Puerto Rico Assignment of Contract as Security for Loan

Description

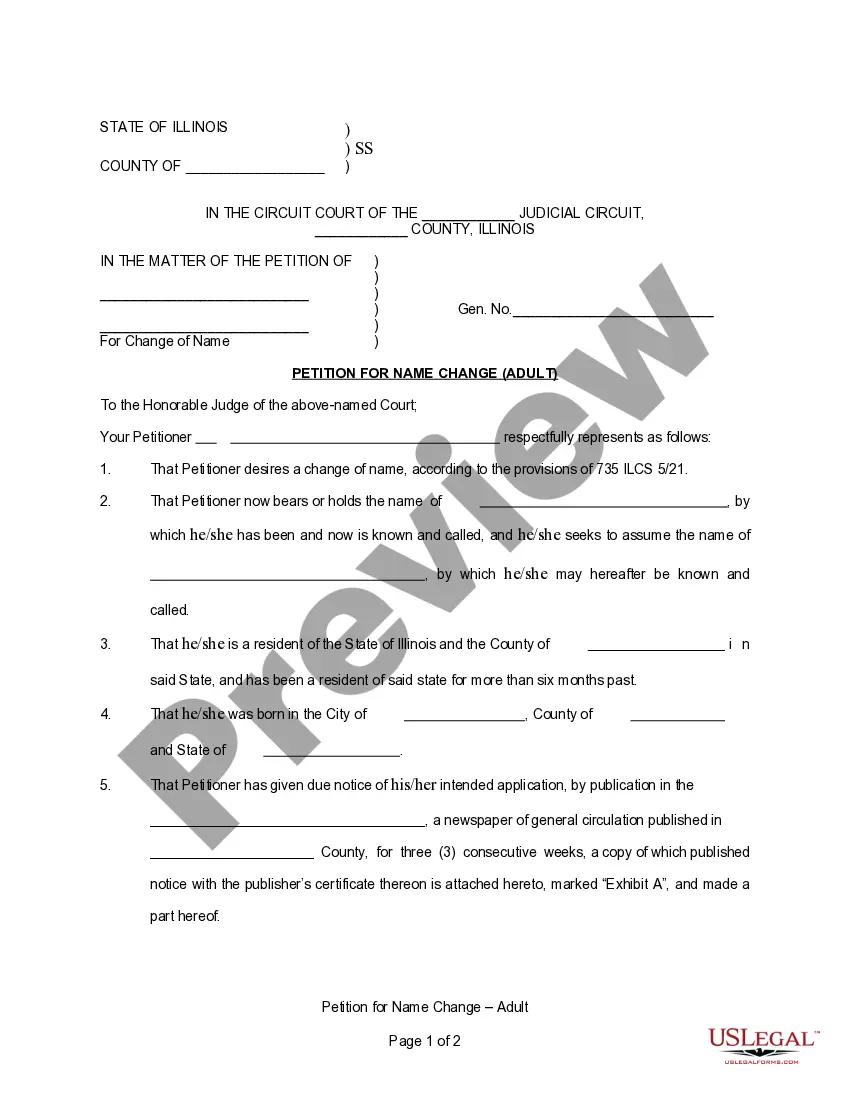

How to fill out Assignment Of Contract As Security For Loan?

You can waste hours on the Web searching for the valid document template that complies with state and federal requirements you will need.

US Legal Forms provides thousands of valid forms that have been reviewed by experts.

You can obtain or print the Puerto Rico Assignment of Contract as Security for Loan from this service.

To find an additional version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can fill out, modify, print, or sign the Puerto Rico Assignment of Contract as Security for Loan.

- Each valid document template you purchase belongs to you permanently.

- To obtain an additional copy of a purchased form, go to the My documents section and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Terms and conditions are determined at the time the security agreement is drafted.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Security agreements can be used to specify a collateral that is already in possession of the debtor, an intangible collateral or an after-acquired property.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed. However, the buyer doesn't own the property till all loan payments have been made.

Often, secured parties use UCC-1 financing statement forms to achieve perfection of security interest outlined in a security agreement. Prepared and signed by both parties, this form includes the following information: The debtor's name (either the name of an organization or an individual taking on debt).