Puerto Rico Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

Are you presently in a place where you will need files for both organization or personal purposes nearly every day time? There are a variety of legitimate papers layouts available on the Internet, but discovering types you can depend on is not easy. US Legal Forms gives 1000s of form layouts, such as the Puerto Rico Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement, which can be written to meet state and federal demands.

When you are presently familiar with US Legal Forms internet site and get a free account, just log in. Next, you may download the Puerto Rico Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement template.

Unless you come with an account and wish to begin to use US Legal Forms, follow these steps:

- Discover the form you need and make sure it is for your appropriate area/region.

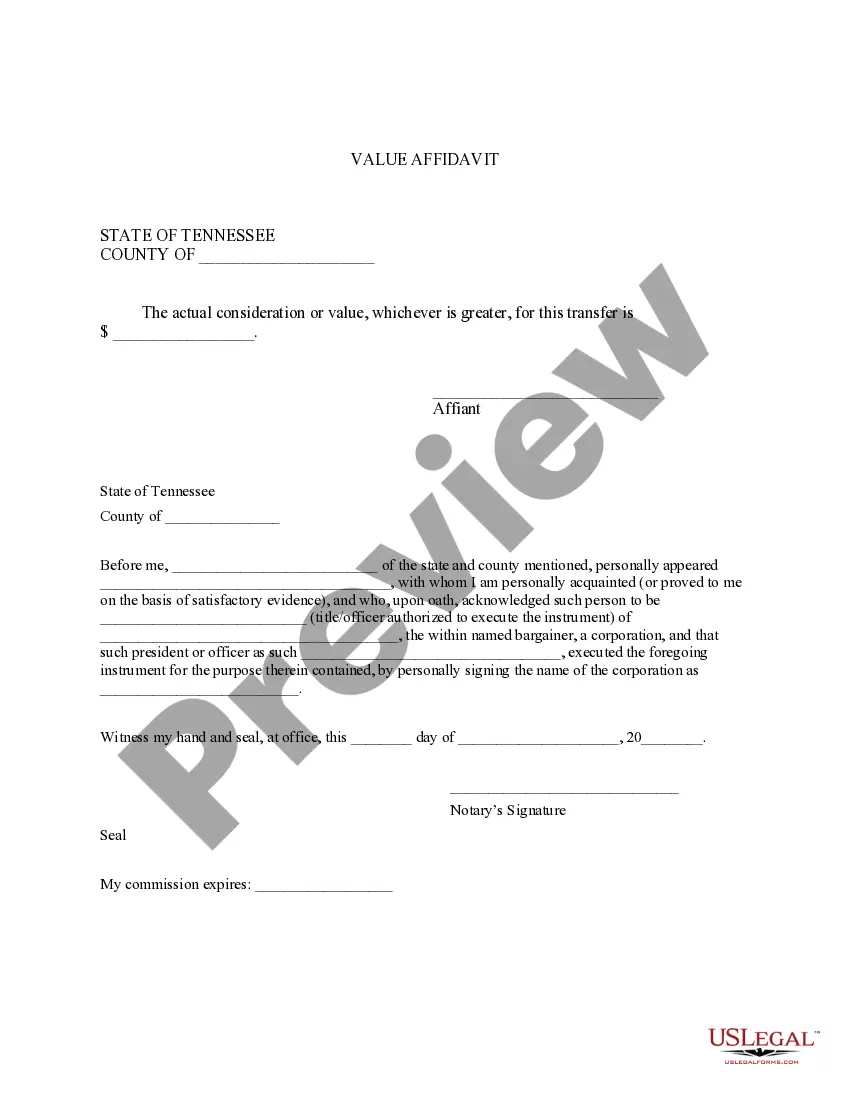

- Use the Preview key to analyze the form.

- Read the description to ensure that you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search area to get the form that meets your requirements and demands.

- When you find the appropriate form, click on Purchase now.

- Opt for the rates program you want, complete the desired information and facts to produce your money, and pay for the transaction utilizing your PayPal or charge card.

- Pick a convenient data file structure and download your copy.

Locate all of the papers layouts you might have bought in the My Forms menu. You can get a more copy of Puerto Rico Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement any time, if necessary. Just click the essential form to download or print the papers template.

Use US Legal Forms, by far the most extensive selection of legitimate forms, in order to save some time and steer clear of blunders. The assistance gives professionally produced legitimate papers layouts which can be used for a range of purposes. Produce a free account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Income Taxes In the event that an irrevocable non-grantor trust is terminated, the income that the assets have generated will presumably be distributed to the beneficiaries. It will be their responsibility to pay the taxes on the money.

[7] The income beneficiary then has capital gain in the entire amount of the proceeds received when the trust is terminated ? which is not a great tax result. The reason it is important to watch for this issue is that every trust has an income interest held by someone.

A corporation declares bankruptcy. However, if a liquidating trust is established for a corporation that is in bankruptcy, an EIN for that trust is required. See Trea- sury Reg. § 301.7701-4(d).

A liquidating trust formed for the primary purpose of liquidating and distributing the assets transferred to it is taxed as a trust, and not as an association, despite the possibility of profit ( Reg. §301.7701-4(d)).

A liquidating trust is a new legal entity that becomes successor to the liquidating fund. The remaining assets and liabilities are transferred into the newly formed trust and the former owners of the liquidating fund become unit holders or beneficiaries of the trust.