Puerto Rico Web Site Use Agreement

Description

How to fill out Web Site Use Agreement?

US Legal Forms - one of several greatest libraries of legal varieties in the States - gives an array of legal file themes you are able to down load or print. Using the website, you can find 1000s of varieties for enterprise and personal uses, categorized by classes, suggests, or search phrases.You will discover the most recent variations of varieties like the Puerto Rico Web Site Use Agreement in seconds.

If you currently have a monthly subscription, log in and down load Puerto Rico Web Site Use Agreement through the US Legal Forms library. The Obtain button will show up on every single develop you see. You get access to all formerly downloaded varieties from the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, listed below are straightforward directions to obtain began:

- Ensure you have picked out the right develop to your metropolis/county. Click on the Preview button to check the form`s content material. Read the develop information to actually have selected the right develop.

- In the event the develop does not fit your needs, use the Research area at the top of the display screen to discover the one who does.

- If you are satisfied with the form, verify your choice by visiting the Acquire now button. Then, pick the prices program you prefer and offer your references to sign up to have an bank account.

- Process the deal. Make use of your bank card or PayPal bank account to accomplish the deal.

- Select the format and down load the form in your gadget.

- Make modifications. Complete, change and print and sign the downloaded Puerto Rico Web Site Use Agreement.

Each and every template you added to your bank account does not have an expiry day and is yours for a long time. So, if you wish to down load or print an additional backup, just check out the My Forms portion and click on the develop you will need.

Gain access to the Puerto Rico Web Site Use Agreement with US Legal Forms, one of the most comprehensive library of legal file themes. Use 1000s of expert and condition-distinct themes that satisfy your organization or personal requires and needs.

Form popularity

FAQ

A. Corporation (Default Rule for PR LLCs) ? the members of the entity have limited liability. Under the PR Code, corporations are subject to a double taxation regime. Initially, the entity pays income taxes when it realizes profits, subsequently, income taxes are paid when dividends are paid to its members.

Entities in Puerto Rico are identified through a taxpayer ID known as the Employer Identification Number (EIN), which is issued by the US Internal Revenue Service (IRS). Unlike other jurisdictions, the local Treasury does not issue a separate identification number.

Ingly if an LLC is organized under the laws of Puerto Rico it is taxed as a domestic corporation and if organized under the laws of any other country, including the United States, it is taxed as a foreign corporation. A Puerto Rico LLC is a foreign eligible entity for U.S. federal income taxes.

This brief describes the unexpected results of two Federal tax acts which have defined Puerto Rico´s tax identity since it became a U.S. territory in 1898. The first law ? the Revenue Act of 1921 ? classified Puerto Rico as a ?foreign country? for tax purposes.

A Puerto Rico LLC (limited liability company) is a business entity that offers strong liability protection and more flexibility than a corporation in how it can be managed and taxed.

Limited Liability Companies Although a Puerto Rico LLC is automatically treated as a corporation for US federal income tax purposes, it may elect to be treated as a partnership or disregarded entity, as applicable. This election is accomplished through the filing of Form 8832 with the IRS.

Formatting a Puerto Rico Address The USPS recognizes addresses in Puerto Rico as domestic. The main difference is "Calle," which means "street" in Spanish. Calle will be placed before the street's name for Puerto Rico shipments. For example 234 Calle Mariposa Apt 6.

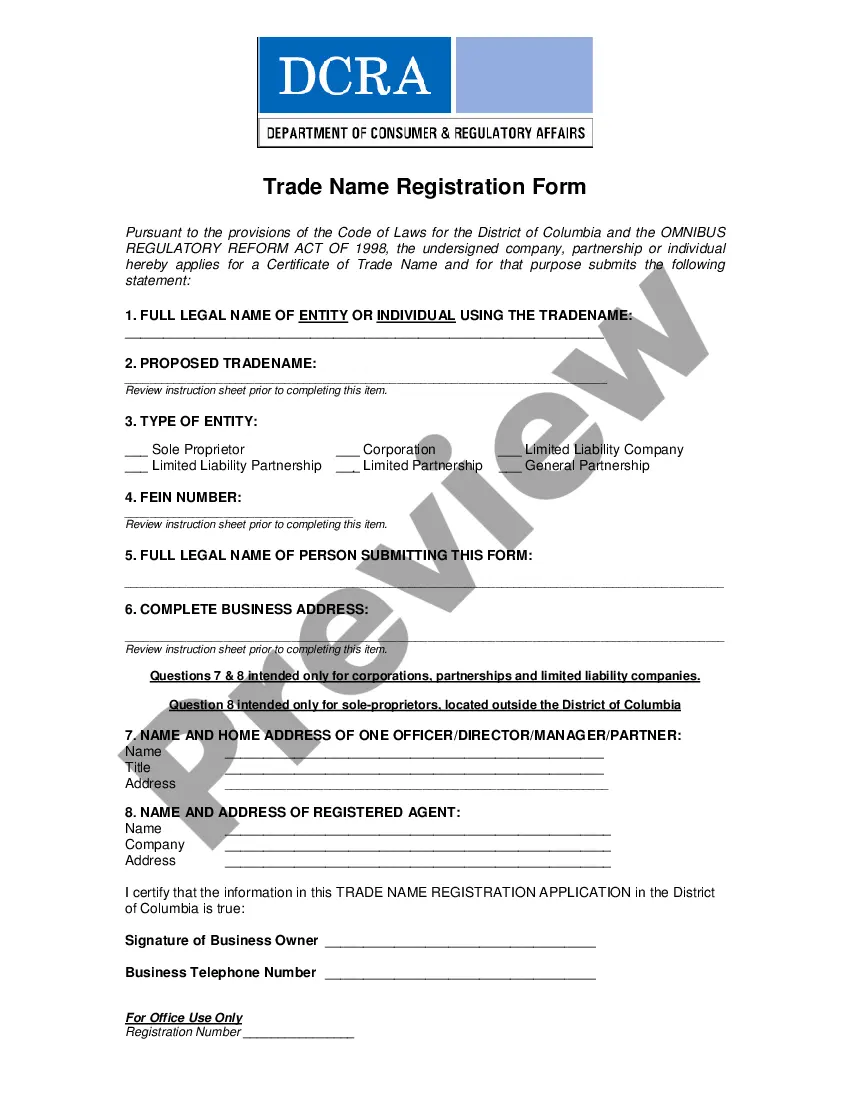

A Puerto Rico DBA, also referred to as a trade name, is an alternative name that your business can use in place of its legal business name. All types of businesses are able to get a DBA, including Puerto Rico sole proprietors, general partnerships, LLCs, and corporations. A DBA is just like your legal business name.