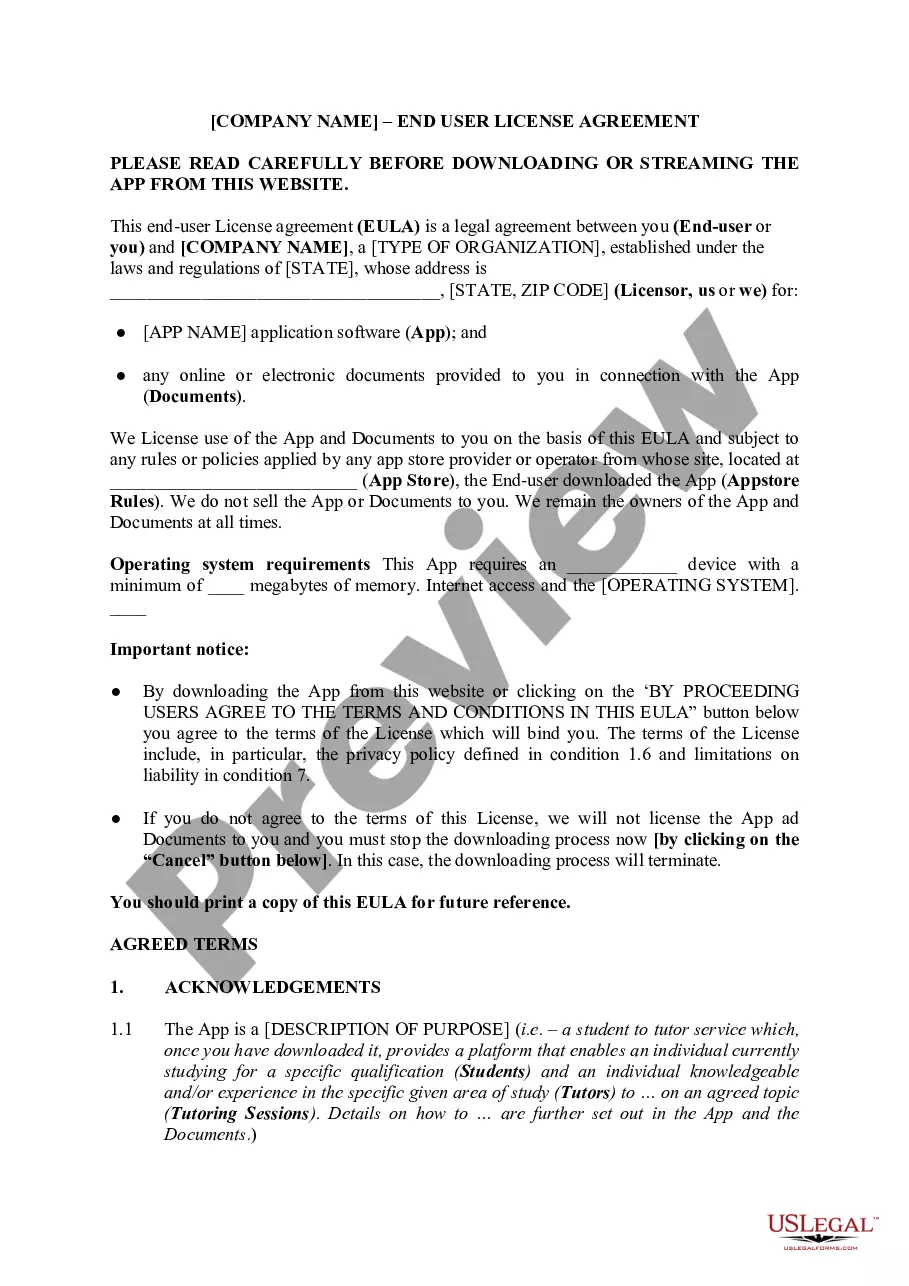

- Very first, be sure that you have selected the best papers template to the area/city of your liking. See the develop outline to ensure you have picked the right develop. If offered, take advantage of the Preview option to look throughout the papers template also.

- If you want to locate another version in the develop, take advantage of the Lookup field to obtain the template that meets your requirements and requirements.

- After you have identified the template you desire, simply click Get now to continue.

- Select the pricing program you desire, type your accreditations, and sign up for a free account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal profile to pay for the lawful develop.

- Select the formatting in the papers and down load it in your system.

- Make adjustments in your papers if necessary. You may full, modify and indication and produce Puerto Rico Assignment of Overriding Royalty Interest (No Proportionate Reduction).

Acquire and produce a huge number of papers templates using the US Legal Forms site, which provides the most important assortment of lawful varieties. Use professional and state-specific templates to handle your business or individual requirements.

Form popularity

FAQ

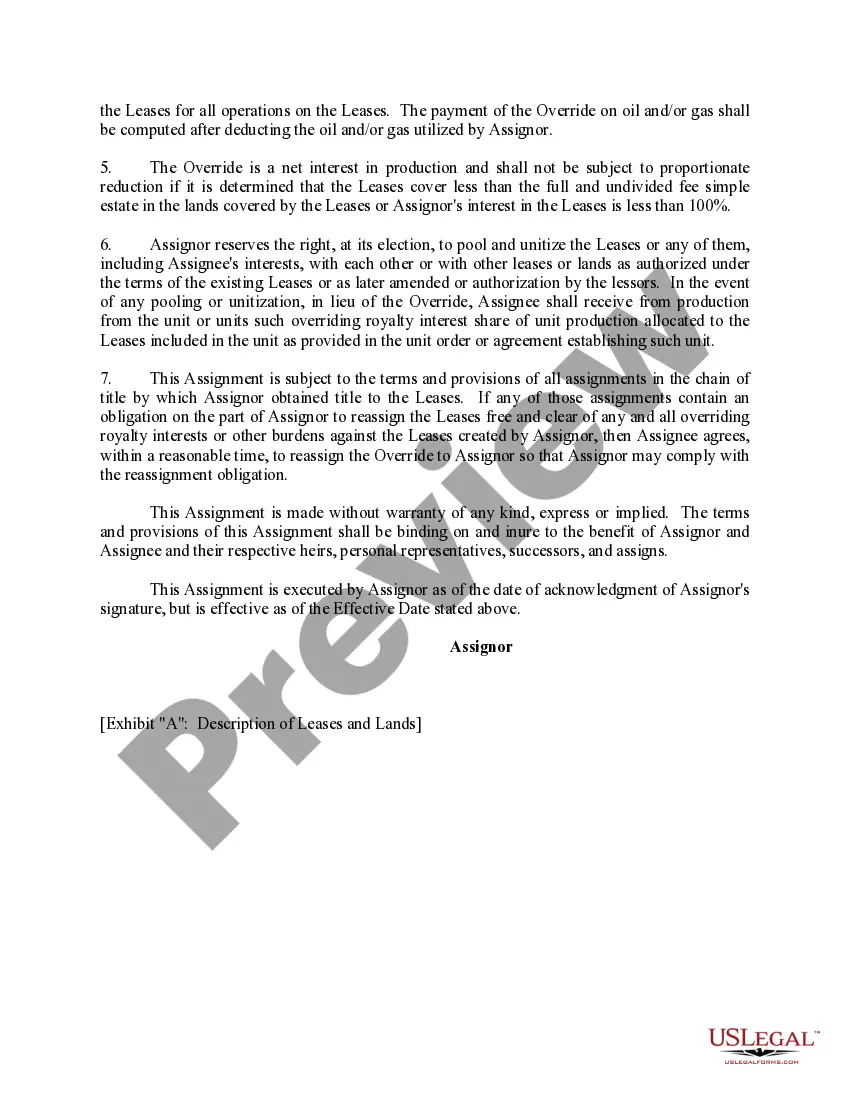

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.