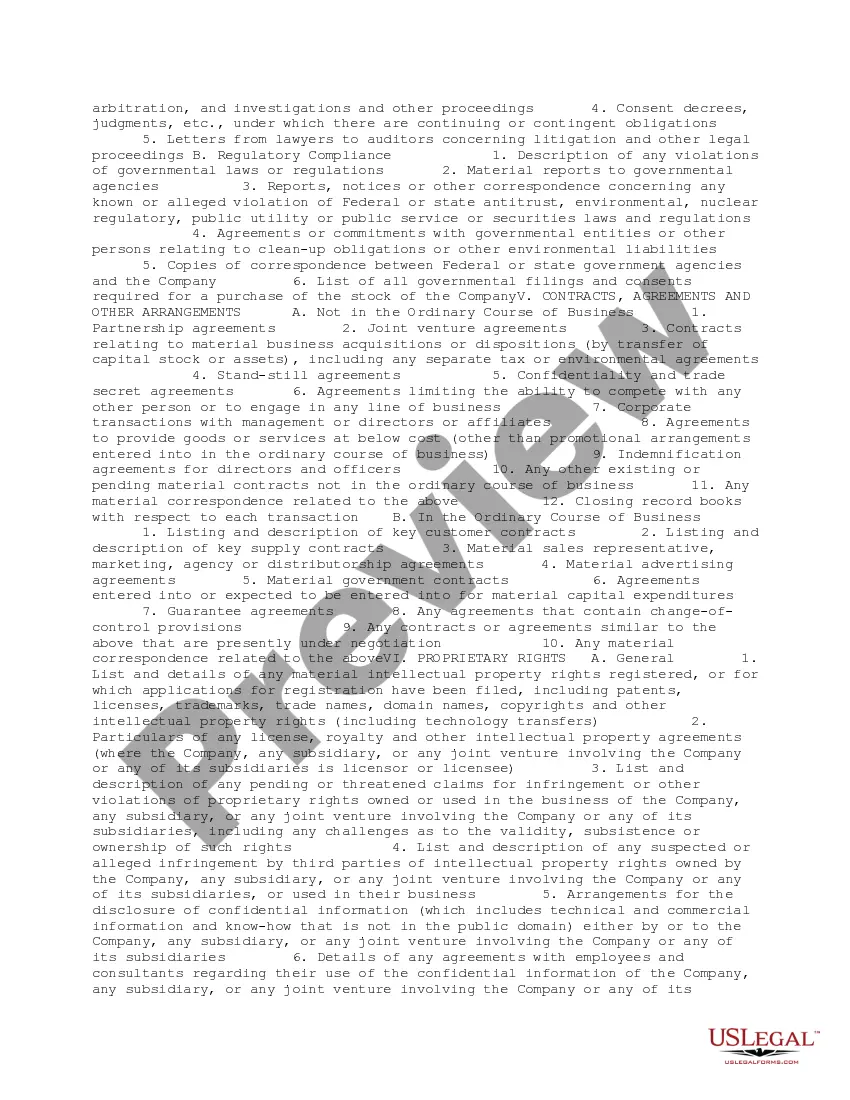

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

Puerto Rico Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

If you need to download, save, or print legal document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site's simple and convenient search function to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of the legal form and download it to your device.

- Use US Legal Forms to locate the Puerto Rico Request for Due Diligence Documents from a Technology Company with just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to retrieve the Puerto Rico Request for Due Diligence Documents from a Technology Company.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure that you have selected the form for the correct region/state.

- Step 2. Use the Review feature to check the form's details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms in the legal form style.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Form popularity

FAQ

Rule 60 in Puerto Rico pertains to the process of modifying or setting aside judgments in court. This rule allows parties to seek relief from final orders under specific circumstances, such as mistake or newly discovered evidence. Understanding this rule can significantly affect legal proceedings, including business matters. For those involved in business decisions, awareness of the Puerto Rico Request for Due Diligence Documents from a Technology Company can provide crucial insights into compliance and legal requirements.

Applying for due diligence usually necessitates a detailed examination of business records and documents. To begin, you should gather comprehensive information about your company, including financial statements and legal documents. Additionally, you may submit a formal request for due diligence documents to relevant authorities. To streamline this process, you can leverage USLegalForms, which provides guidance on how to navigate the Puerto Rico Request for Due Diligence Documents from a Technology Company.

Yes, a US citizen can easily start a business in Puerto Rico. The process requires you to register your business with the local government and might include obtaining specific permits. Additionally, you should review any applicable tax incentives for businesses in the region. By understanding the Puerto Rico Request for Due Diligence Documents from a Technology Company, you can ensure compliance and facilitate your business's success.

Yes, a US company can do business in Puerto Rico, as it is a US territory. Businesses often take advantage of the local market and tax incentives available. When expanding to Puerto Rico, making a Puerto Rico Request for Due Diligence Documents from a Technology Company is advisable to navigate the local regulations and ensure compliance.

Examples of due diligence include reviewing a company's financial records, checking legal agreements, and evaluating operational capabilities. This process ensures that you understand potential threats and opportunities. By making a Puerto Rico Request for Due Diligence Documents from a Technology Company, you gain access to these comprehensive assessments, helping you make sound investment choices.

The due diligence documents include financial statements, contracts, compliance records, and reports on operational matters. They help clarify a company's financial health and legal standing. If you utilize a Puerto Rico Request for Due Diligence Documents from a Technology Company, you can access these crucial documents to mitigate risks in your business decisions.

Due diligence documents are essential papers that a company reviews before completing a transaction or investment. These documents provide valuable insights and assess risks related to the deal. When you make a Puerto Rico Request for Due Diligence Documents from a Technology Company, you gather necessary information to ensure a well-informed decision.

The primary difference between an IFE and an IBE, or International Banking Entity, lies in their regulatory framework and operational focus. While IFEs cater mainly to international clients and offer specific tax incentives, IBEs focus primarily on providing banking services to individuals and businesses involved in international transactions. Understanding these distinctions is critical for anyone looking into a Puerto Rico Request for Due Diligence Documents from a Technology Company.

Due diligence requirements in Puerto Rico typically involve verifying the legal, financial, and operational details of an entity. Investors and businesses must gather comprehensive documentation to assess risk and ensure compliance with regulations. If you are pursuing a Puerto Rico Request for Due Diligence Documents from a Technology Company, staying organized and using platforms like uslegalforms can simplify the documentation process.

An IFE, or International Financial Entity, is a specific type of financial organization in Puerto Rico designed to cater to international clients and business activities. These entities enjoy certain fiscal benefits and tax incentives that promote their establishment and operation in Puerto Rico. Understanding the role of an IFE is important, especially when dealing with a Puerto Rico Request for Due Diligence Documents from a Technology Company.