Puerto Rico Marketing Personnel Agreement - Self-Employed Independent Contractor

Description

How to fill out Marketing Personnel Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of many largest libraries of legal varieties in the USA - gives an array of legal document layouts you are able to obtain or printing. Utilizing the internet site, you can get a huge number of varieties for company and specific functions, sorted by types, says, or key phrases.You can find the newest types of varieties just like the Puerto Rico Marketing Personnel Agreement - Self-Employed Independent Contractor within minutes.

If you currently have a registration, log in and obtain Puerto Rico Marketing Personnel Agreement - Self-Employed Independent Contractor from the US Legal Forms catalogue. The Download option will appear on every kind you perspective. You have access to all formerly saved varieties from the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, listed below are straightforward recommendations to get you started:

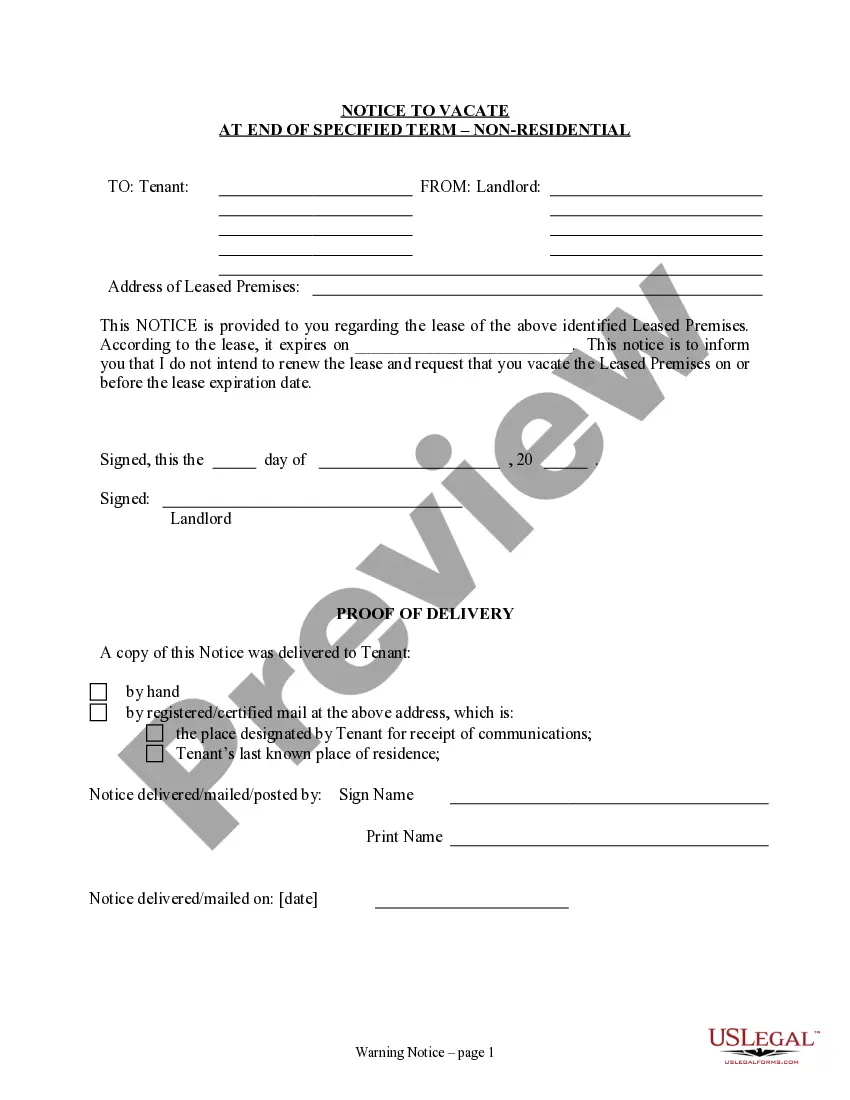

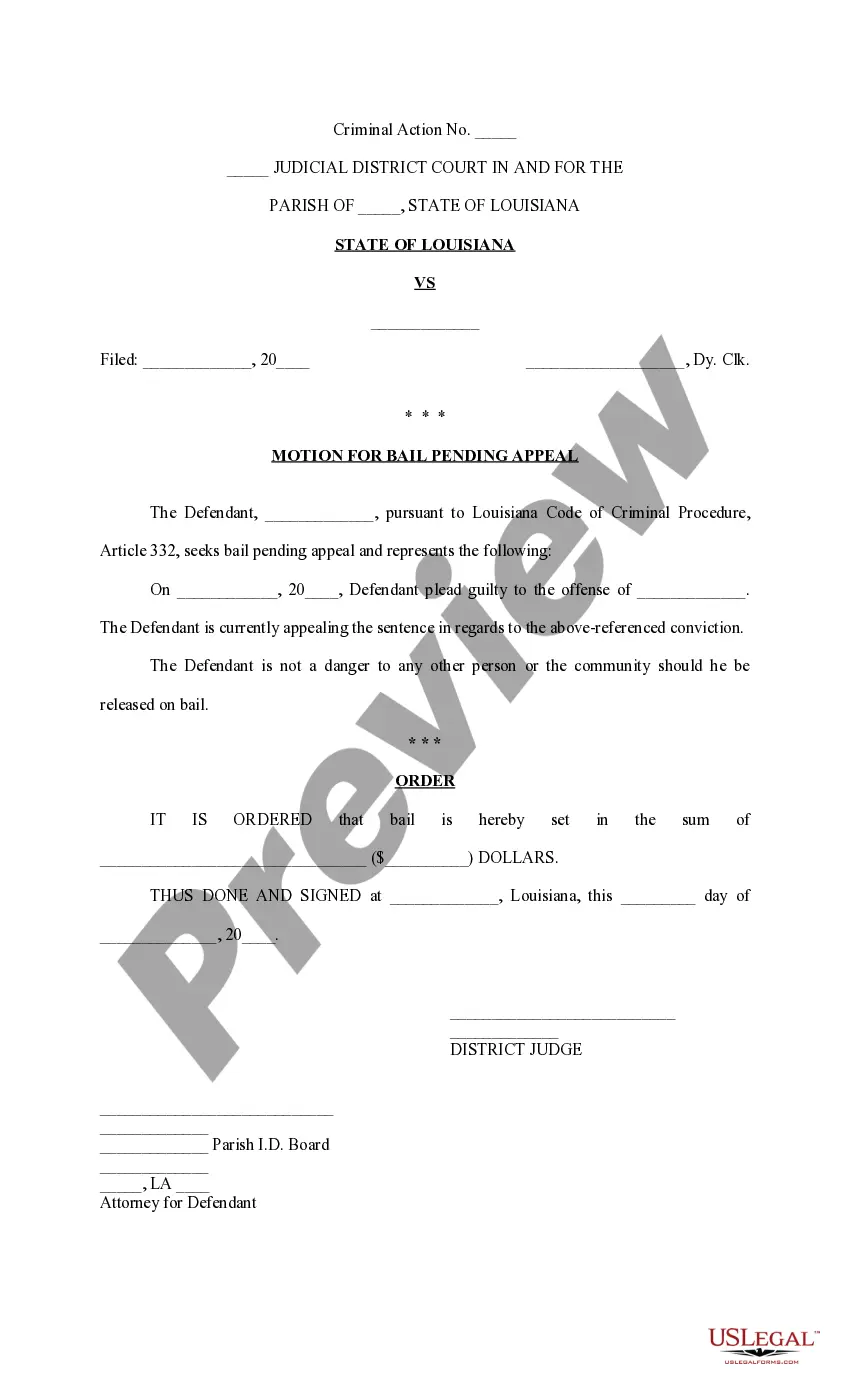

- Be sure to have selected the best kind for your city/region. Click on the Review option to check the form`s information. Look at the kind explanation to actually have selected the appropriate kind.

- If the kind does not match your demands, utilize the Lookup industry at the top of the display to get the one that does.

- When you are happy with the shape, confirm your option by simply clicking the Get now option. Then, pick the pricing program you like and supply your credentials to sign up for the accounts.

- Procedure the purchase. Use your bank card or PayPal accounts to complete the purchase.

- Choose the file format and obtain the shape on your own product.

- Make alterations. Fill up, change and printing and sign the saved Puerto Rico Marketing Personnel Agreement - Self-Employed Independent Contractor.

Every template you included with your account lacks an expiry date and is your own eternally. So, if you wish to obtain or printing an additional version, just check out the My Forms area and click on around the kind you will need.

Gain access to the Puerto Rico Marketing Personnel Agreement - Self-Employed Independent Contractor with US Legal Forms, probably the most substantial catalogue of legal document layouts. Use a huge number of skilled and express-distinct layouts that satisfy your company or specific requirements and demands.

Form popularity

FAQ

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.