Puerto Rico COBRA Continuation Waiver Letter

Description

How to fill out COBRA Continuation Waiver Letter?

If you are looking to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the website's straightforward and user-friendly search feature to locate the forms you require. Various templates for business and personal purposes are categorized by types and jurisdictions, or by keywords.

Utilize US Legal Forms to find the Puerto Rico COBRA Continuation Waiver Letter with just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you obtained within your account. Navigate to the My documents section and choose a form to print or download again.

Stay proactive and obtain, and print the Puerto Rico COBRA Continuation Waiver Letter with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to retrieve the Puerto Rico COBRA Continuation Waiver Letter.

- You can also access forms you previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

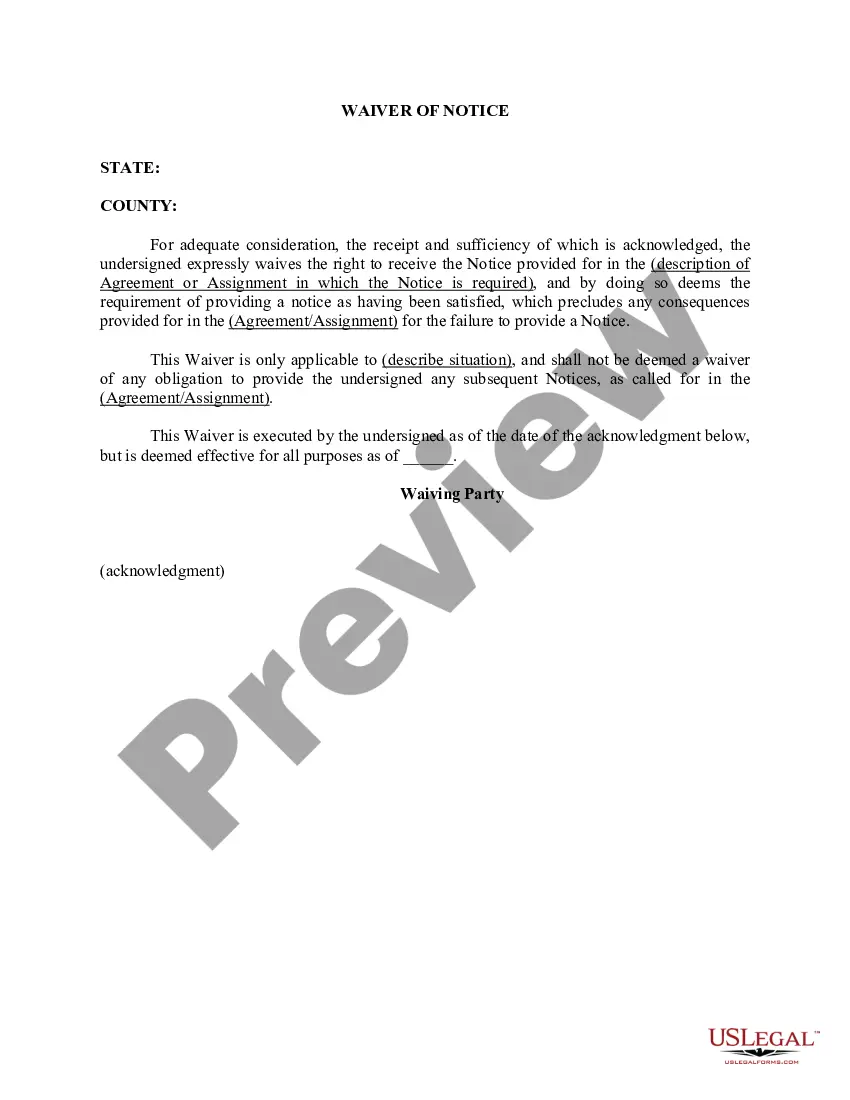

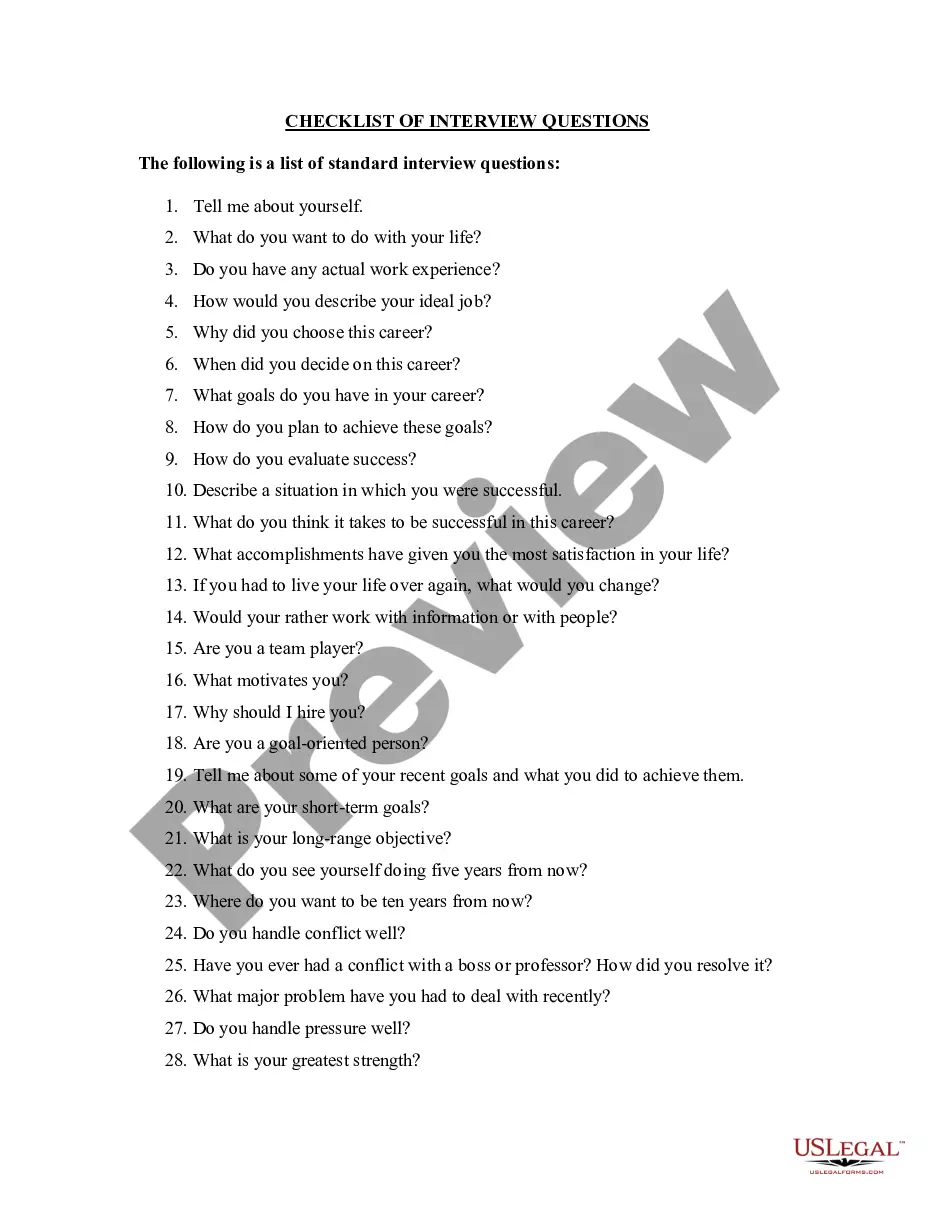

- Step 2. Use the Review option to examine the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you want, click the Get now button. Select your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify and print or sign the Puerto Rico COBRA Continuation Waiver Letter.

Form popularity

FAQ

COBRA Coverage PeriodsYou can cancel the COBRA coverage at any time within 18 months. You're not locked in. You will likely want to drop COBRA once you become eligible for a different health plan, such as if you get another job. If you stop paying premiums, COBRA coverage will end automatically.

Instead, Assistance Eligible Individuals do not have to pay any of the COBRA premium for the period of coverage from April 1, 2021 through September 30, 2021. The premium is reimbursed directly to the employer, plan administrator, or insurance company through a COBRA premium assistance credit.

If you waive COBRA coverage during the election period, you must be permitted later to revoke your waiver of coverage and to elect continuation coverage as long as you do so during the election period. Then, the plan need only provide continuation coverage beginning on the date you revoke the waiver.

If you want to avoid paying the COBRA cost, go with a short-term plan if you're waiting for approval on another health plan. Choose a Marketplace or independent plan for broader coverage. Choose a high-deductible plan to keep your costs low.

The general notice describes general COBRA rights and employee obligations. This notice must be provided to each covered employee and each covered spouse of an employee who becomes covered under the plan. The notice must be provided within the first 90 days of coverage under the group health plan.

Q3: Which employers are required to offer COBRA coverage? COBRA generally applies to all private-sector group health plans maintained by employers that had at least 20 employees on more than 50 percent of its typical business days in the previous calendar year.

Federal law requires that most group health plans (including this Plan) give employees and their families the opportunity to continue their health care coverage through COBRA continuation coverage when there's a qualifying event that would result in a loss of coverage under an employer's plan.

There are several other scenarios that may explain why you received a COBRA continuation notice even if you've been in your current position for a long time: You may be enrolled in a new plan annually and, therefore, receive a notice each year. Your employer may have just begun offering a health insurance plan.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

In addition, the law does not apply to plans sponsored by the governments of the District of Columbia or any territory or possession of the United States, certain church-related organizations, or the federal government.