Puerto Rico Private Investigator Agreement - Self-Employed Independent Contractor

Description

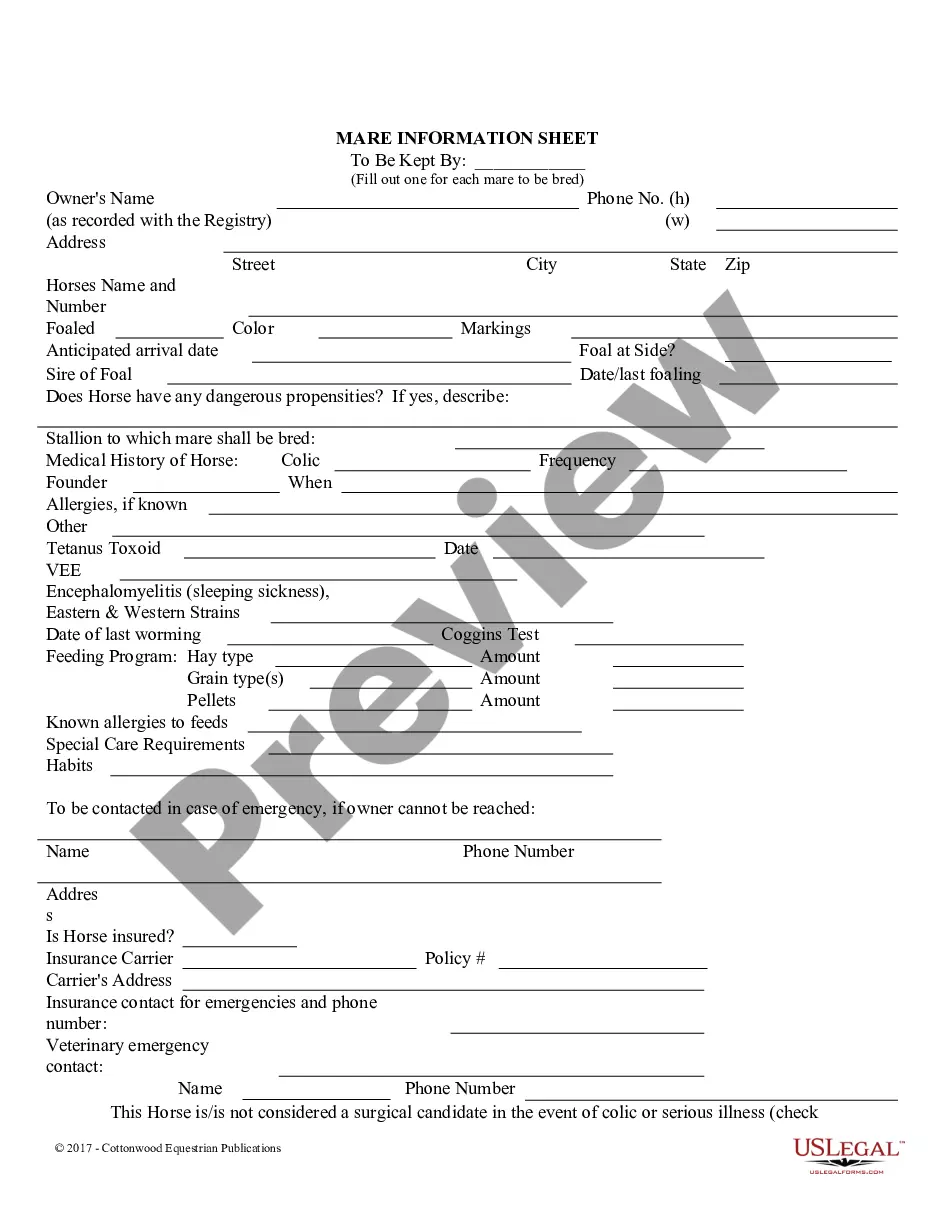

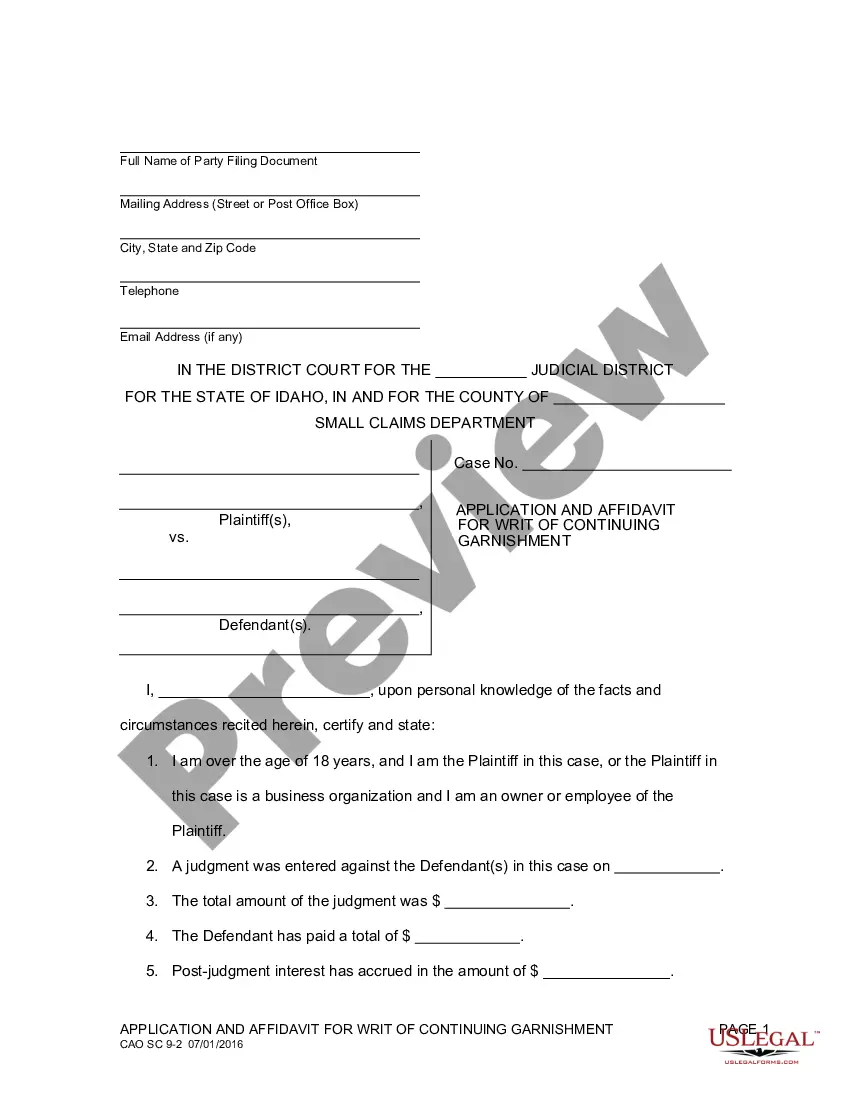

How to fill out Private Investigator Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online searching for the legal document template that complies with the federal and state regulations you need.

US Legal Forms offers thousands of legal forms that are vetted by experts.

You can download or print the Puerto Rico Private Investigator Agreement - Self-Employed Independent Contractor from the service.

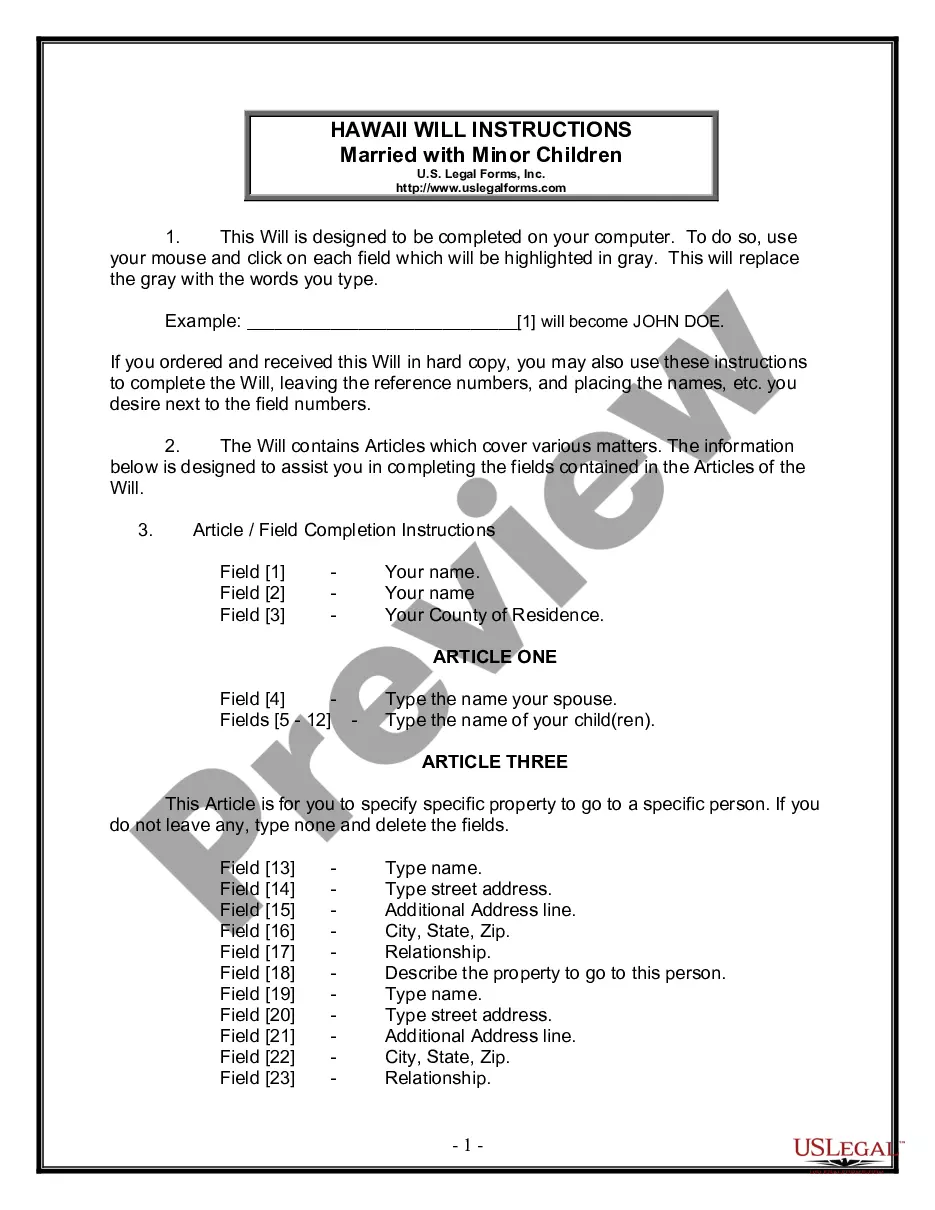

First, ensure that you have selected the appropriate document template for the county/region of your choice. Review the form details to confirm you have selected the correct form. If available, take advantage of the Preview button to examine the document template as well. If you wish to obtain another version of the form, utilize the Search section to find the template that meets your needs and requirements. Once you have located the template you want, click Download now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make changes to the document if necessary. You can complete, edit, sign, and print the Puerto Rico Private Investigator Agreement - Self-Employed Independent Contractor. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, amend, print, or sign the Puerto Rico Private Investigator Agreement - Self-Employed Independent Contractor.

- Each legal document template you obtain is yours permanently.

- To acquire an additional copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Rule 75, part of the Puerto Rico Rules of Civil Procedure, pertains to the service of process. This rule guides how legal documents must be delivered to parties involved in a case, ensuring they are properly informed. When drafting a Puerto Rico Private Investigator Agreement - Self-Employed Independent Contractor, it's essential to understand these rules for effective enforcement. US Legal Forms can assist you in drafting documents that adhere to local legal standards.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

What is a self-employed contractor in Canada? Self-employed contractors set their own terms and decide how and when to perform the required work. You don't have anyone overseeing your activities and you're free to work when, and for whom you choose, and may provide your services to different payers at the same time.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

First ownership - the general rule The general rule in relation to IP created by an employee during the course of their employment is that, in the absence of agreement to the contrary, the first owner is the employer.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Generally speaking, the creator or originator of an idea, work, or novel invention is presumed to own the copyright to their creations. However, if the work was created as a part of a work-made-for-hire agreement, or in an employer-employee agreement, the copyright belongs to the employer.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.