Puerto Rico Industrial Revenue Development Bond Workform

Description

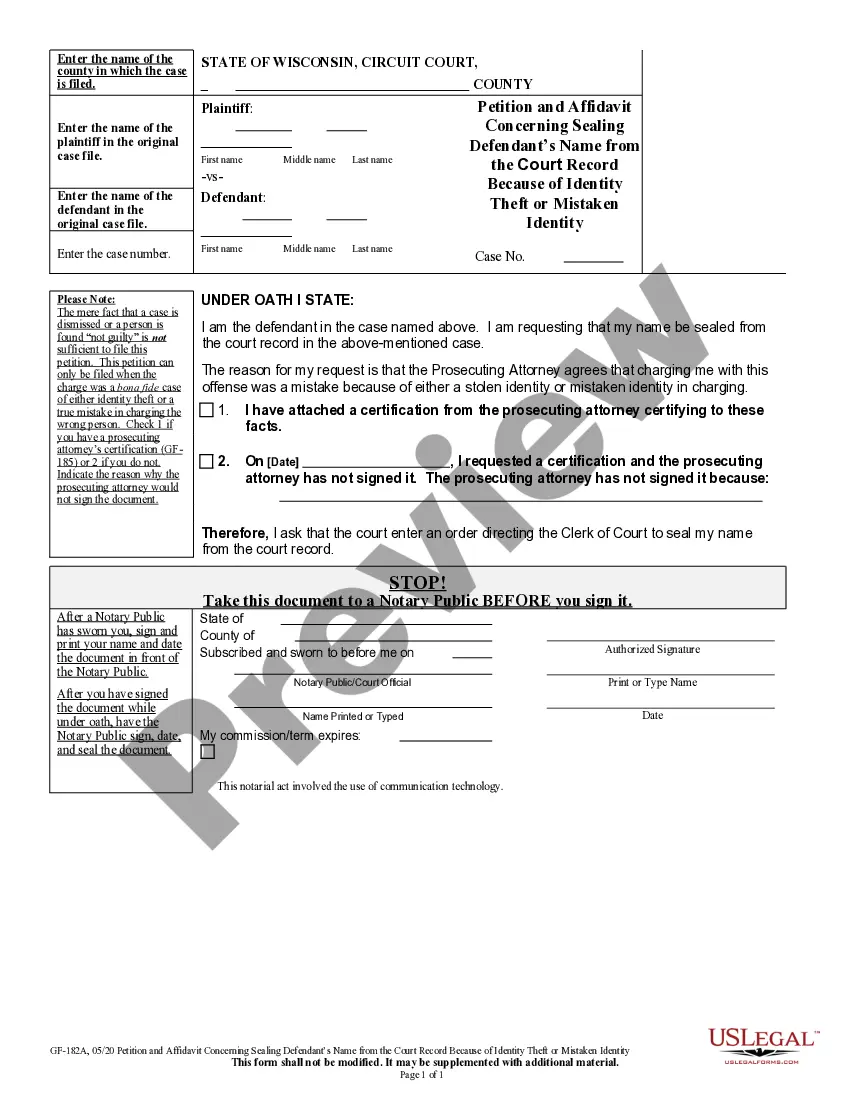

How to fill out Industrial Revenue Development Bond Workform?

Are you presently within a situation the place you will need papers for either organization or person uses virtually every time? There are a variety of authorized papers templates available on the net, but discovering kinds you can trust is not easy. US Legal Forms delivers thousands of develop templates, just like the Puerto Rico Industrial Revenue Development Bond Workform, that happen to be written in order to meet state and federal demands.

In case you are presently acquainted with US Legal Forms internet site and possess your account, merely log in. After that, it is possible to download the Puerto Rico Industrial Revenue Development Bond Workform design.

Unless you offer an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Discover the develop you require and ensure it is to the correct city/region.

- Take advantage of the Review key to check the shape.

- Look at the description to ensure that you have selected the appropriate develop.

- In the event the develop is not what you`re trying to find, use the Search field to find the develop that suits you and demands.

- If you find the correct develop, click on Purchase now.

- Select the rates strategy you need, fill out the required details to make your money, and purchase the transaction utilizing your PayPal or charge card.

- Select a hassle-free data file format and download your duplicate.

Get every one of the papers templates you have purchased in the My Forms menus. You may get a additional duplicate of Puerto Rico Industrial Revenue Development Bond Workform at any time, if needed. Just click on the required develop to download or printing the papers design.

Use US Legal Forms, one of the most substantial assortment of authorized forms, to save lots of some time and avoid faults. The assistance delivers professionally manufactured authorized papers templates that you can use for a selection of uses. Produce your account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

All bonds issued by the Government of Puerto Rico, or by its authority, shall be exempt from taxation by the Government of the United States, or by the Government of Puerto Rico or of any political or municipal subdivision thereof, or by any State, Territory, or possession, or by any county, municipality, or other ...

Puerto Rico holds a unique position as an unincorporated U.S. territory. Under Internal Revenue Code (IRC) §933, Puerto Rico source income is excluded from U.S. federal tax.

Under Internal Revenue Code Section 957(c): 1) a bona fide resident of Puerto Rico is not treated as a U.S. person (as defined in Internal Revenue Code Section 7701(a)(30)) and thus is not subject to GILTI or Subpart F inclusions.

Bonds issued by the government of Puerto Rico and its subdivisions are exempt from federal, state, and local taxes (so called "triple tax exemption"). However, unlike other triple tax exempt bonds, Puerto Rican bonds uphold such exemption regardless of where the bond holder resides.

Taxable Interest Income Enter the amount of federal bond interest included in federal income on Schedule CA (540 or 540NR), line 8, column B. 2) Other states Federal law does not tax interest from state or local bonds. California taxes the interest from non-California state and local bonds.

Bonds issued by the government of Puerto Rico and its subdivisions are exempt from federal, state, and local taxes (so called "triple tax exemption"). However, unlike other triple tax exempt bonds, Puerto Rican bonds uphold such exemption regardless of where the bond holder resides.

Entities in Puerto Rico are identified through a taxpayer ID known as the Employer Identification Number (EIN), which is issued by the US Internal Revenue Service (IRS). Unlike other jurisdictions, the local Treasury does not issue a separate identification number.

Municipal Bonds This means interest on these bonds are excluded from gross income for federal tax purposes. In addition, interest on the bonds is exempt from State of California personal income taxes.