Vermont Sample Letter for Corporation Taxes

Description

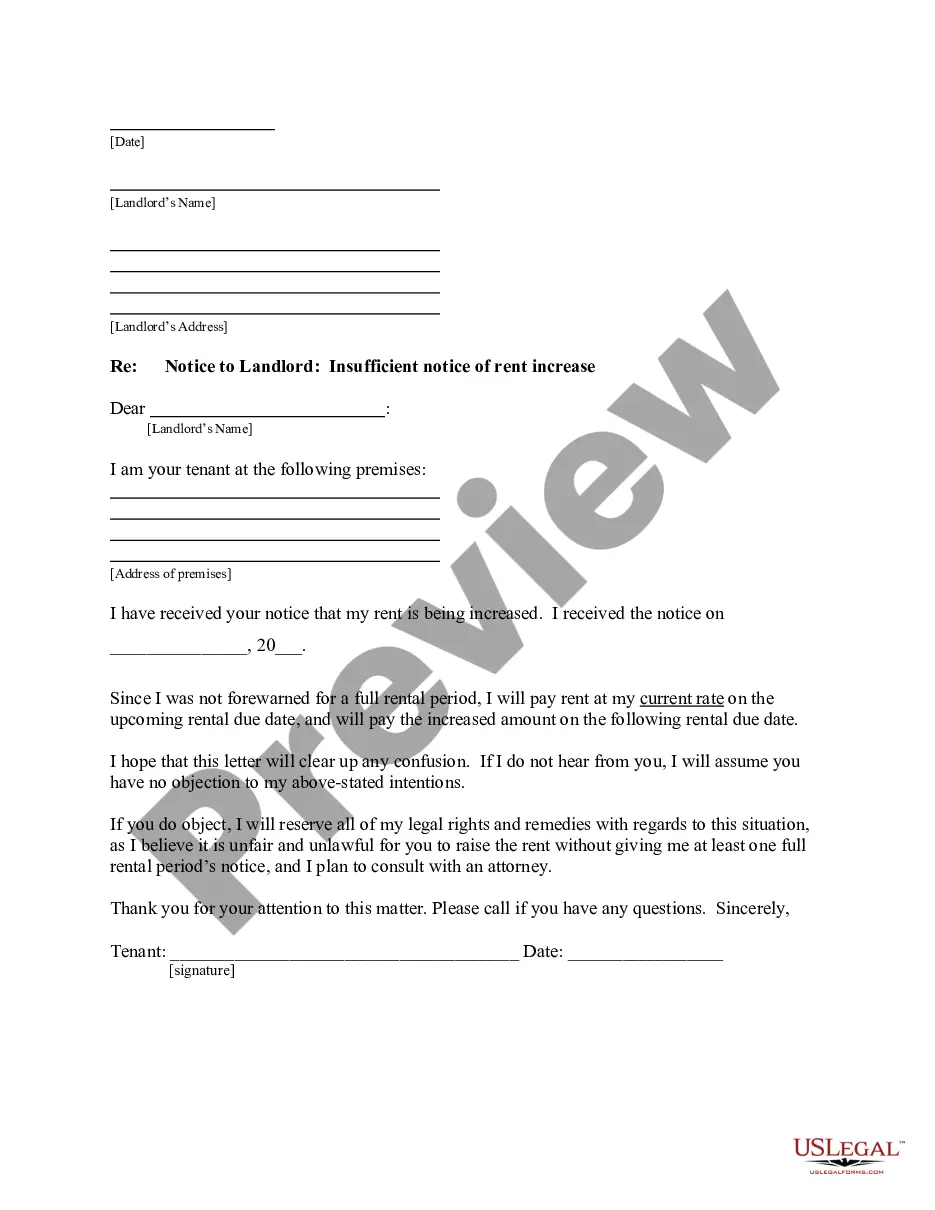

How to fill out Sample Letter For Corporation Taxes?

If you need to comprehensive, download, or print out legitimate file layouts, use US Legal Forms, the biggest selection of legitimate varieties, which can be found on the web. Take advantage of the site`s simple and handy lookup to get the paperwork you will need. Various layouts for company and personal reasons are categorized by types and says, or keywords and phrases. Use US Legal Forms to get the Vermont Sample Letter for Corporation Taxes in just a handful of clicks.

Should you be currently a US Legal Forms consumer, log in to your account and click the Down load option to find the Vermont Sample Letter for Corporation Taxes. You can even accessibility varieties you in the past downloaded within the My Forms tab of the account.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for that proper area/region.

- Step 2. Use the Preview option to examine the form`s content material. Do not neglect to see the information.

- Step 3. Should you be not satisfied using the form, make use of the Research area at the top of the screen to get other models from the legitimate form format.

- Step 4. After you have found the shape you will need, select the Acquire now option. Select the pricing program you like and add your references to sign up to have an account.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Select the formatting from the legitimate form and download it in your gadget.

- Step 7. Full, modify and print out or signal the Vermont Sample Letter for Corporation Taxes.

Each legitimate file format you purchase is your own for a long time. You might have acces to each and every form you downloaded in your acccount. Click the My Forms segment and decide on a form to print out or download once more.

Remain competitive and download, and print out the Vermont Sample Letter for Corporation Taxes with US Legal Forms. There are many specialist and state-specific varieties you can use for the company or personal requires.

Form popularity

FAQ

California does tax S Corps Also, all LLCs and S Corps must pay a minimum franchise tax of $800 annually, except for the first year. Your business will be required to pay these taxes in advance four times per year in the form of estimated corporate taxes.

S Corps and Pass-Through Status S corps have pass-through status and do not pay tax to the IRS. This means the IRS does not levy taxes on the S corp as a business.

What is the tax rate for S corporations? The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

You'll need a federal tax ID number before you can get a Vermont state tax ID number. When you have it, make use of our Vermont state tax ID number obtainment services. You'll just need to answer a few questions about you and your business, and you'll receive your state tax ID in 4 to 6 weeks.

An S corporation must pay a $250 minimum tax. ( 32 V.S.A. Sec. 5915 ) An S corporation that engages in activities in Vermont that would subject a C corporation to the requirement of filing a return must file an annual return with the Commissioner of Taxes.

Vermont Tax Rates, Collections, and Burdens Vermont also has a graduated corporate income tax, with rates ranging from 6.00 percent to 8.5 percent. Vermont has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.30 percent.

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.