Puerto Rico VETS-100 Report

Description

How to fill out VETS-100 Report?

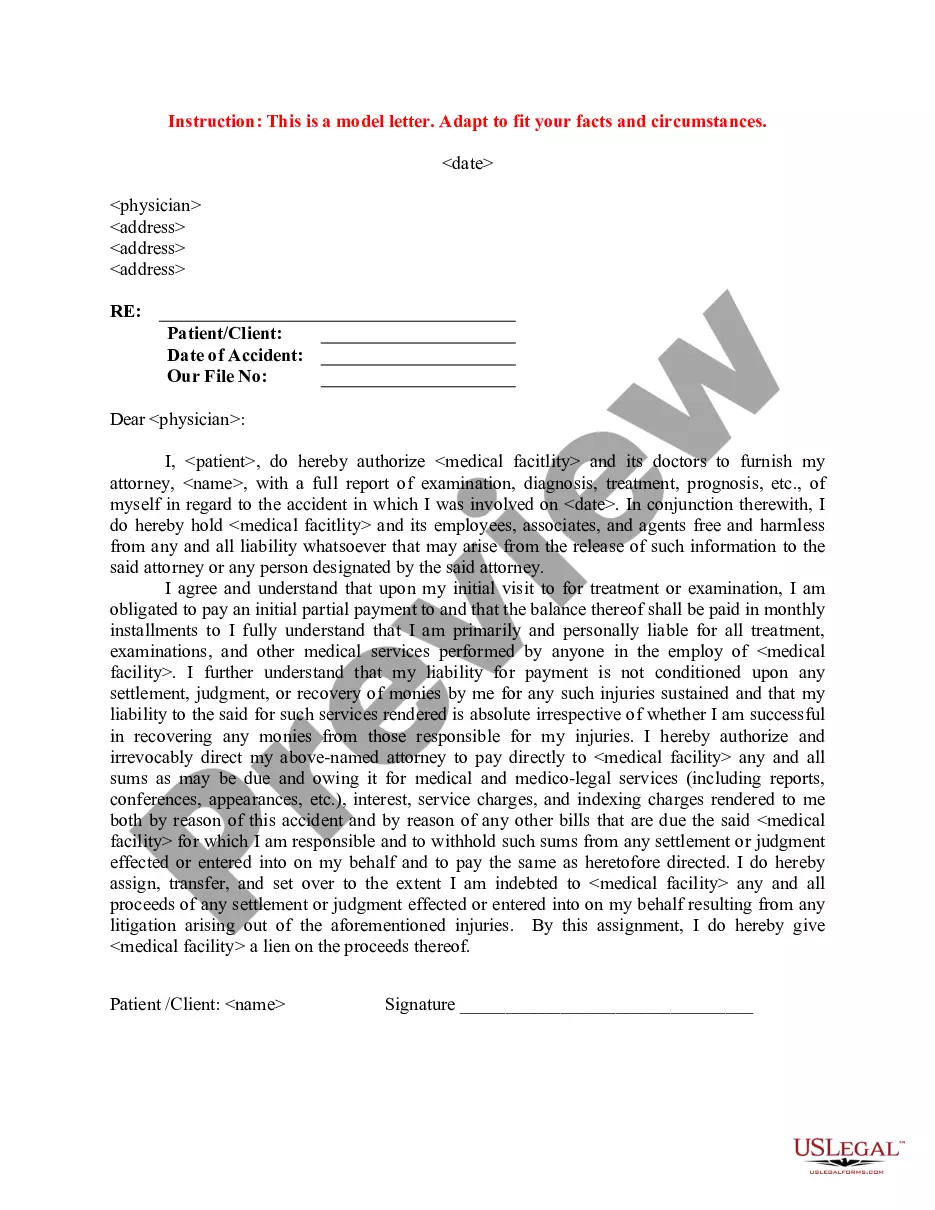

You might spend numerous hours online attempting to locate the legal document template that aligns with the federal and state stipulations you require.

US Legal Forms offers thousands of legal templates that have been evaluated by professionals.

It is easy to download or print the Puerto Rico VETS-100 Report from the service.

If available, utilize the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and press the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Puerto Rico VETS-100 Report.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the county/area you select.

- Review the form details to confirm you have selected the right template.

Form popularity

FAQ

Non-residents in Puerto Rico are subject to a withholding tax rate of 30% on most income sources, including dividends and interest. This tax can vary based on specific treaties or agreements, so it’s crucial to examine your individual circumstances. If you're navigating these details for the Puerto Rico VETS-100 Report, understanding the tax implications is vital. USLegalForms can assist you by providing detailed resources to help clarify your tax status.

Employers who have contracts with the federal government, or receive federal funds, must complete the Puerto Rico VETS-100 Report. This report serves to document the employment of veterans, and it is essential for complying with federal regulations. The requirement applies to businesses with federal contracts worth $100,000 or more. If you are unsure about your obligations, USLegalForms can provide guidance to ensure compliance.

The VETS-100 Report and VETS-4212 serve different purposes regarding veteran employment. The VETS-100 focuses on contractors’ compliance with veteran hiring laws, while VETS-4212 is more about reporting veteran employment statistics. Understanding these distinctions can help ensure compliance with federal regulations, which is where the Puerto Rico VETS-100 Report can be an invaluable resource.

What are my rights as a protected veteran? As a protected veteran under Section 4212, you have the right to work in an environment free of discrimination. You cannot be denied employment, harassed, demoted, terminated, paid less or treated less favorably because of your veteran status.

The VETS-100A Report adopts the job categories used on the revised EEO-1 Report, while the VETS-100 Report has a single Officials and Managers job category. Source: US Department of Labor, Veterans' Employment and Training Service, .

How do I submit the form?Email to vets4212-customersupport@dolncc.dol.gov.Mail to: VETS-4212 Submission. Veterans' Employment and Training Service Center. Department of Labor National Contact Center (DOL-NCC) 7425 Boston Blvd. Springfield, VA 22153.

The VETS-100A Report is now named the VETS-4212 Report. The VETS-100 Report is rescinded, rendering obsolete the VETS reporting requirements applicable to Government contracts and subcontracts entered into before December 1, 2003. The term covered veteran is replaced with the term protected veteran.

Prior to 2002, the Vietnam Era Veterans' Readjustment Act (VEVRA) required federal contractors and subcontractors with contracts worth $25,000 or more to collect certain categories of data on the covered veterans in their workforce annually and report these data on the Federal Contractor Veterans' Employment Report

The VETS-4212 Report is due on September 30 annually. Federal contractors and subcontractors are encouraged to complete and submit the reports online through our VETS-4212 Reporting Application website.

The VETS-4212 Report should be filed if a business has a current federal government contract or subcontract worth $150,000 or more, regardless of the number of employees.