Puerto Rico Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

You can spend time on the web attempting to find the lawful record template that meets the state and federal needs you require. US Legal Forms provides a huge number of lawful forms which can be reviewed by specialists. It is simple to acquire or printing the Puerto Rico Memorandum of Trust Agreement from our service.

If you already have a US Legal Forms bank account, you are able to log in and click on the Obtain option. Afterward, you are able to total, revise, printing, or indicator the Puerto Rico Memorandum of Trust Agreement. Each and every lawful record template you purchase is yours forever. To have yet another version of the purchased develop, go to the My Forms tab and click on the corresponding option.

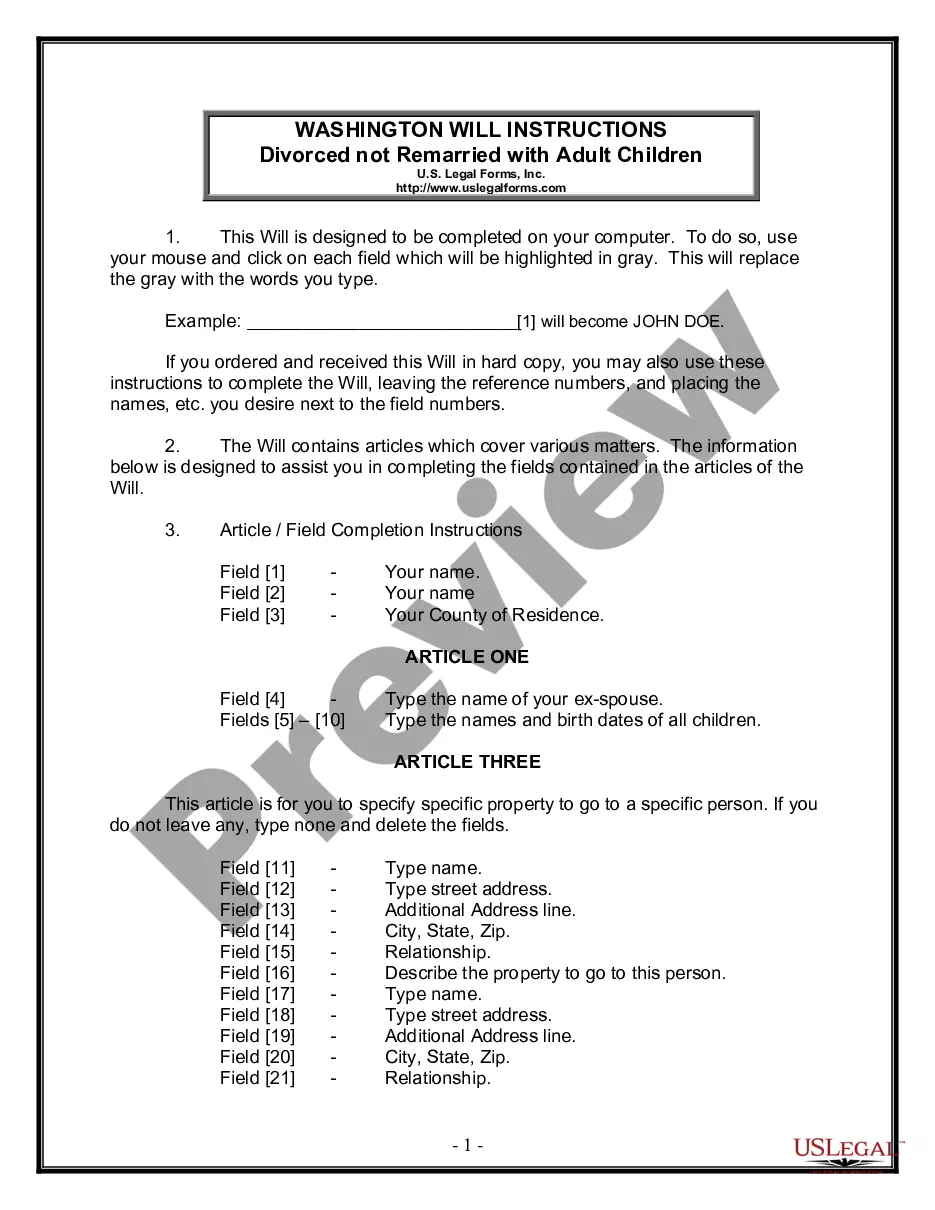

If you work with the US Legal Forms site initially, adhere to the easy directions beneath:

- Initially, make sure that you have chosen the proper record template for that region/town of your liking. Read the develop information to ensure you have chosen the right develop. If readily available, make use of the Preview option to search with the record template also.

- If you would like discover yet another version of your develop, make use of the Research field to get the template that fits your needs and needs.

- When you have found the template you need, simply click Buy now to continue.

- Find the prices program you need, type in your qualifications, and register for an account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal bank account to pay for the lawful develop.

- Find the formatting of your record and acquire it to your device.

- Make modifications to your record if required. You can total, revise and indicator and printing Puerto Rico Memorandum of Trust Agreement.

Obtain and printing a huge number of record templates while using US Legal Forms site, which provides the biggest collection of lawful forms. Use skilled and condition-certain templates to take on your small business or specific requirements.

Form popularity

FAQ

A declaration of trust, or nominee declaration, appoints a trustee to oversee assets for the benefit of another person or people. The declaration also describes the assets that are to be held in the trust and how they are to be managed. State laws have different requirements for the creation of a declaration of trust.

In PR, only a notary attorney (unique position for PR attorney) who originally recorded the document(s) will have the originals and can provide copies to interested parties at an additional fee. The attorney typically charges anywhere from $25.00 to $50.00.

By visiting the Land Registry, you can verify who owns it and if the property has any charges or encumbrances.

In PR, only a notary attorney (unique position for PR attorney) who originally recorded the document(s) will have the originals and can provide copies to interested parties at an additional fee. The attorney typically charges anywhere from $25.00 to $50.00.

Notary Law is very important because unlike many places in the U.S., Puerto Rico uses notary attorneys to execute all deeds that transfer property. All public documents, affidavit, and sworn statements must be drafted by and signed by a notary attorney.

Attention all property owners in Puerto Rico! Don't forget that your property tax bills are due at the end of this month, January 2023. As a reminder, property taxes in Puerto Rico are paid twice a year, with the first installment due at the end of June and the second at the end of January.