Puerto Rico Release of Judgment Lien - By Creditor

Description

How to fill out Release Of Judgment Lien - By Creditor?

If you have to complete, down load, or printing legitimate record templates, use US Legal Forms, the biggest selection of legitimate varieties, which can be found on-line. Take advantage of the site`s easy and convenient look for to obtain the papers you want. Various templates for business and person functions are categorized by categories and states, or key phrases. Use US Legal Forms to obtain the Puerto Rico Release of Judgment Lien - By Creditor within a couple of clicks.

Should you be presently a US Legal Forms client, log in to the accounts and then click the Down load option to obtain the Puerto Rico Release of Judgment Lien - By Creditor. You may also access varieties you previously saved from the My Forms tab of the accounts.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the form to the appropriate metropolis/region.

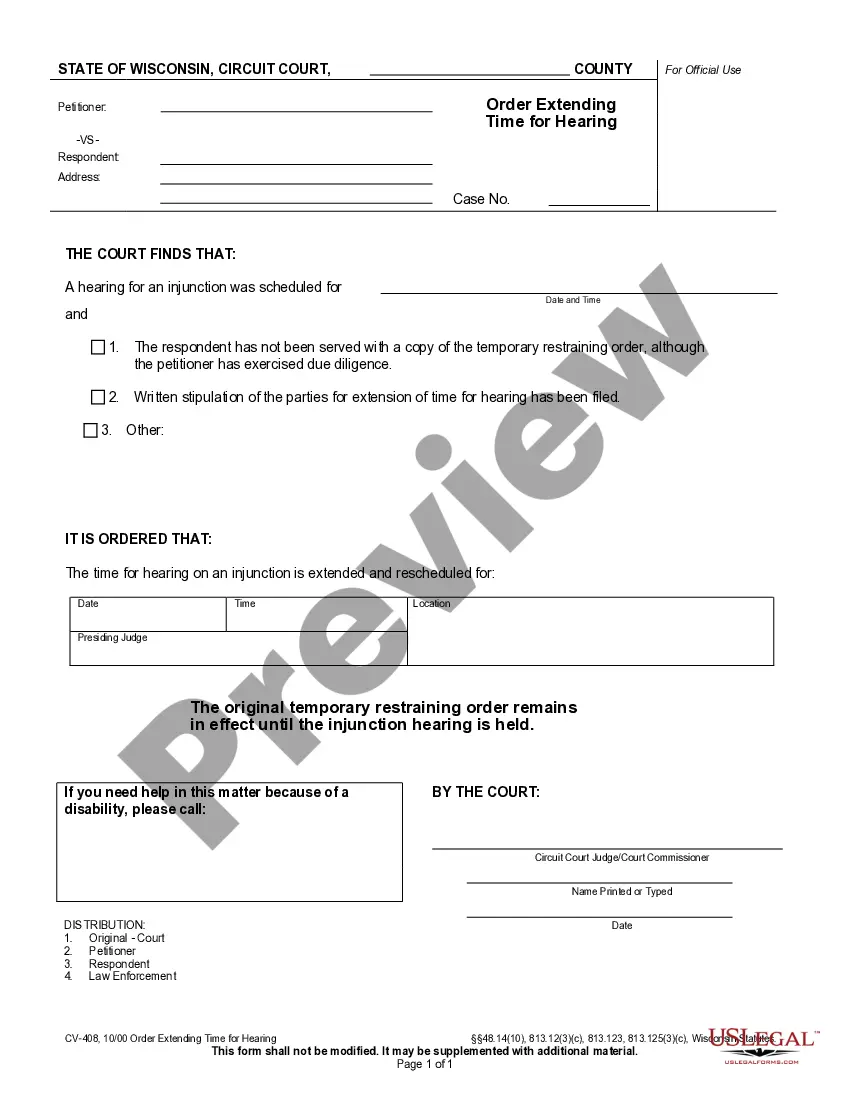

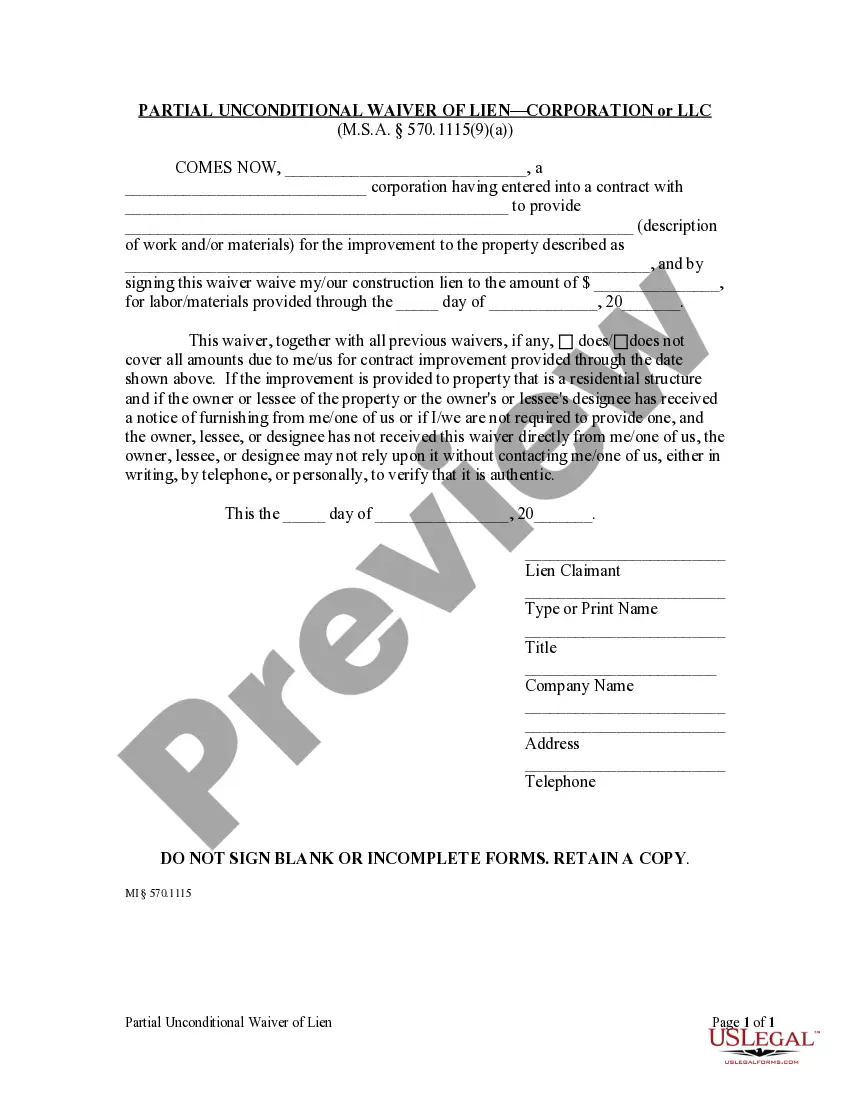

- Step 2. Use the Preview choice to look through the form`s articles. Never forget to read the explanation.

- Step 3. Should you be not happy with all the type, take advantage of the Search field towards the top of the display screen to find other types from the legitimate type design.

- Step 4. Upon having discovered the form you want, go through the Purchase now option. Select the costs strategy you prefer and add your qualifications to sign up for an accounts.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Choose the format from the legitimate type and down load it on your own product.

- Step 7. Total, edit and printing or signal the Puerto Rico Release of Judgment Lien - By Creditor.

Every legitimate record design you get is yours permanently. You possess acces to each and every type you saved in your acccount. Click the My Forms portion and choose a type to printing or down load once again.

Be competitive and down load, and printing the Puerto Rico Release of Judgment Lien - By Creditor with US Legal Forms. There are many skilled and condition-specific varieties you can use for your business or person demands.

Form popularity

FAQ

Tax lien: The statute of limitations for a tax lien in Ohio is 15 years from the date the tax liability was assessed. This means that the government has 15 years to collect the taxes owed before the lien expires. Judgment lien: In Ohio, a judgment lien can be valid for up to 5 years.

Once the state liens are paid, you will receive a Lien Satisfaction Notice from the Ohio Attorney General's office. To release the lien, you are to bring the notice to the Clerk's office.

In order to release a lien, payment including court costs must be paid in full. The cost of releasing Ohio Department of Taxation, Bureau of Workers Compensation, Child Support, and City of Akron Liens is $60.50.

Within 28 days after payment in full of the amount due on a judgment that is the basis for a judgment lien, the judgment creditor or the judgment creditor's attorney shall record a discharge of judgment lien with the office of the register of deeds where the judgment lien is recorded.

A release of an abstract of judgment can occur where the debtor files an Affidavit of Release of a Judgment Lien (sworn statement) showing that the real property in question is the debtor's homestead and meets certain legally-established criteria set forth in Texas Property Code §41.002, which can be up to 10 acres for ...

Your judgment lien release lawyer in Texas, will send the necessary paperwork to the creditor to release the lien on the homestead. Your attorney can take additional action if the creditor refuses. Generally, a partial release can be obtained in 45 days or less, even if the creditor refuses to comply.

If you win a judgment and the other party does not pay, you may start collection proceedings. Certain methods for collecting judgments such as bank and earnings garnishments, liens and attachments are permitted under the law. Filings on these actions can be made in the Clerk's Office Civil Division.

Manual Lien Release To remove the lien from the BMV records, you must take the title to any County Clerk of Courts Title Office and apply for a title. The County Clerk of Courts Title Office will issue you a new paper title.