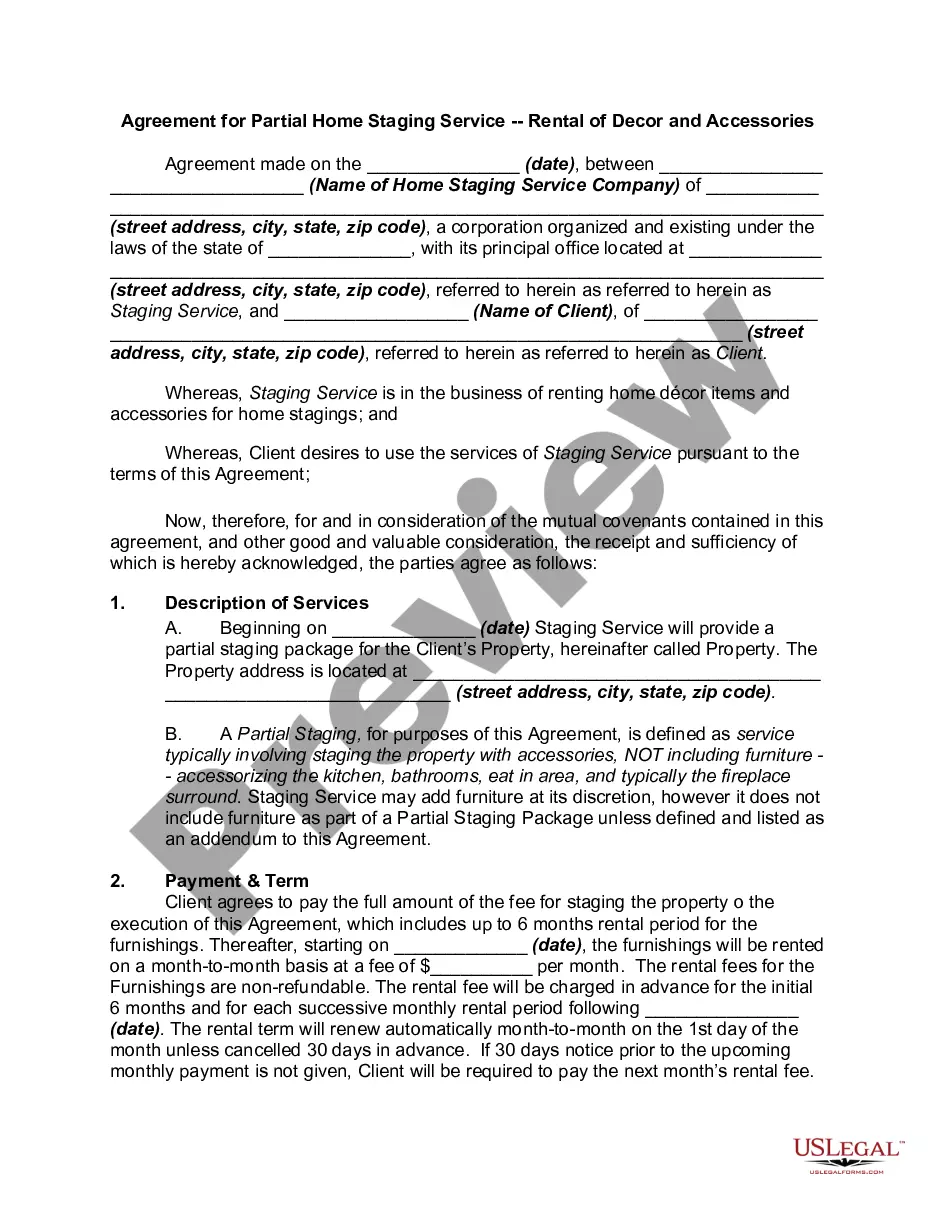

This form may be used to establish an Irrevocable Reversionary Living Trust, with the United States as Grantor; to provide secondary payment for medical benefits to the beneficiary named in the form.

Puerto Rico Irrevocable Reversionary Inter Vivos Medical Trust

Description

How to fill out Irrevocable Reversionary Inter Vivos Medical Trust?

Have you been within a position that you need to have documents for both company or personal uses almost every day? There are a lot of legal record themes available on the Internet, but finding kinds you can rely on is not straightforward. US Legal Forms gives a huge number of develop themes, such as the Puerto Rico Irrevocable Reversionary Inter Vivos Medical Trust, that are published to fulfill federal and state needs.

In case you are previously acquainted with US Legal Forms website and possess a merchant account, simply log in. After that, it is possible to down load the Puerto Rico Irrevocable Reversionary Inter Vivos Medical Trust format.

Should you not come with an account and would like to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for the correct metropolis/region.

- Take advantage of the Preview switch to examine the form.

- See the description to actually have chosen the correct develop.

- In case the develop is not what you`re looking for, take advantage of the Look for industry to get the develop that meets your requirements and needs.

- Whenever you find the correct develop, click on Buy now.

- Choose the rates plan you need, fill out the specified information and facts to produce your account, and pay money for your order using your PayPal or bank card.

- Select a handy file formatting and down load your copy.

Get each of the record themes you have purchased in the My Forms menu. You can aquire a further copy of Puerto Rico Irrevocable Reversionary Inter Vivos Medical Trust at any time, if possible. Just select the essential develop to down load or produce the record format.

Use US Legal Forms, probably the most comprehensive selection of legal kinds, to save lots of efforts and avoid mistakes. The services gives appropriately produced legal record themes that can be used for an array of uses. Make a merchant account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

You can also disclaim an inheritance if you're the named beneficiary of a financial account or instrument, such as an individual retirement account (IRA), 401(k) or life insurance policy. Disclaiming means that you give up your right to receive the inheritance.

party member, called a trustee, is responsible for managing and overseeing an irrevocable trust.

There are some other irrevocable trust deductions that may help further reduce the tax burden to the trust or estate. Investment Advisory Fees. Bond Premiums. Theft Losses. Income Distribution. Qualified Mortgage Insurance Premiums. Cemetery Perpetual Care Fund. Estate Taxes. Charitable Deductions.

Usually there are two ways in which a beneficiary can be removed; The beneficiary can sign a legal document renouncing their interest in the Trust assets. The Trustee can use their discretionary power to remove an individual as a beneficiary by following the instructions in the Trust Deed.

To remove the trustee of an irrevocable trust, a court must get involved. To start the process, a party with an interest in the trust (like a beneficiary or a co-trustee) must file a petition with the appropriate court requesting that the court remove the trustee.

Form 1041: Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trust's or estate's tax year. For example, for a trust or estate with a tax year ending December 31, the due date is April 15 of the following year.

An intervivos trust is an agreement where the person creating the trust (referred to variously as the grantor, settlor, or trustor) during the creator's life appoints a trustee to receive assets for the benefit of the creator and/or one or more beneficiaries.

Once a California Trust becomes irrevocable, the Trust beneficiaries generally cannot be changed. That's the good news.