Puerto Rico Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

If you need to fill out, download, or print official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Take advantage of the site’s straightforward and convenient search feature to locate the documents you require.

A wide range of templates for business and personal use are categorized by types and jurisdictions, or keywords. Use US Legal Forms to quickly find the Puerto Rico Self-Employed Independent Contractor Consulting Agreement - Detailed.

If you are already a US Legal Forms user, Log Into your account and click the Download button to access the Puerto Rico Self-Employed Independent Contractor Consulting Agreement - Detailed. You can also retrieve forms you have previously downloaded in the My documents section of your account.

Every legal document you acquire is yours permanently. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download and print the Puerto Rico Self-Employed Independent Contractor Consulting Agreement - Detailed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Ensure you have chosen the form for the correct state/country.

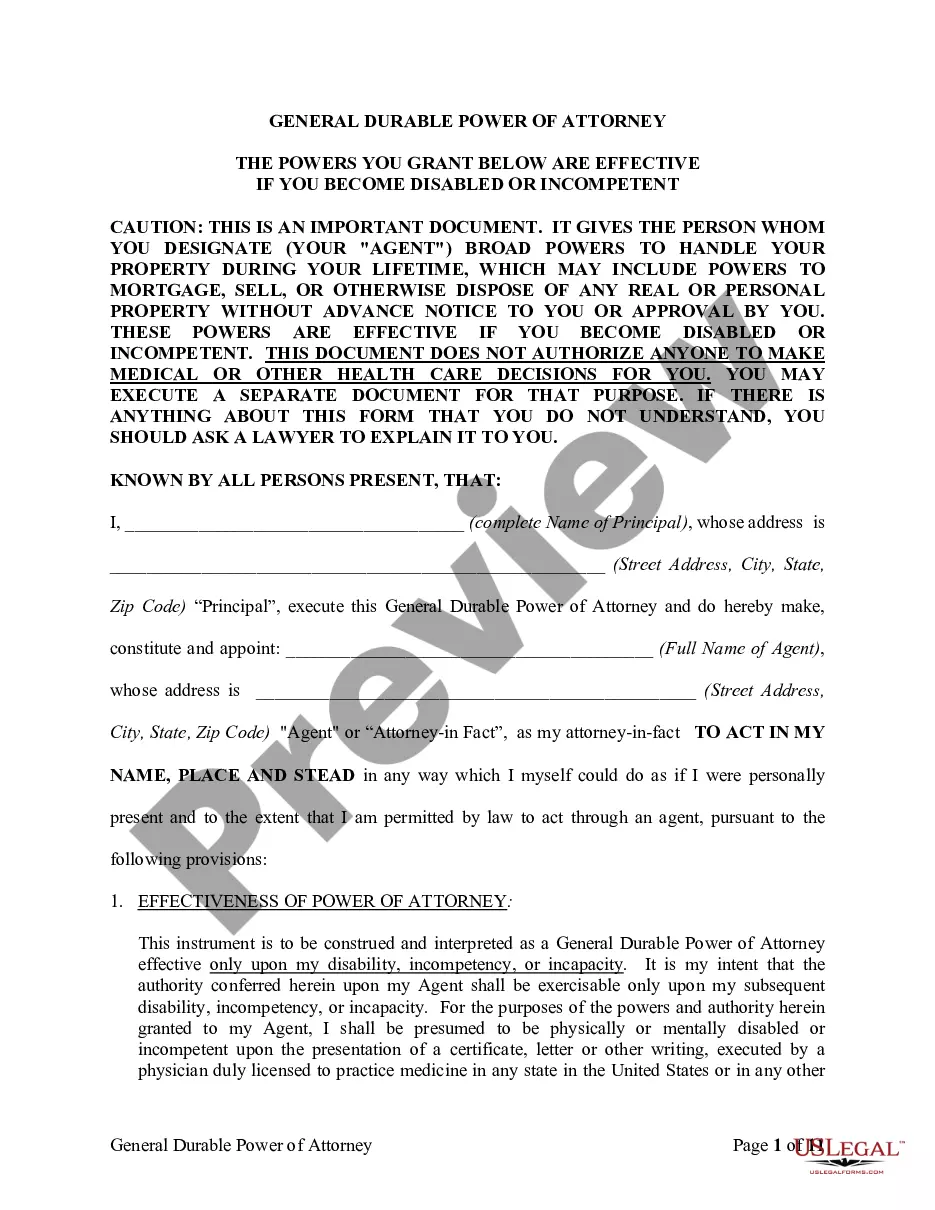

- Step 2. Utilize the Preview option to review the form’s contents. Remember to read the description carefully.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get Now button. Select the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Puerto Rico Self-Employed Independent Contractor Consulting Agreement - Detailed.

Form popularity

FAQ

Form 1099-NEC & Independent Contractors.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent consultants improve operations, solve problems, and develop strategies. They can be employed in many industries and typically require specialized knowledge of the field they work in. Independent consultants rely on extensive skill and experience and are often retired experts in their field.

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

9s and 1099s are tax forms that businesses need when working with independent contractors. Form 9 is what an independent contractor fills out and provides to the employer. Form 1099 has details on the wages an employer pays to an independent contractor. This form is filed with the IRS and state tax authorities.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.