Puerto Rico Sample Performance Review for Nonexempt Employees

Description

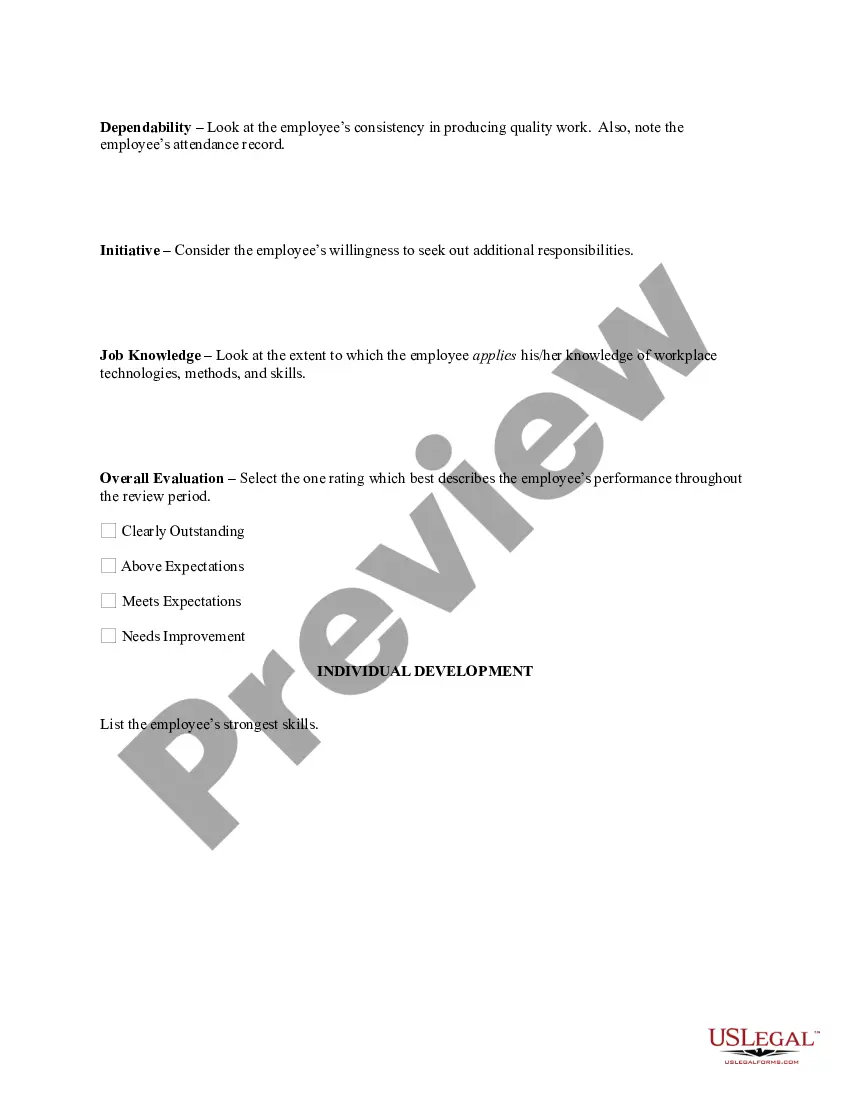

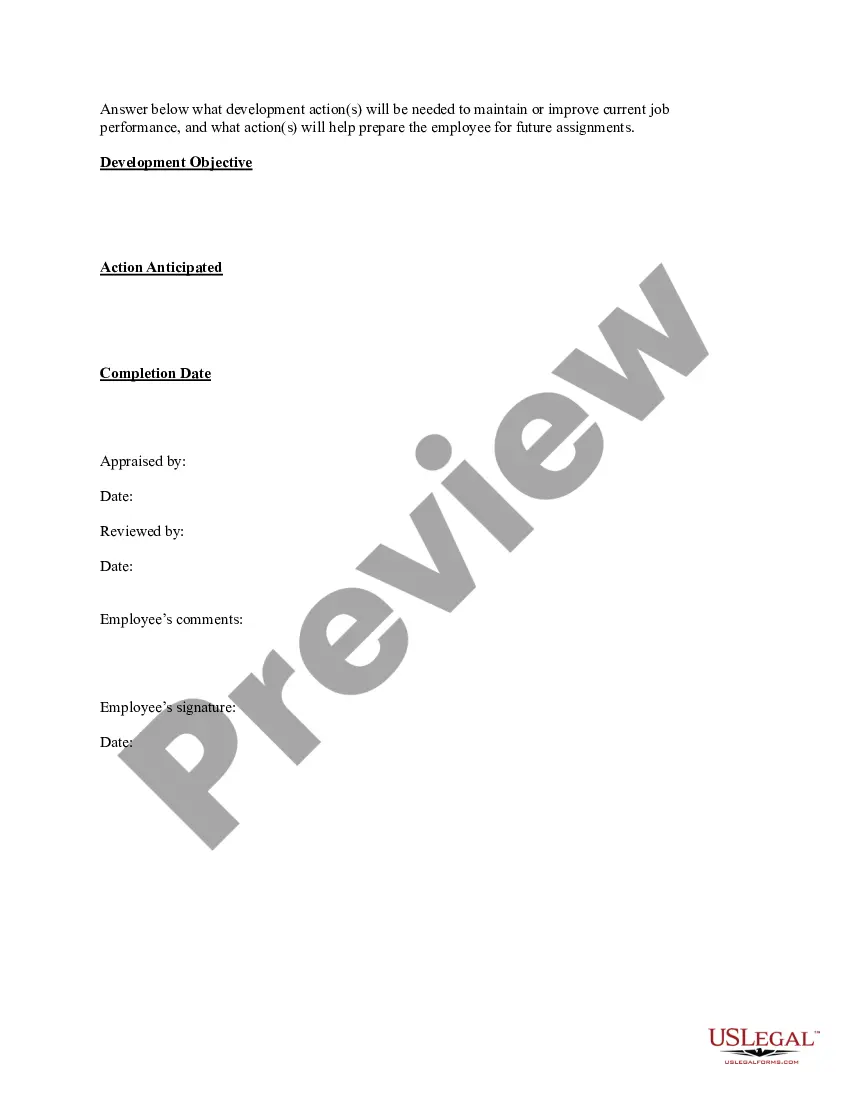

How to fill out Sample Performance Review For Nonexempt Employees?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal uses, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Puerto Rico Sample Performance Review for Nonexempt Employees in just a few minutes.

If you currently possess a membership, Log In to access the Puerto Rico Sample Performance Review for Nonexempt Employees in the US Legal Forms library. The Download button will appear on every form you review. You have access to all previously downloaded forms in the My documents tab of your account.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the contents of the form.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Many Non-Competes are unenforceable because they restrict competition across too broad of a territory. Non-Competes usually describe a restricted area in which the employee cannot compete.

Restrictive covenantsNon-compete clauses in employment contracts are valid and enforceable in Puerto Rico under general freedom of contract principles but must comply with requirements established by the Supreme Court of Puerto Rico.

By Janet A. In California, North Dakota, the District of Columbia, and Oklahoma, non-competes are either entirely or largely unenforceable as against public policy. Other states, including Maine, Maryland, New Hampshire, Rhode Island, and Washington, have banned non-compete agreements for low-wage workers.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

You Can Void a Non-Compete by Proving Its Terms Go Too Far or Last Too Long. Whether a non-compete is unenforceable because it covers too large of a geographical area or it lasts too long can depend on many factors. Enforceability can depend on your industry, skills, location, etc.

Non-compete agreements are typically considered enforceable if they: Have reasonable time restrictions (generally less than one year) Are limited to a certain geographic area (specific cities or counties, rather than entire states)

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.