Puerto Rico End User Online Services Terms and Conditions

Description

How to fill out End User Online Services Terms And Conditions?

Choosing the right authorized document format might be a battle. Obviously, there are a variety of layouts available online, but how will you obtain the authorized type you want? Utilize the US Legal Forms site. The assistance delivers 1000s of layouts, including the Puerto Rico End User Online Services Terms and Conditions, which can be used for business and personal requirements. Each of the forms are examined by specialists and satisfy state and federal specifications.

In case you are previously authorized, log in for your accounts and click the Acquire button to obtain the Puerto Rico End User Online Services Terms and Conditions. Make use of accounts to check from the authorized forms you might have acquired earlier. Visit the My Forms tab of the accounts and acquire one more version of the document you want.

In case you are a whole new user of US Legal Forms, here are basic recommendations that you can stick to:

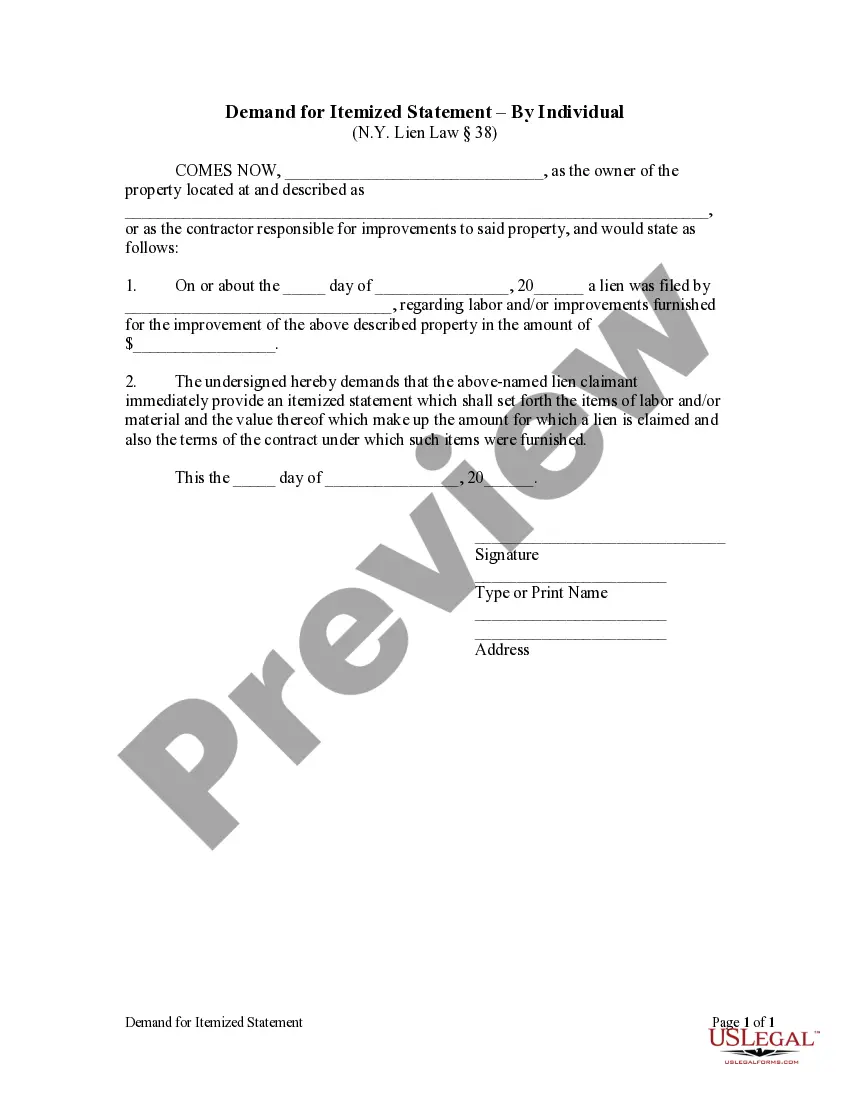

- Very first, be sure you have chosen the correct type for the town/state. It is possible to look through the form using the Preview button and read the form outline to make certain this is basically the right one for you.

- In case the type is not going to satisfy your expectations, utilize the Seach field to find the appropriate type.

- Once you are certain the form is proper, select the Buy now button to obtain the type.

- Select the rates plan you want and type in the required information and facts. Make your accounts and purchase your order with your PayPal accounts or credit card.

- Choose the file file format and down load the authorized document format for your gadget.

- Full, revise and produce and indicator the received Puerto Rico End User Online Services Terms and Conditions.

US Legal Forms may be the most significant library of authorized forms that you can find numerous document layouts. Utilize the company to down load professionally-created documents that stick to express specifications.

Form popularity

FAQ

Aside from income tax, U.S. federal taxes include customs taxes, federal commodity taxes, and federal payroll taxes (Social Security, Medicare, and Unemployment taxes). Not all Puerto Rican employees and corporations pay federal income taxes.

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.

Business name and registration Register your business name with the local government where your business is located. If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

In terms of tax benefits, Puerto Rico is a sunny place for US residents to start a business, especially if they plan to export products out of Puerto Rico to the rest of the world. The Puerto Rico government offers tax incentives to attract US business owners to emigrate to Puerto Rico.

Foreign LLCs only need to file the Certificate of Authorization and pay state fees in order to do business in Puerto Rico.

If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

A Puerto Rico DBA (doing business as), or trade name, is like an alias for your business. Every business has a legal business name, and a DBA simply allows a business to use a different name to operate. Whether your business is a billion dollar corporation or a sole proprietorship, you can register a DBA.

Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written. We recommend a written LLCA that is signed by all members.