Puerto Rico Acquisition, Merger, or Liquidation

Description

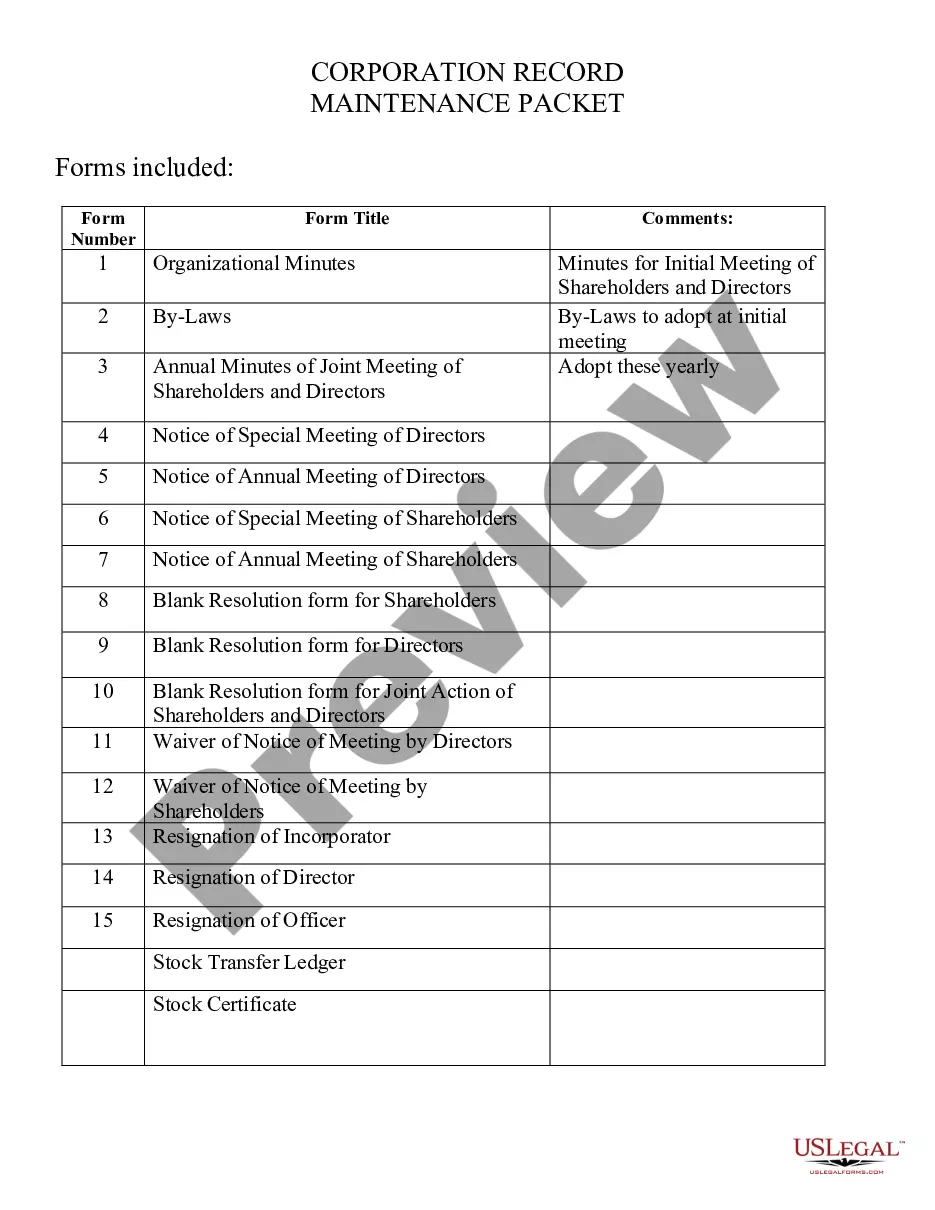

How to fill out Acquisition, Merger, Or Liquidation?

US Legal Forms - among the biggest libraries of legal forms in America - delivers a wide range of legal document web templates you are able to acquire or printing. While using site, you will get a large number of forms for business and personal functions, categorized by groups, says, or keywords and phrases.You can get the newest models of forms just like the Puerto Rico Acquisition, Merger, or Liquidation within minutes.

If you already have a registration, log in and acquire Puerto Rico Acquisition, Merger, or Liquidation through the US Legal Forms collection. The Acquire switch will show up on every form you see. You have accessibility to all earlier downloaded forms from the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are easy directions to obtain started out:

- Be sure you have picked the best form for the city/area. Go through the Preview switch to examine the form`s content material. See the form outline to actually have chosen the proper form.

- In case the form does not satisfy your requirements, take advantage of the Search discipline at the top of the display screen to discover the the one that does.

- In case you are content with the shape, verify your option by visiting the Acquire now switch. Then, select the pricing plan you favor and supply your references to register for an account.

- Method the purchase. Use your credit card or PayPal account to complete the purchase.

- Find the structure and acquire the shape on your product.

- Make adjustments. Fill out, revise and printing and sign the downloaded Puerto Rico Acquisition, Merger, or Liquidation.

Each web template you included in your money lacks an expiration date and is also the one you have permanently. So, if you want to acquire or printing one more copy, just check out the My Forms section and click on around the form you need.

Get access to the Puerto Rico Acquisition, Merger, or Liquidation with US Legal Forms, by far the most comprehensive collection of legal document web templates. Use a large number of expert and status-specific web templates that satisfy your business or personal demands and requirements.

Form popularity

FAQ

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes. If a U.S. corporation decides to establish its operations in Puerto Rico through a Puerto Rico subsidiary, the latter will not constitute part of the consolidated group for purposes of U.S. income tax returns, since a P.R.

LLCs may be organized by any natural or legal person by filing articles of organization (also referred to as the certificate of formation) in the Puerto Rico State Department.

A Puerto Rico tax return reporting Puerto Rico income and a U.S. tax return is reflected on Form 1040-NR - FileIT.

For foreign tax credit purposes, all qualified taxes paid to U.S. possessions are considered foreign taxes. For this purpose, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands and American Samoa.

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.

The income tax rate can be reduced to 1% if the exempt business is engaged in a ?Novel Pioneer Activity.? Act 60 imposes a base period income limitation on the income tax benefits for businesses that were engaged in the eligible activity in Puerto Rico before filing the tax exemption application.

Accounting records must be prepared in ance with the GAAP followed in the United States.

Puerto Rico primarily follows U.S. GAAP for financial reporting. However, some entities in Puerto Rico, especially those under the jurisdiction of the Puerto Rico Financial Oversight and Management Board, may use International Financial Reporting Standards (IFRS).