Puerto Rico Release of Liens for Vendor's Lien and Deed of Trust Lien

Description

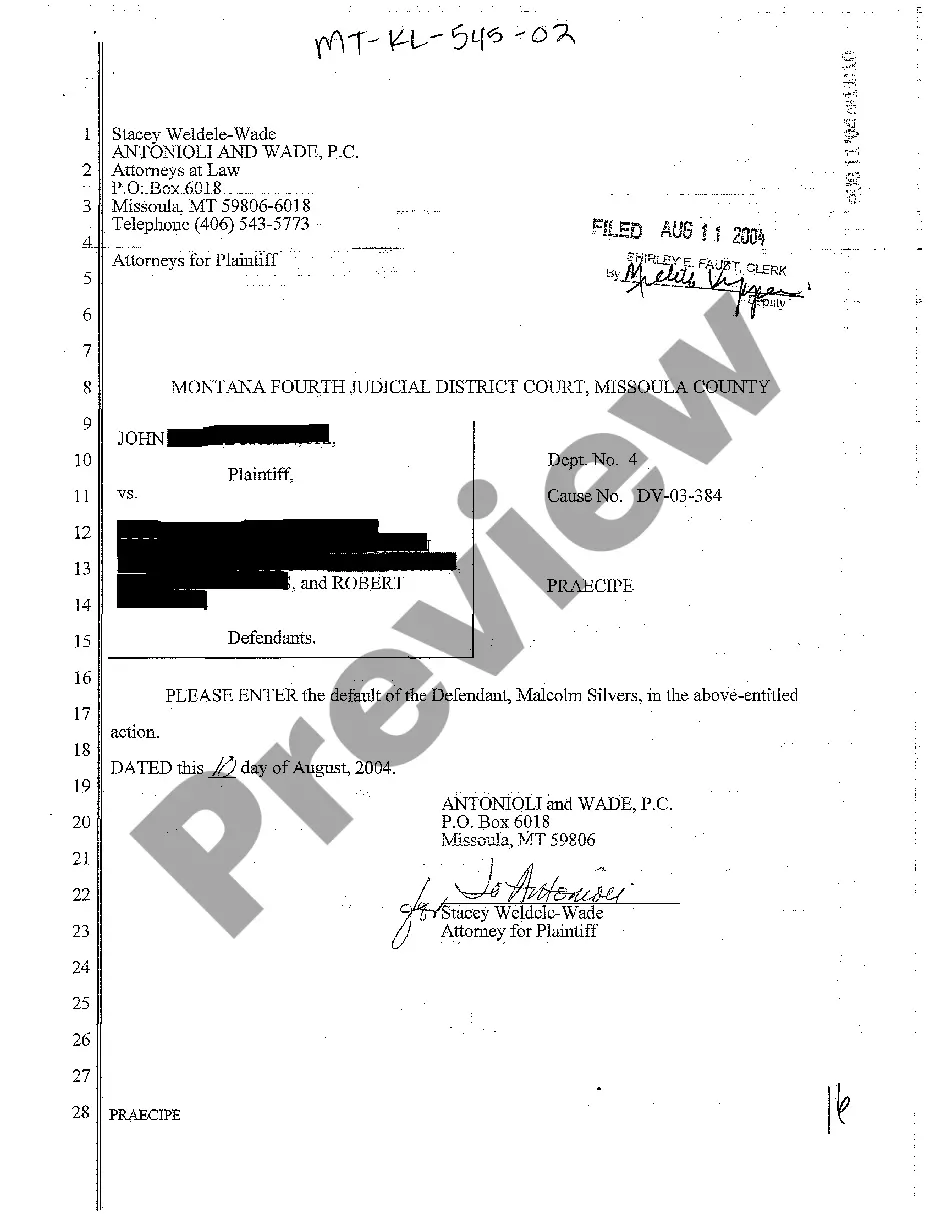

How to fill out Release Of Liens For Vendor's Lien And Deed Of Trust Lien?

If you need to comprehensive, download, or print lawful document layouts, use US Legal Forms, the greatest collection of lawful forms, which can be found on the Internet. Take advantage of the site`s simple and easy convenient look for to find the paperwork you will need. Various layouts for business and specific reasons are sorted by classes and claims, or key phrases. Use US Legal Forms to find the Puerto Rico Release of Liens for Vendor's Lien and Deed of Trust Lien within a couple of mouse clicks.

If you are presently a US Legal Forms client, log in to the bank account and click the Down load switch to get the Puerto Rico Release of Liens for Vendor's Lien and Deed of Trust Lien. You can even access forms you formerly saved within the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the right metropolis/land.

- Step 2. Make use of the Review method to look over the form`s content material. Never neglect to see the information.

- Step 3. If you are not happy using the form, use the Look for discipline at the top of the display screen to find other versions of the lawful form web template.

- Step 4. Once you have discovered the shape you will need, click on the Purchase now switch. Pick the pricing plan you like and include your qualifications to sign up for the bank account.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the file format of the lawful form and download it on your system.

- Step 7. Full, change and print or sign the Puerto Rico Release of Liens for Vendor's Lien and Deed of Trust Lien.

Every single lawful document web template you get is yours forever. You have acces to each and every form you saved with your acccount. Select the My Forms area and decide on a form to print or download again.

Contend and download, and print the Puerto Rico Release of Liens for Vendor's Lien and Deed of Trust Lien with US Legal Forms. There are many specialist and state-certain forms you can utilize for your business or specific requirements.

Form popularity

FAQ

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

Typically, it's the responsibility of the seller to pay off the lien on his or her property on or before the day of closing. Most liens are paid off from the proceeds of the sale at the time of closing.

Release Of Lien Texas Form To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

In PR, only a notary attorney (unique position for PR attorney) who originally recorded the document(s) will have the originals and can provide copies to interested parties at an additional fee. The attorney typically charges anywhere from $25.00 to $50.00.

This deed contemplates that the property will be paid in the form of cash and seller financing through a promissory note provided by the grantee to the grantor; the vendor's lien will be held by the grantor until such time the grantee pays off the note, at which time the deed becomes absolute.

Summary lien removal is governed by Texas Property Code Section 53.160 (?Summary Motion to Remove Invalid Lien or Unenforceable Lien?). This sets forth a process by which a lien can be removed in as fast as 21 days after the contractor (lien claimant) appears in the action.

A release of a lien may be executed in the lien release section located on the front of the certificate of title, on this form, or on the lienholder's letterhead. A release of lien on the lienholder's letterhead must contain the same information as required in the ?Vehicle Information? section of this form.

Lenders in Texas customarily use a release of lien when the loan secured by a deed of trust has been paid in full or otherwise satisfied. The release of lien is recorded in the county where the real property collateral is located.