Puerto Rico Self-Employed Independent Welder Services Contract

Description

How to fill out Self-Employed Independent Welder Services Contract?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can quickly find the latest documents like the Puerto Rico Self-Employed Independent Welder Services Contract in just a few seconds.

If you already have a subscription, Log In and download the Puerto Rico Self-Employed Independent Welder Services Contract from the US Legal Forms database. The Download button will appear on each document you view. You have access to all previously downloaded forms from the My documents section of your account.

Make changes. Complete, edit, and print and sign the downloaded Puerto Rico Self-Employed Independent Welder Services Contract.

Each document you add to your account has no expiration date and is yours forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- To use US Legal Forms for the first time, here are some basic instructions to get started.

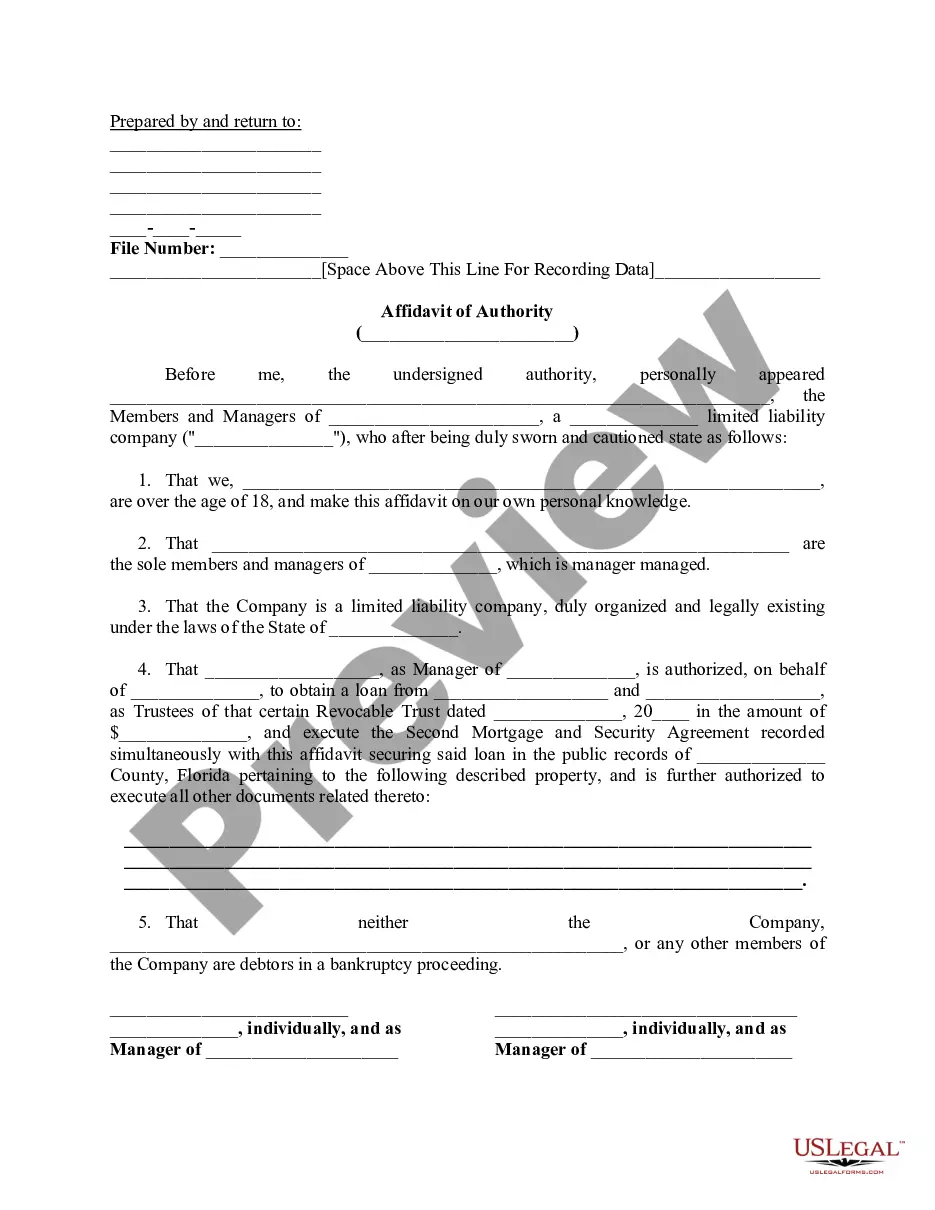

- Ensure you have chosen the correct form for your city/county. Click on the Preview button to view the details of the form. Review the form description to confirm that you've selected the appropriate form.

- If the form doesn't meet your requirements, use the Search box at the top of the screen to find one that does.

- When satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred pricing plan and provide your credentials to register for an account.

- Process the payment. Use your Visa, MasterCard, or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Like all self-employed workers, independent contractors can pick and choose which projects they want to work on. They can take multiple short-term jobs, but it's more common that they opt for longer-term work arrangements with one or two clients. Because of this, most are paid by the hour.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.7 Sept 2021

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

7 Tips for Managing Freelancers and Independent ContractorsWhat the Experts Say.Understand what they want.Set expectations.Build the relationship.Make them feel part of the team.Don't micromanage.Give feedback.Pay them well.More items...?

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.