Puerto Rico Ratification of Unit Agreement (By Interest Owner)

Description

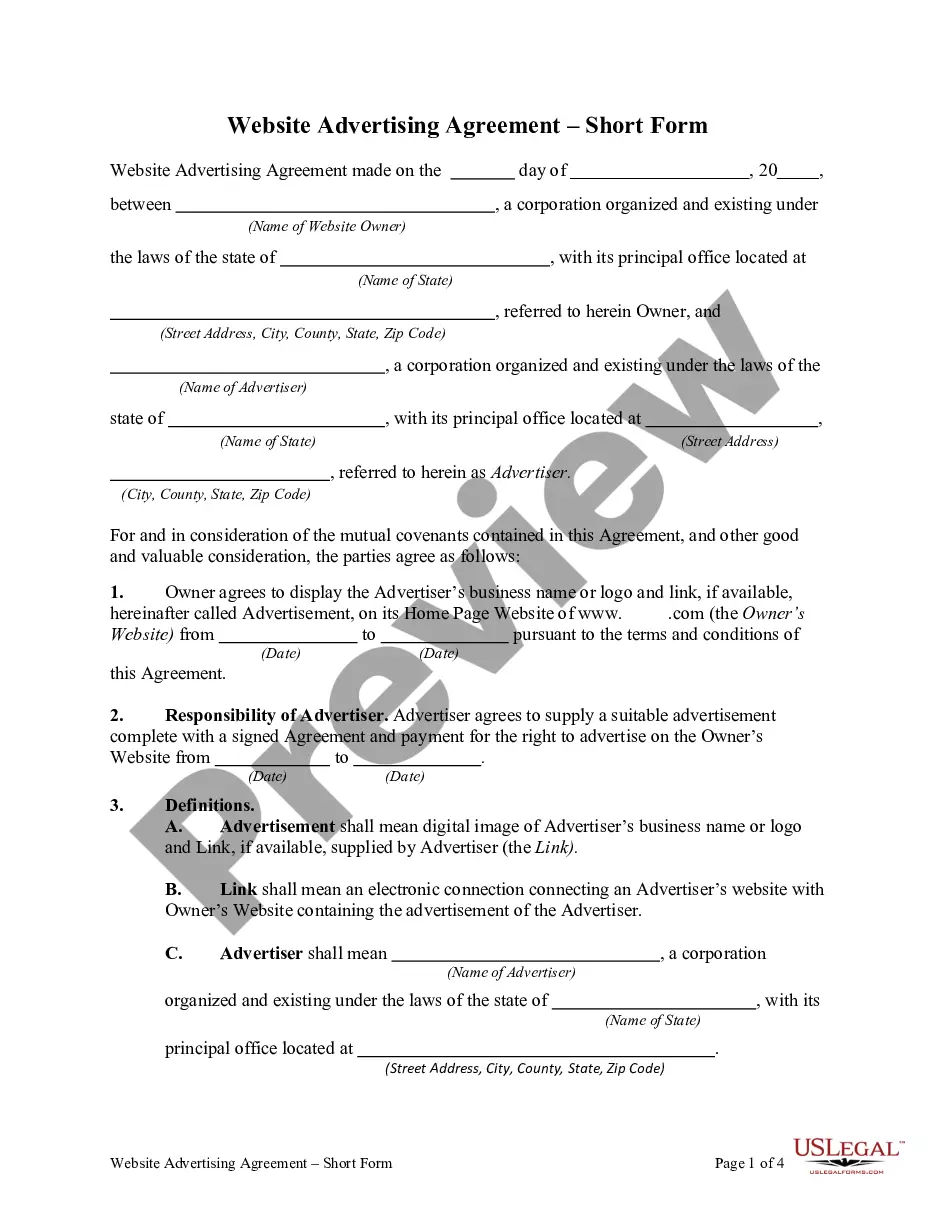

How to fill out Ratification Of Unit Agreement (By Interest Owner)?

Are you currently within a situation where you will need documents for possibly enterprise or person reasons nearly every day? There are a variety of lawful record layouts available on the net, but discovering versions you can depend on is not effortless. US Legal Forms delivers a huge number of kind layouts, just like the Puerto Rico Ratification of Unit Agreement (By Interest Owner), that happen to be composed to fulfill state and federal demands.

Should you be previously informed about US Legal Forms internet site and get a merchant account, just log in. Next, you may acquire the Puerto Rico Ratification of Unit Agreement (By Interest Owner) format.

Should you not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the kind you need and make sure it is for the right town/county.

- Utilize the Review button to analyze the shape.

- See the outline to actually have selected the correct kind.

- In the event the kind is not what you are looking for, use the Lookup industry to find the kind that fits your needs and demands.

- Whenever you find the right kind, simply click Get now.

- Pick the prices prepare you want, submit the required info to generate your money, and pay for the order with your PayPal or charge card.

- Pick a handy document format and acquire your copy.

Get all the record layouts you possess bought in the My Forms menus. You may get a extra copy of Puerto Rico Ratification of Unit Agreement (By Interest Owner) whenever, if required. Just click on the necessary kind to acquire or print out the record format.

Use US Legal Forms, by far the most comprehensive selection of lawful types, to save lots of time and stay away from mistakes. The services delivers appropriately manufactured lawful record layouts that can be used for a variety of reasons. Generate a merchant account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Puerto Rico offers great tax incentives to LLCs and individuals who move to Puerto Rico, including a 4% income tax and exemptions from paying taxes on capital gains, interest, or dividends (for individuals and businesses that meet the requirements).

Register your business name with the local government where your business is located. If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

Foreign LLCs only need to file the Certificate of Authorization and pay state fees in order to do business in Puerto Rico.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

A. Corporation (Default Rule for PR LLCs) ? the members of the entity have limited liability. Under the PR Code, corporations are subject to a double taxation regime. Initially, the entity pays income taxes when it realizes profits, subsequently, income taxes are paid when dividends are paid to its members.