Puerto Rico Directors and officers liability insurance

Description

How to fill out Directors And Officers Liability Insurance?

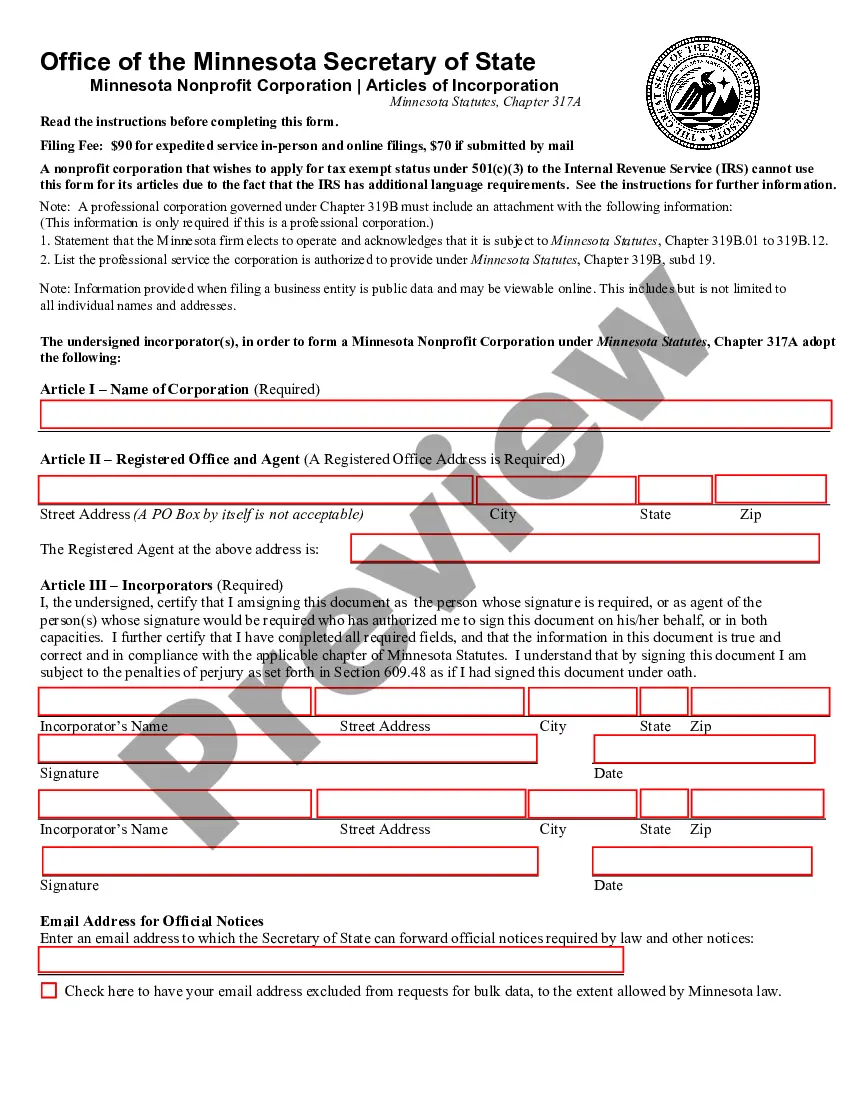

Finding the right authorized papers design might be a have a problem. Needless to say, there are a variety of themes accessible on the Internet, but how do you get the authorized develop you want? Make use of the US Legal Forms internet site. The services delivers a large number of themes, including the Puerto Rico Directors and officers liability insurance, that you can use for business and personal needs. Each of the forms are inspected by pros and satisfy state and federal specifications.

In case you are currently registered, log in for your accounts and click on the Download option to get the Puerto Rico Directors and officers liability insurance. Make use of accounts to search through the authorized forms you may have ordered in the past. Go to the My Forms tab of your accounts and obtain an additional version in the papers you want.

In case you are a brand new consumer of US Legal Forms, listed below are basic guidelines that you should adhere to:

- Very first, be sure you have selected the correct develop for your metropolis/area. You may check out the form while using Preview option and look at the form explanation to guarantee it will be the best for you.

- If the develop does not satisfy your preferences, use the Seach industry to get the correct develop.

- Once you are sure that the form is acceptable, click the Buy now option to get the develop.

- Select the pricing prepare you want and type in the essential information and facts. Build your accounts and purchase the transaction using your PayPal accounts or bank card.

- Select the file file format and acquire the authorized papers design for your gadget.

- Comprehensive, edit and printing and indication the acquired Puerto Rico Directors and officers liability insurance.

US Legal Forms will be the biggest collection of authorized forms where you can find various papers themes. Make use of the service to acquire expertly-manufactured paperwork that adhere to state specifications.

Form popularity

FAQ

There are quite a few differences between vitamin D and vitamin D3, but the main difference between them is that vitamin D is a fat-soluble vitamin that regulates calcium and phosphorous levels in the body, whereas the vitamin D3 is the natural form of vitamin D produced by the body from sunlight.

While management liability insurance includes several covers, D&O is the mandatory component. This means all the other cover options ? such as, corporate legal, employment practices, crime, and statutory liability ? are optional, allowing you to tailor your management liability package to your needs.

In Mathematics, ? and ? essentially refer to the same thing, i.e., change. This means that ?x=x1?x2=?x. The difference between ? and d is also clear and distinct in differential calculus. We know that dydx is always an operator and not a fraction, whereas ?y?x is an infinitesimal change.

The symbol d indicates an ordinary derivative and is used for the derivative of a function of one variable, y = y(t). The symbol ? indicates a partial derivative, and is used when differentiating a function of two or more variables, u = u(x,t).

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

All motor vehicle drivers in Puerto Rico are required by law to have an auto liability insurance coverage of at least $4,500 for property damage to third parties. In the event of a traffic accident, this insurance covers damages to third parties.

Further, officers and directors who participate in or authorize the commission of wrongful acts that are prohibited by statute, even if the acts are done on behalf of the corporation, may be held personally liable. Officers and directors may also be liable to the corporation or its shareholders.

Two forms of vitamin D are available in supplements: vitamin D3 and vitamin D2. Both can help correct vitamin D deficiency, but most doctors recommend D3 because it is slightly more active and therefore slightly more effective.