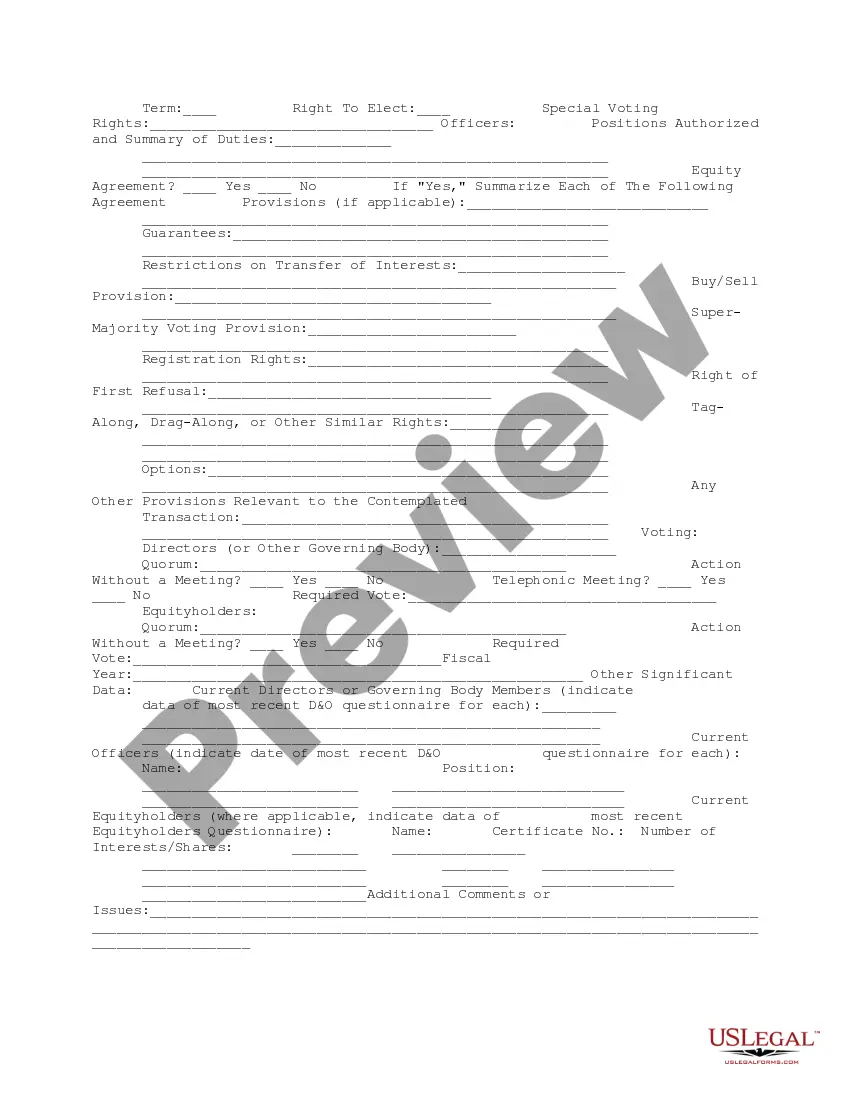

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Puerto Rico Company Data Summary

Description

How to fill out Company Data Summary?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document formats available online, but locating trustworthy versions is not straightforward.

US Legal Forms provides a wide range of form templates, such as the Puerto Rico Company Data Summary, which can be filled out to fulfill state and federal requirements.

If you discover the correct form, click on Get now.

Select the pricing plan you wish, complete the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you will be able to download the Puerto Rico Company Data Summary template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to your correct state/area.

- Utilize the Preview button to examine the form.

- Read the description to confirm you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Puerto Rico sourced income consists of income generated from business activities that take place within Puerto Rico. This includes income from services performed, property rented or sold, and capital gains from assets located in the territory. Recognizing what qualifies as Puerto Rico sourced income is key for every business operating in Puerto Rico, as it affects tax obligations and overall financial planning. A comprehensive Puerto Rico Company Data Summary can assist you in navigating these complexities and ensuring compliance.

In Puerto Rico, addresses follow a specific format that includes the recipient's name, street address, city, and zip code. Generally, the street address consists of the street name, followed by the building number. The city is typically included, and the zip code is five digits. Understanding this format is essential for accurate Puerto Rico Company Data Summary, especially for businesses that plan to interact within the area and reach their target audience effectively.

Rule 22 in Puerto Rico pertains to the regulations governing the management and operation of certain types of corporations. This rule outlines the specific requirements for corporate governance, including documentation and reporting protocols. For those interested in ensuring compliance and understanding the nuances of corporate law, the Puerto Rico Company Data Summary can serve as a valuable resource, offering essential insights and summaries that simplify these regulations.

In Puerto Rico, the term 100x35 refers to a specific measurement that helps businesses and individuals understand data related to zoning and land use. This measurement indicates a property's dimensions, usually in feet, such as a lot that measures 100 feet wide and 35 feet deep. When considering insightful investment opportunities, it's important to reference the Puerto Rico Company Data Summary, which provides comprehensive details about properties and their zoning classifications.

Form 480.6 is a tax form used in Puerto Rico for declaring certain income types, particularly regarding royalties, trust income, and certain other payments. It serves as a declaration of income for tax purposes, ensuring transparency and compliance. Using a comprehensive Puerto Rico Company Data Summary can aid in filling out form 480.6 accurately.

Yes, Puerto Rico has specific reporting requirements to the IRS. Businesses operating in Puerto Rico need to adhere to both local tax regulations and federal regulations. Understanding these obligations will help you maintain a clear Puerto Rico Company Data Summary, reducing the risk of penalties.

Individuals and businesses that earn income in Puerto Rico must file a tax return. This includes residents and non-residents who have Puerto Rico-source income. To streamline your tax filing process and maintain compliance, consider referring to a Puerto Rico Company Data Summary to ensure you meet your obligations correctly.

A 10K report is a comprehensive annual filing required by the SEC for publicly traded companies, while a traditional annual report is more company-specific and often intended for shareholders. The 10K includes detailed financial information and management analysis, giving you a complete overview of the company's health. For Puerto Rico businesses, understanding these distinctions can enhance your Puerto Rico Company Data Summary.

Creating an annual report is straightforward. First, gather your company’s financial documents, including income statements and balance sheets. Then, compile a narrative section detailing your business performance, goals, and strategies for the upcoming year. Finally, consider using the US Legal platform to streamline this process and ensure accuracy in your Puerto Rico Company Data Summary.

Finding public records in Puerto Rico involves accessing the official repositories that contain these documents. You can search online through government websites or visit physical offices for more assistance. Utilizing the Puerto Rico Company Data Summary can streamline your search by highlighting key resources. For a thorough approach, US Legal Forms is a reliable option that simplifies the entire process.