Puerto Rico Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

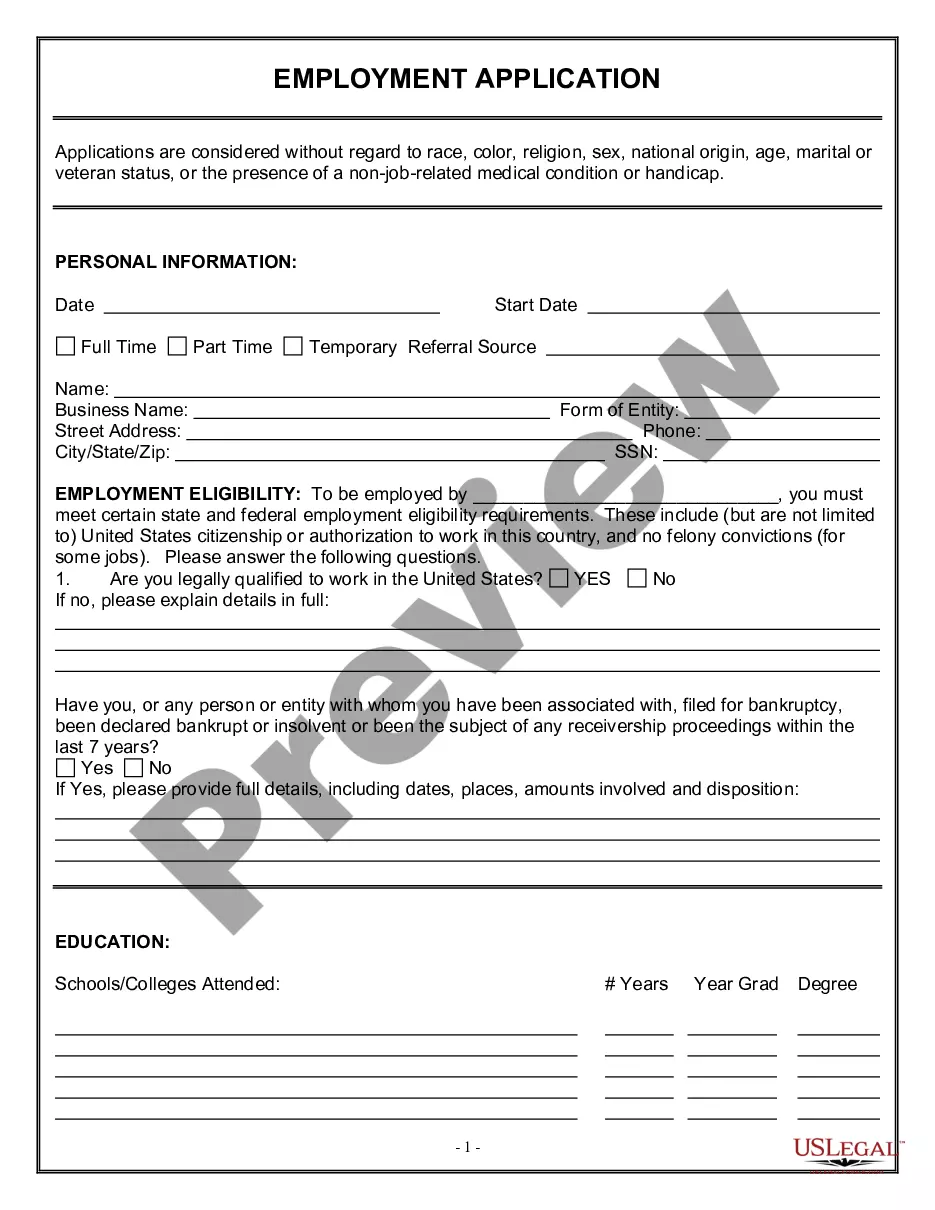

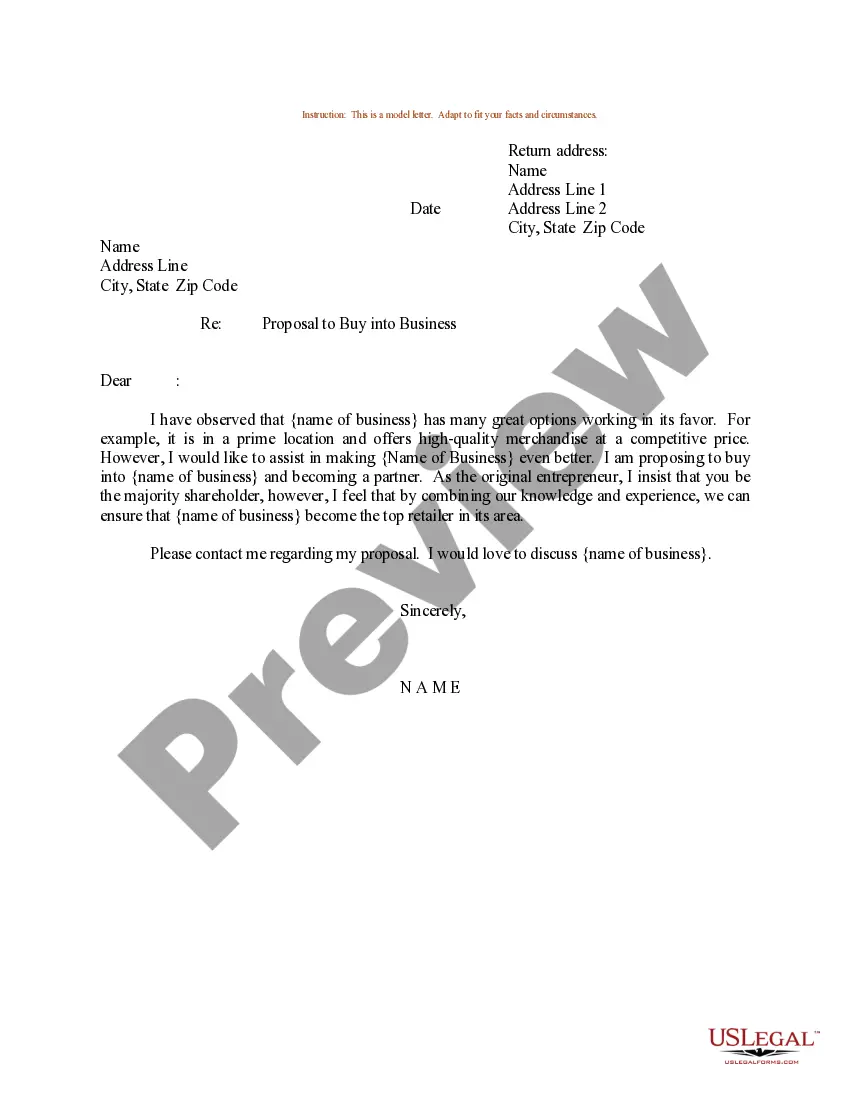

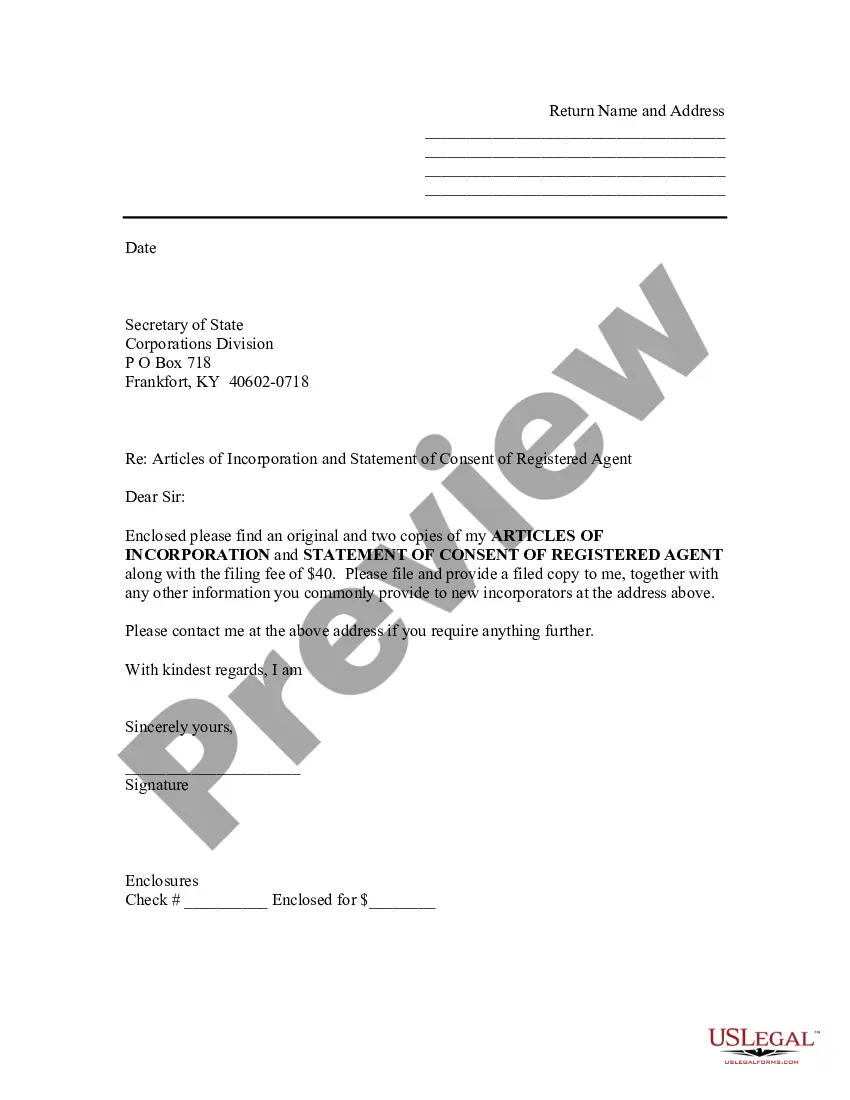

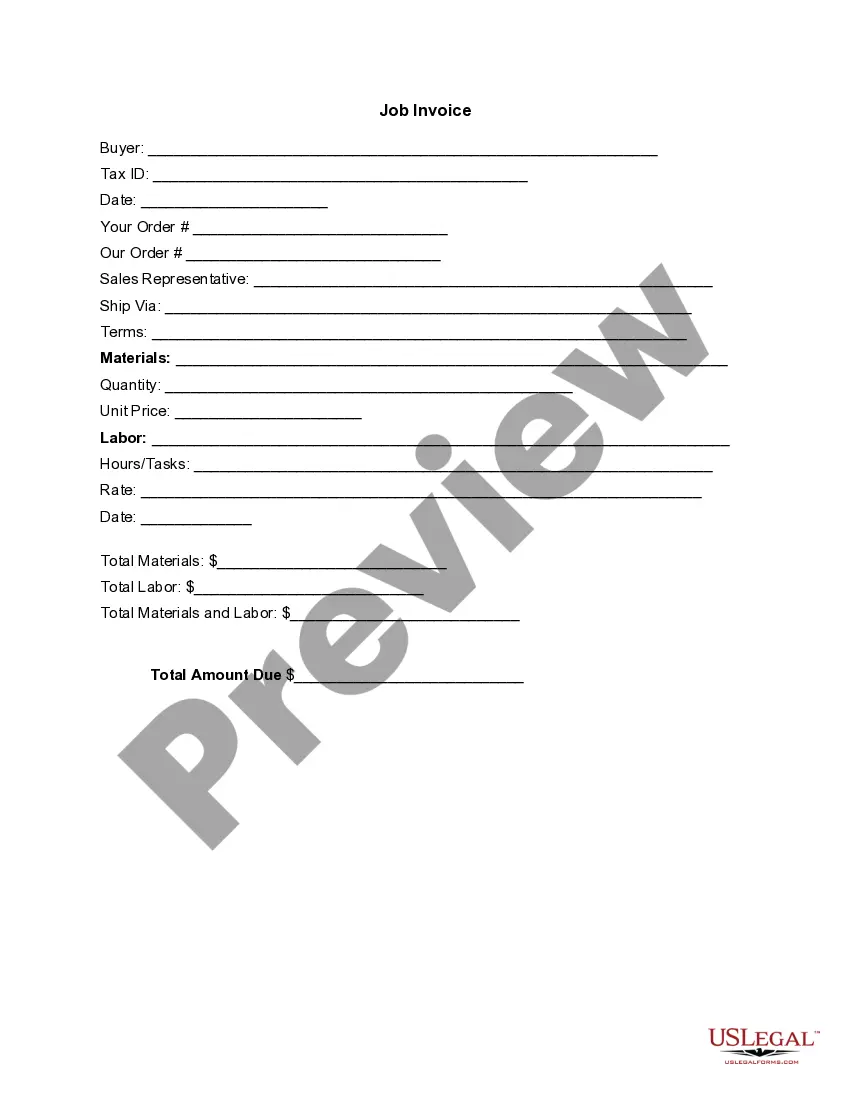

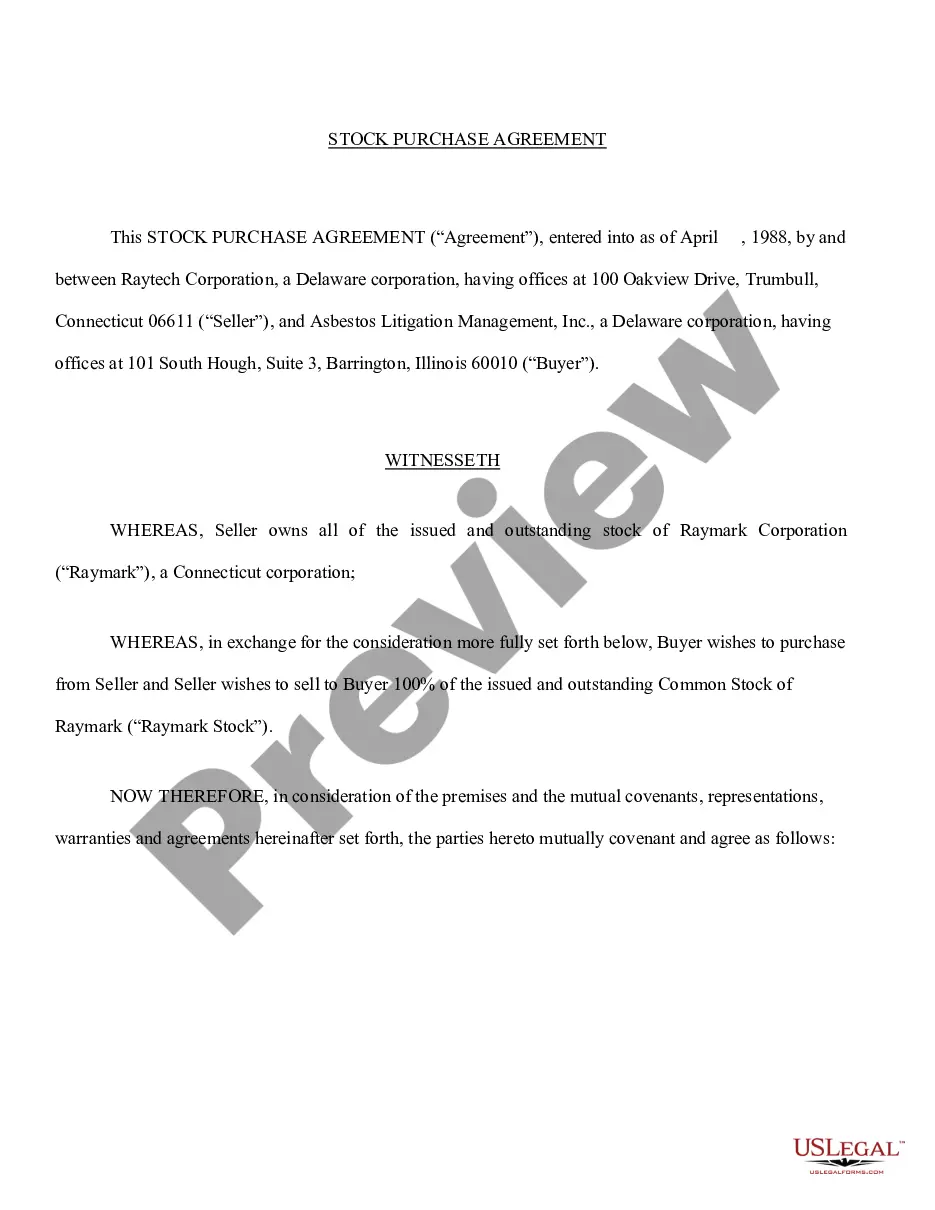

Are you currently within a placement that you require files for possibly company or individual purposes just about every day time? There are tons of legitimate papers templates accessible on the Internet, but finding types you can rely isn`t straightforward. US Legal Forms offers 1000s of form templates, just like the Puerto Rico Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which are composed in order to meet state and federal requirements.

If you are presently knowledgeable about US Legal Forms site and get a merchant account, simply log in. Afterward, you may obtain the Puerto Rico Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse design.

If you do not provide an profile and wish to begin to use US Legal Forms, follow these steps:

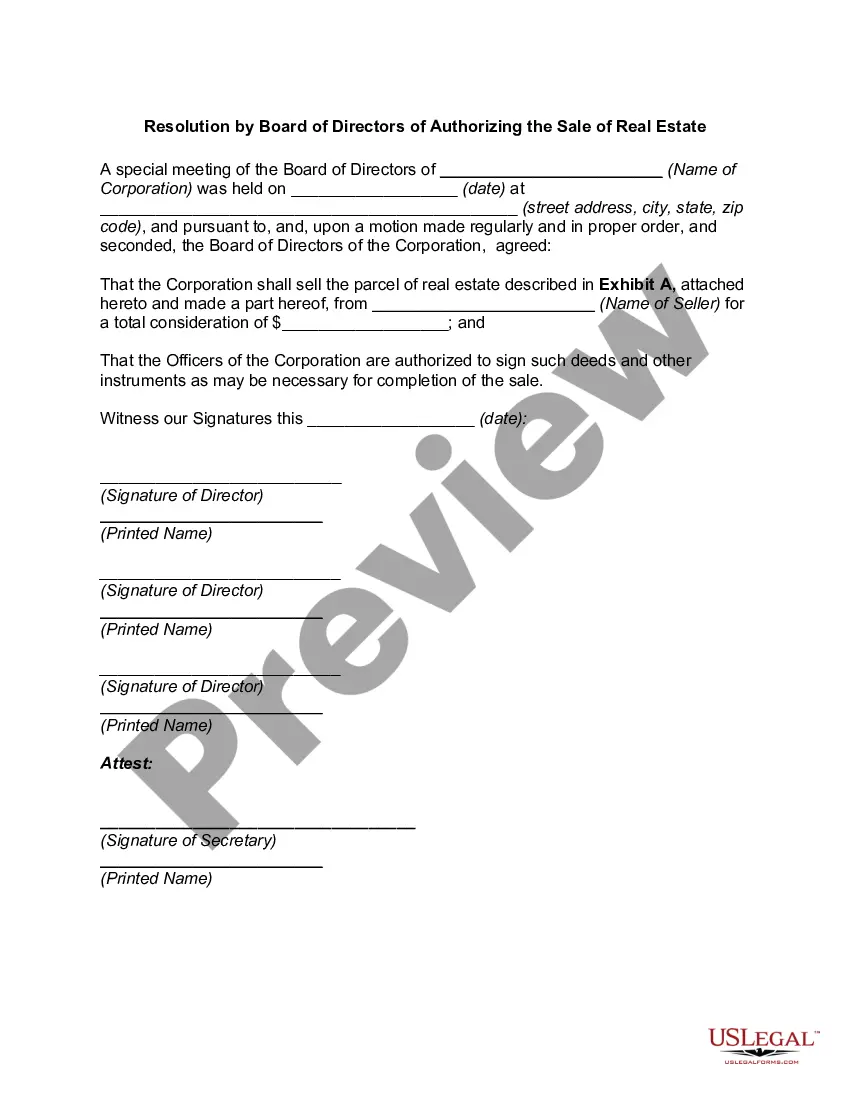

- Get the form you need and make sure it is to the proper city/state.

- Use the Preview button to analyze the shape.

- Look at the information to ensure that you have selected the right form.

- In the event the form isn`t what you are searching for, make use of the Research field to obtain the form that fits your needs and requirements.

- When you find the proper form, simply click Purchase now.

- Choose the pricing program you need, complete the necessary details to create your account, and purchase the transaction making use of your PayPal or credit card.

- Pick a convenient paper format and obtain your duplicate.

Find all of the papers templates you might have purchased in the My Forms menu. You can aquire a additional duplicate of Puerto Rico Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse whenever, if needed. Just go through the necessary form to obtain or printing the papers design.

Use US Legal Forms, one of the most considerable selection of legitimate types, to conserve efforts and stay away from mistakes. The services offers expertly manufactured legitimate papers templates that can be used for a range of purposes. Generate a merchant account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

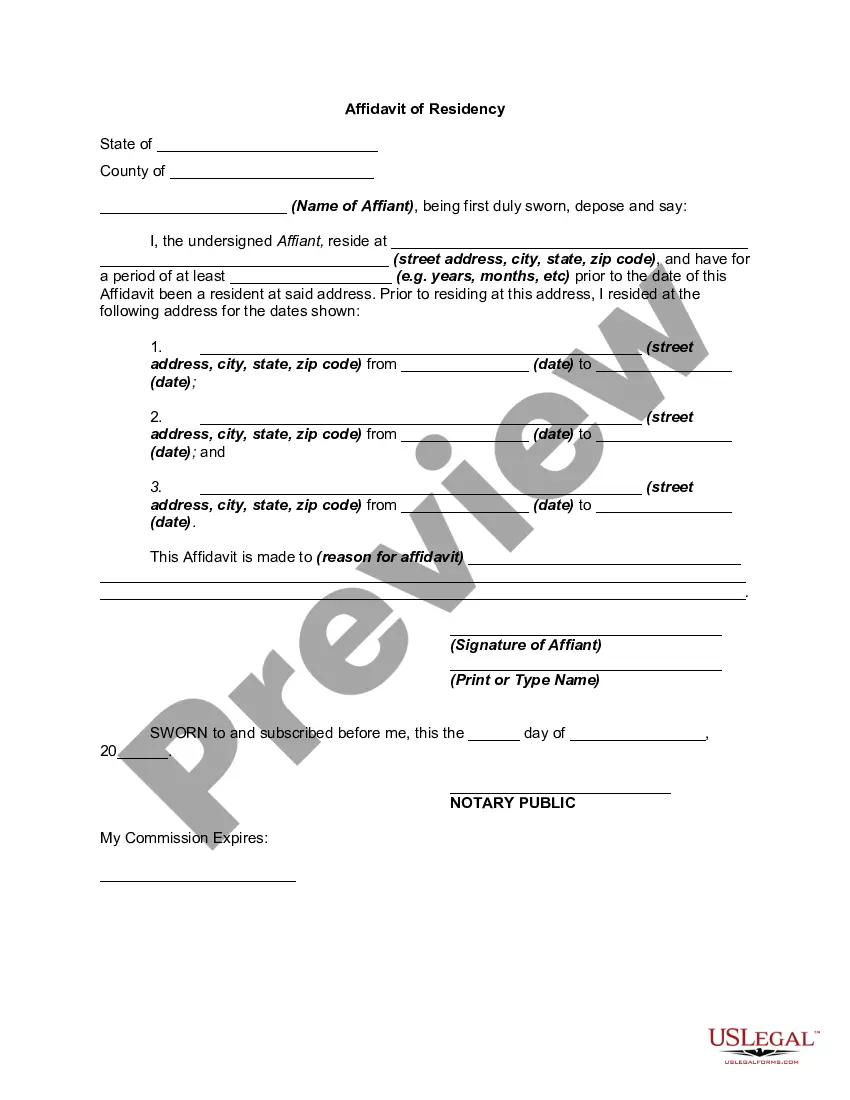

While various types of trusts can be labeled as ?residuary,? broadly speaking, a residuary trust is a trust that contains the remaining property that is not specifically left to a beneficiary in pour-over will, in the trust, or through another trust. What Is a Residuary or Residual Trust? - RMO LLP rmolawyers.com ? Blog rmolawyers.com ? Blog

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure. Marital Trust | Definition, How It Works, Advantages ... Carbon Collective Investment ? sustainable-investing Carbon Collective Investment ? sustainable-investing

With a QTIP trust, no one (including the surviving spouse) may be given the power to appoint trust property to anyone as long as the surviving spouse is alive.

A marital deduction trust is a trust where transfers of property between married partners are free of federal transfer tax. A marital deduction trust can take one of two forms: A life estate coupled with a general power of appointment given to the spouse, or. A Qualified Terminable Interest Property (QTIP) trust.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants). Estate Planning - HRBK Law hrbklaw.com ? hrbk_publications ? estate-planning hrbklaw.com ? hrbk_publications ? estate-planning

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments. What Is a Marital Trust? Benefits, How It Works, and Types Investopedia ? terms ? marital-trust Investopedia ? terms ? marital-trust

Formula Marital Deduction Bequests There are three basic formula clauses that normally are used: (1) pecuniary marital deduction; (2) pecuniary unified credit; and (3) fractional residuary marital reduction. Numerous variations and refinements can be applied to each.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.