Puerto Rico Specialty Services Contact - Self-Employed

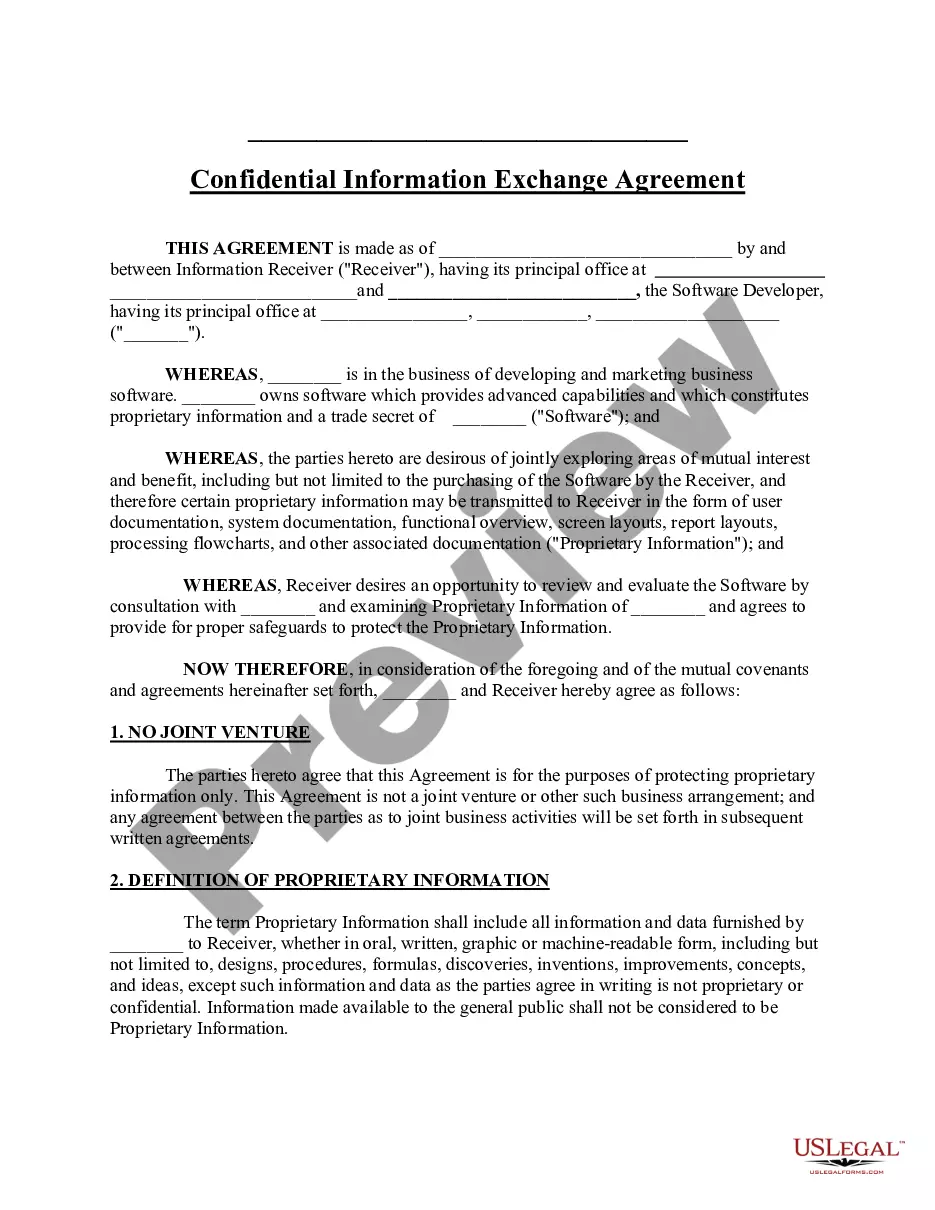

Description

How to fill out Specialty Services Contact - Self-Employed?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every day? There are many legitimate document templates available online, but finding ones you can rely on isn't easy. US Legal Forms offers a vast array of document templates, including the Puerto Rico Specialty Services Contact - Self-Employed, designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Puerto Rico Specialty Services Contact - Self-Employed template.

If you do not possess an account and wish to start using US Legal Forms, follow these steps: Obtain the template you need and ensure it is for the correct area/state. Use the Review button to examine the document. Read the description to confirm that you have selected the right template. If the document isn't what you’re looking for, utilize the Search field to find the template that fits your needs and requirements. If you locate the correct template, click Get now. Choose the pricing plan you want, complete the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard. Select a convenient file format and download your version.

- Find all the document templates you have purchased in the My documents section.

- You can download another version of Puerto Rico Specialty Services Contact - Self-Employed anytime if needed.

- Simply click on the required template to download or print the document format.

- Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes.

- The service provides professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Yes, Puerto Rico typically requires a business license for self-employed individuals operating within its jurisdiction. This license ensures that your business complies with local laws and regulations. The specifics may vary based on your business type and location, so it’s essential to verify local requirements. Utilizing USLegalForms can simplify the process of obtaining the necessary licenses for your freelance activities.

To become a registered agent in Puerto Rico, you must designate a legal representative who can receive official documents on behalf of your business. This person must have a physical address in Puerto Rico and be available during business hours. Following the appropriate steps is crucial to maintain compliance with local laws. Consider using USLegalForms for a comprehensive guide on ensuring your status as a self-employed agent.

Yes, you can work remotely from Puerto Rico, taking advantage of its beautiful environment and vibrant culture. Many self-employed individuals choose Puerto Rico for its appealing tax incentives and supportive business environment. However, ensure that you have the necessary legal registrations and licenses, such as a merchant registration, to facilitate your work. For detailed guidance, USLegalForms can provide important resources tailored for remote workers.

A merchant registration certificate in Puerto Rico is an official document that legitimizes your business activities as a self-employed individual. This certificate proves that you have registered your business with the Puerto Rican government. Without it, you may face legal challenges and limitations in operating your freelance services. For help with the paperwork, USLegalForms offers comprehensive resources tailored for self-employed professionals.

If you plan to work freelance in Puerto Rico, obtaining a merchant registration is necessary. This registration allows you to legally conduct business and receive payments for your services. It ensures compliance with local regulations and demonstrates your commitment to operating as a self-employed individual. For a seamless process, consider reaching out to USLegalForms for guidance on the registration.

Living on $3,000 a month in Puerto Rico is possible, but it depends on your lifestyle and location. Many residents find that this budget allows for a comfortable living, covering basic expenses like housing, food, and transportation. If you're considering self-employment, it's essential to budget effectively, and resources from Puerto Rico Specialty Services Contact - Self-Employed can provide valuable insights into managing your finances in the region.

The chauffeur tax in Puerto Rico applies to professionals who provide transportation services for hire. This tax is essential for those in self-employed roles within the travel and transport sector, ensuring compliance with local regulations. If you're navigating these taxes, connecting with Puerto Rico Specialty Services Contact - Self-Employed can guide you through the requirements and help you stay compliant.

In Puerto Rico, certain items are exempt from sales tax, including basic groceries, prescription medications, and some medical devices. This exemption helps ease the financial burden on residents, especially those who are self-employed and manage their own expenses. To understand how sales tax exemptions apply to your specific situation, it is beneficial to reach out to Puerto Rico Specialty Services Contact - Self-Employed for clarification.

If you are conducting business activities that involve importing goods into Puerto Rico, you may need to fill out customs forms. However, for most self-employed services, customs forms are not typically required. For accurate information regarding your specific situation, contact Puerto Rico Specialty Services Contact - Self-Employed.

Self-employed individuals generally use IRS Form 1040 to file their annual income tax returns, along with any additional forms needed for self-employment income. The 1099 form, on the other hand, is used by clients or businesses to report payments made to a self-employed individual. For assistance navigating these forms, consider reaching out to Puerto Rico Specialty Services Contact - Self-Employed.