Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor

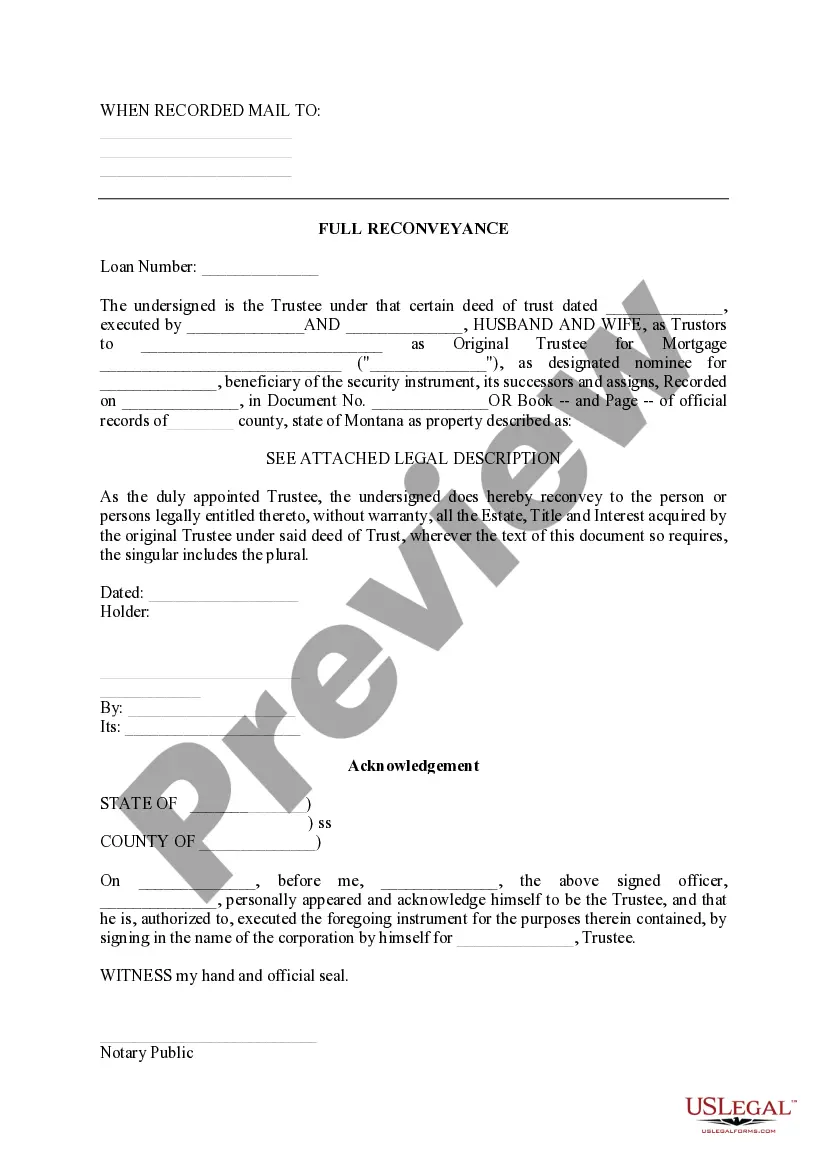

Description

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

Selecting the appropriate authorized document template can be challenging.

Of course, there are numerous templates accessible online, but how can you locate the authorized version you need.

Utilize the US Legal Forms website. The service offers a vast selection of templates, such as the Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor, that you can use for business and personal purposes.

You can preview the form using the Review button and check the form summary to confirm it is suitable for your needs.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to get the Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor.

- Use your account to access the authorized forms you have purchased previously.

- Navigate to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your location/state.

Form popularity

FAQ

As an independent contractor in Puerto Rico, you must report income using forms like 480.6A, as mentioned earlier. This work is essential for fulfilling your obligations under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor. Keeping accurate records of your earnings and expenses simplifies the reporting process. Platforms such as uslegalforms can help streamline this task.

Many businesses operating in Puerto Rico enjoy certain exemptions from federal taxes. Nevertheless, if you are a self-employed independent contractor under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor, you may still be responsible for local taxes. Understanding these exemptions can enhance your financial planning. Consider using uslegalforms to gather the necessary information.

Yes, independent contractors in Puerto Rico are subject to self-employment tax. If you are working under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor, this tax applies to your net earnings. It is important to calculate your tax correctly to avoid underpayment. Resources like uslegalforms can help you comprehend these requirements better.

Self-employment tax in Puerto Rico consists of various contributions to Social Security and Medicare, similar to other states. For individuals operating under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor, knowing the specific rates is crucial. The current rate is around 15.3%, but it’s wise to consult with a local tax professional. Tools available on uslegalforms can help track these obligations.

In Puerto Rico, the equivalent form is referred to as Form 480.6A. This form is used to report payments made to independent contractors, making it essential for those under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor. Accurate reporting can help you avoid issues with local tax authorities. Uslegalforms can provide templates and guidance for this process.

Washington is one of the states without a self-employment tax. However, Puerto Rico has its own tax laws that apply to self-employed individuals. If you are considering a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor, understanding these local regulations is vital. Utilizing platforms like uslegalforms can help clarify your obligations.

If you get hurt as an independent contractor, your eligibility for workers' compensation may vary based on your specific situation. Unlike traditional employees, independent contractors typically do not receive the same benefits. However, understanding the terms in your Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor can provide clarity on your rights and options for addressing any injuries.

The manufacturing exemption in Puerto Rico allows certain businesses to benefit from reduced tax rates and incentives. Under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor, this exemption can apply to specific assembly and manufacturing activities. Knowing these benefits can help you optimize your business operations and tax liabilities.

Yes, an independent contractor is indeed considered self-employed. This classification means that you operate your own business, handle your own taxes, and manage your own finances. Working under a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor further clarifies your status and responsibilities.

To protect yourself as an independent contractor, consider drafting clear agreements that outline expectations and responsibilities. Utilizing a Puerto Rico Electronics Assembly Agreement - Self-Employed Independent Contractor can provide you with the necessary legal framework. Additionally, seeking legal advice and maintaining proper documentation can safeguard your interests.