Puerto Rico Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

You have the capability to spend hours online trying to locate the legal document template that fulfills the state and federal standards you require.

US Legal Forms offers thousands of legal forms that are vetted by specialists.

You can easily obtain or generate the Puerto Rico Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment from this service.

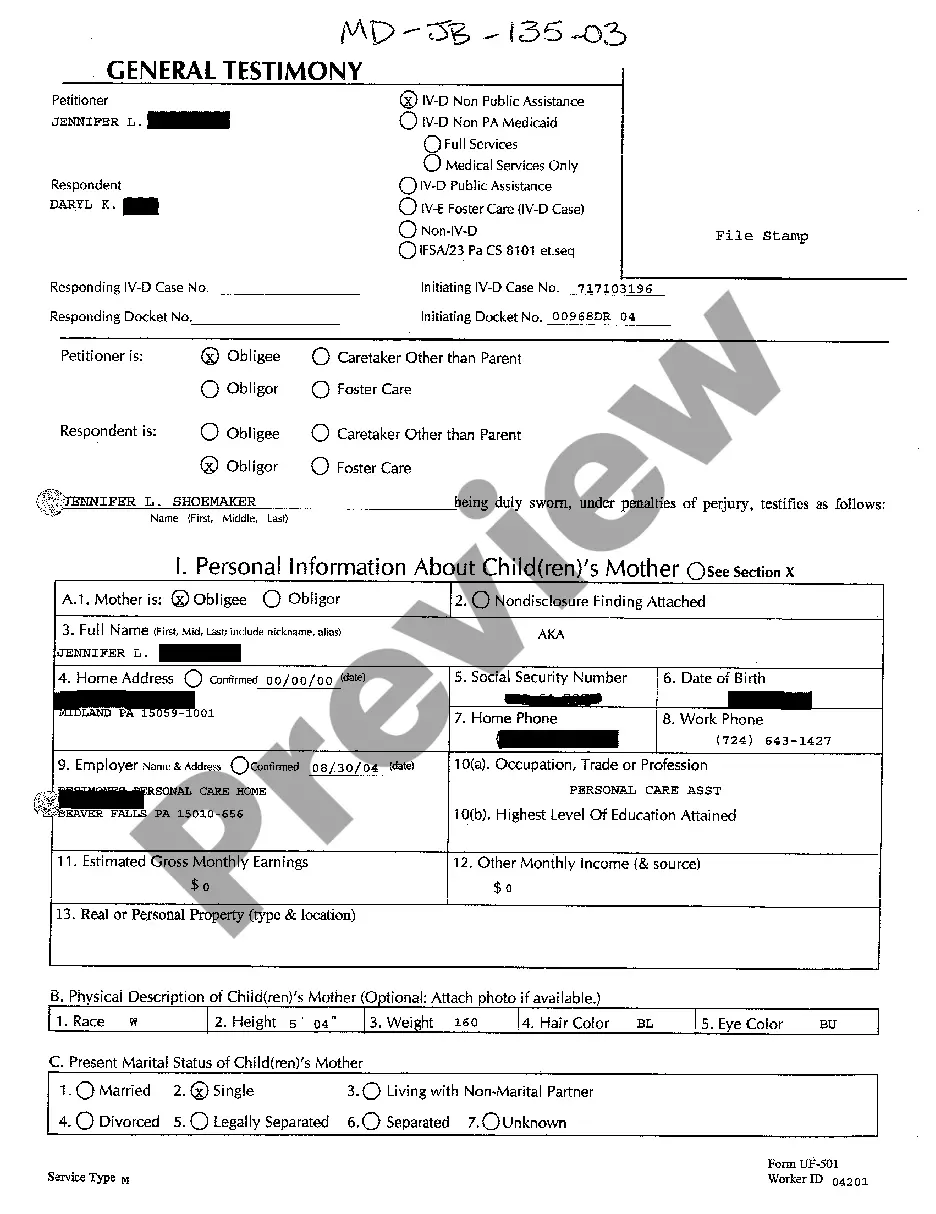

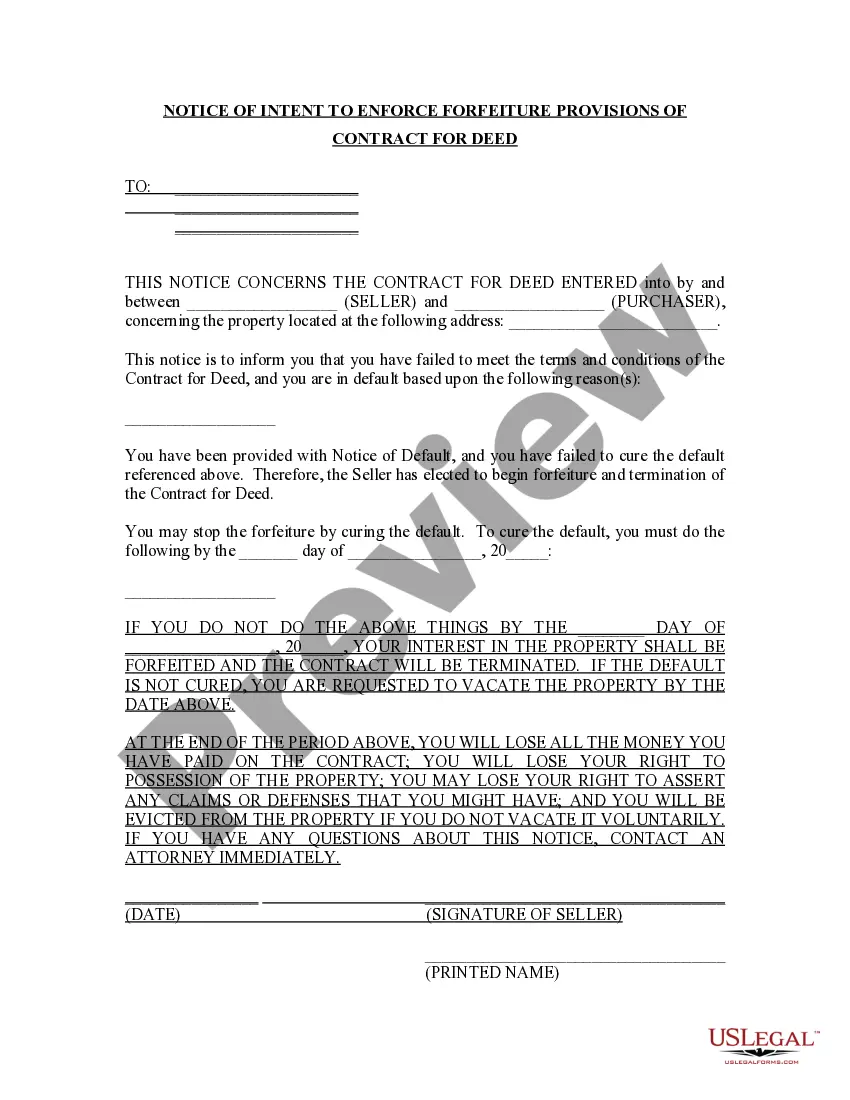

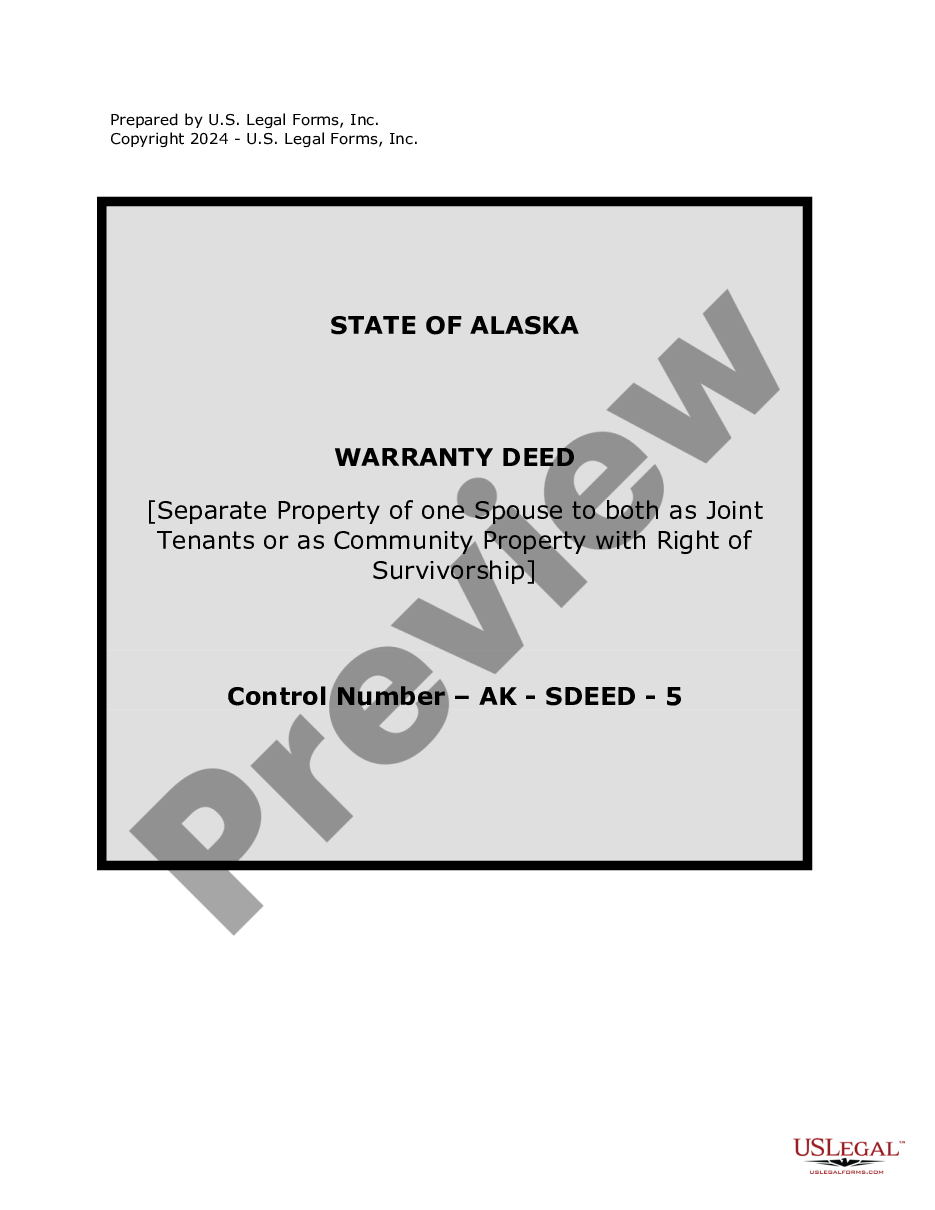

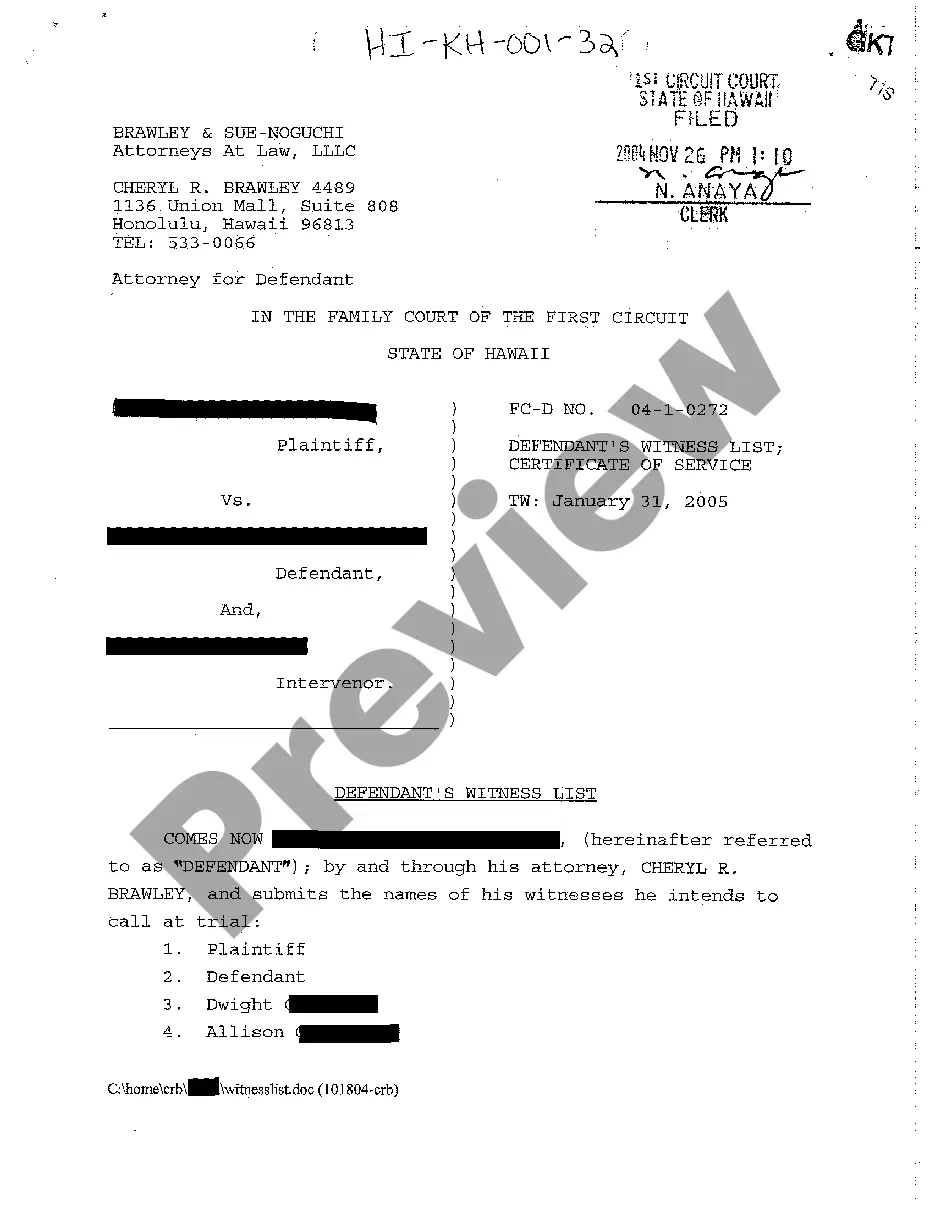

If available, take advantage of the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, produce, or sign the Puerto Rico Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- Every legal document template you purchase is yours indefinitely.

- To acquire another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have chosen the appropriate document template for your county/city of choice.

- Review the form description to make certain you have selected the correct document.

Form popularity

FAQ

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

Under the law, partners may generally dissolve a partnership by: the term of the agreement expiring; or. one partner giving notice to the other of their intention to dissolve the partnership if no term is defined.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).14-Sept-2018

The distribution of payments of the Company in the process of winding-up shall be made in the following order: (i) All known debts and liabilities of the Company, excluding debts and liabilities to Members who are creditors of the Company; (ii) All known debts and liabilities of the Company owed to Members who are

Debt to parties, account of capital of each partner, advances given by partners, residue to be divided amongst partners in profit sharing ratio.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.