Puerto Rico Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

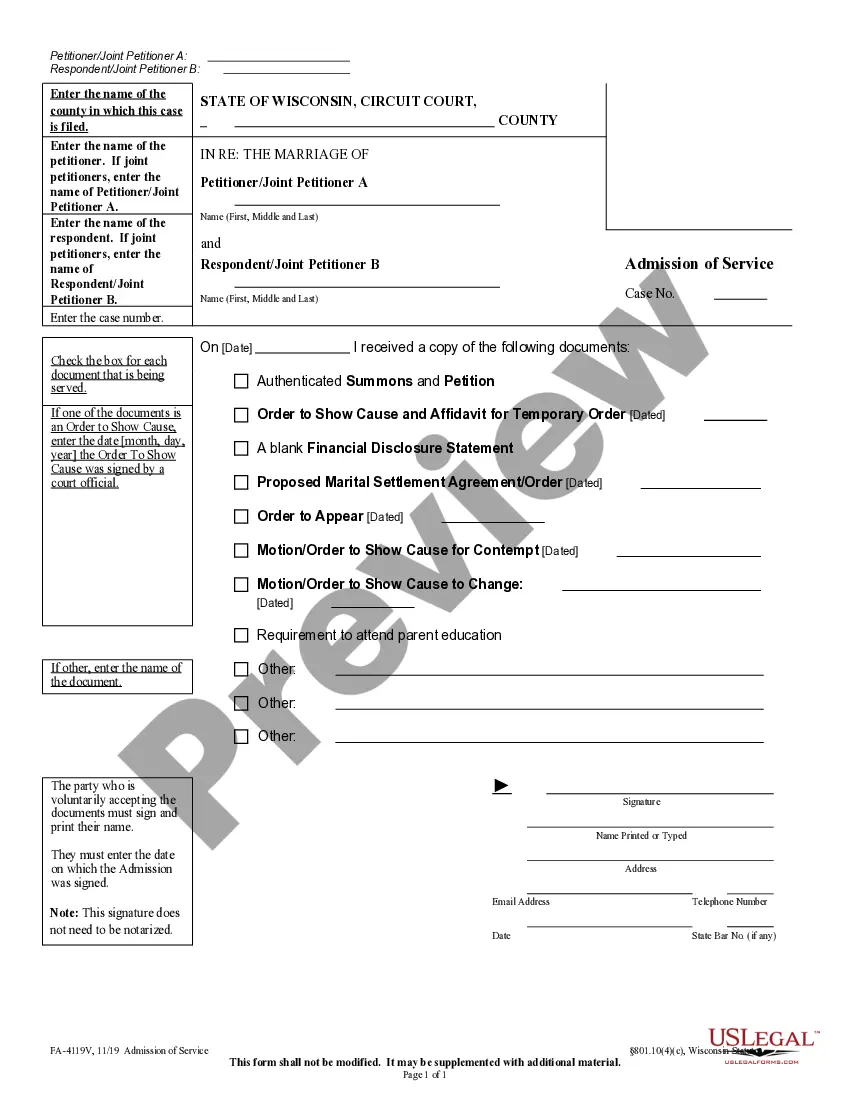

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

You might spend hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides a vast selection of legal forms that can be reviewed by professionals.

You can effortlessly access or print the Puerto Rico Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets from the platform.

Review the form description to confirm you have selected the right one. If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the Puerto Rico Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your choice.

Form popularity

FAQ

Can Partners Take Unequal Distributions? You may be entitled to unequal distribution of partnership profits regardless of the partners' share of capital under a partnership agreement. An S Corporation cannot take advantage of this tax break because it cannot adjust its tax bill in this way.

What Happens If The Partner Has Withdrawn All Of The Income Of The Partnership? The business' equity can be sold, retired, or passed on to heirs when a partner dies. Similarly to the admission of a new partner to a partnership, it dissolves once a partner has withdrawn. A new agreement needs to be drafted.

If a partner is allocated more than what its pro rata share of IRC 751(b) assets equals, the distribution will be disproportionate. Partners receive money and property from a partnership.

Distributions that exceed the stock basis will be generally taxed as long-term capital gains on the personal tax returns of shareholders. Currently, the rate for long-term capital gains is 15 percent. If you need help with S corp distributions in excess of basis, you can post your legal need on UpCounsel's marketplace.

LLCs are not required to periodically distribute profits to members. If profits are distributed, a member still has an equal claim for future distributions.

How Do You Treat Distributions In Excess Of Basis? As long as the interest in the partnership has been held for long (or short term in this case) a partner receiving distributions exceeding basis receives capital gains (or long or short term, when this happens).

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets.

Excess distribution occurs when a shareholder receives a distribution that is over their adjusted basis, which reduces the adjusted basis to zero. Generally, if you receive a distribution in excess of your basis, you must report those excess on your individual tax return subject to capital gains tax.

Under what conditions will a partner recognize gain in a liquidating distribution? In the situation in which a partnership distributes only money and the amount exceeds the partner's basis in her partnership interest, she will recognize a gain equal to the excess.

The amount of distribution to a partnership does not equal that of a corporation. In many cases, partner equity does not translate to equivalent investment contributions. partners may make contributions equal to the entire company or their ownership shares and can make contributions in many different ways.