Puerto Rico Statement of Reduction of Capital of a Corporation

Description

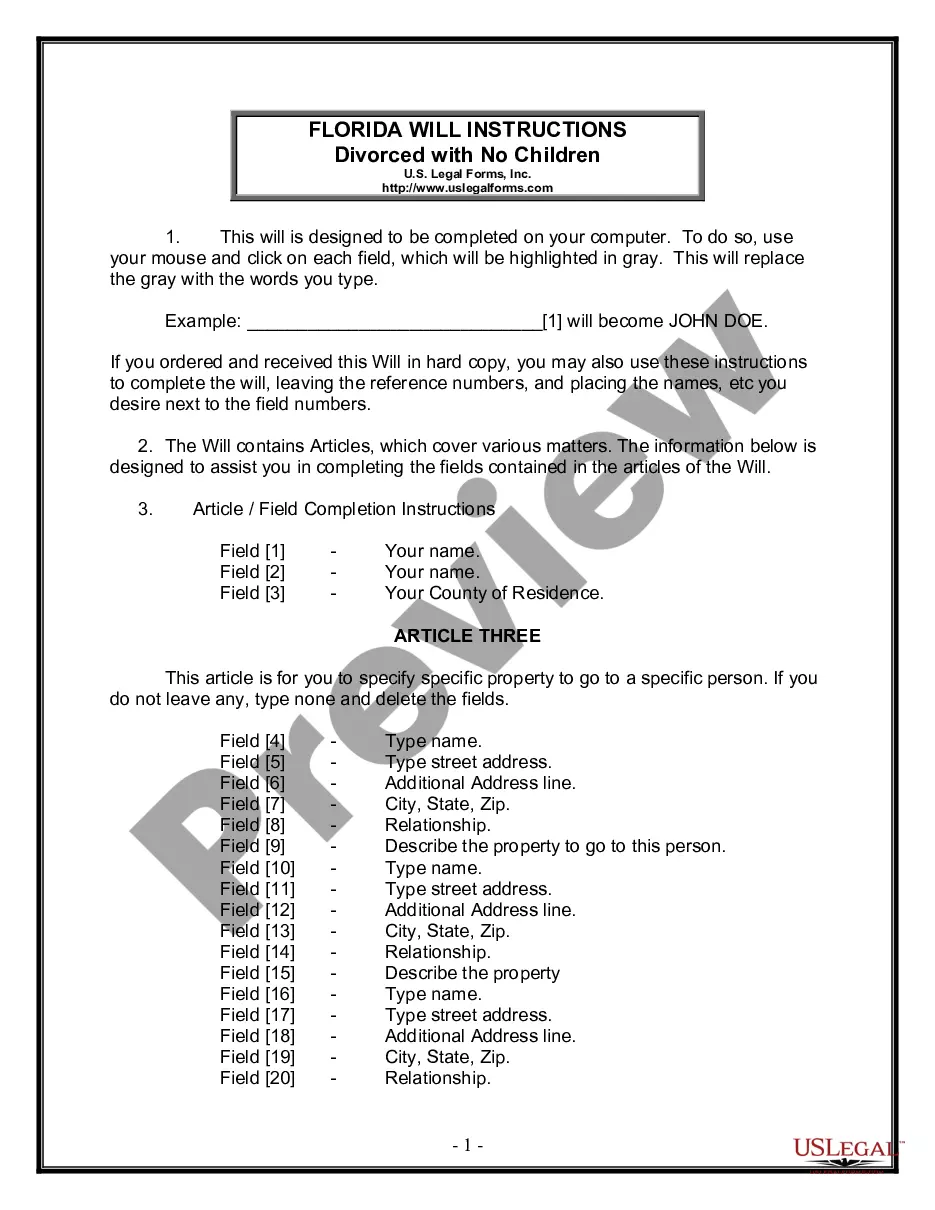

How to fill out Statement Of Reduction Of Capital Of A Corporation?

Are you in a position the place you require paperwork for sometimes enterprise or individual uses virtually every day? There are a variety of authorized papers themes available on the net, but finding kinds you can depend on is not simple. US Legal Forms delivers a large number of develop themes, just like the Puerto Rico Statement of Reduction of Capital of a Corporation, which can be published in order to meet federal and state requirements.

When you are already informed about US Legal Forms site and possess an account, merely log in. Following that, it is possible to acquire the Puerto Rico Statement of Reduction of Capital of a Corporation format.

If you do not come with an bank account and need to start using US Legal Forms, adopt these measures:

- Get the develop you want and ensure it is for the appropriate city/state.

- Utilize the Review switch to examine the shape.

- Read the description to actually have chosen the appropriate develop.

- If the develop is not what you are trying to find, take advantage of the Look for area to obtain the develop that suits you and requirements.

- Once you obtain the appropriate develop, click Purchase now.

- Select the costs strategy you would like, fill out the necessary details to make your money, and purchase your order utilizing your PayPal or bank card.

- Select a handy paper formatting and acquire your backup.

Find all the papers themes you have purchased in the My Forms menus. You can aquire a further backup of Puerto Rico Statement of Reduction of Capital of a Corporation whenever, if possible. Just click the needed develop to acquire or print the papers format.

Use US Legal Forms, the most substantial variety of authorized kinds, to save efforts and stay away from faults. The support delivers skillfully created authorized papers themes that you can use for a variety of uses. Produce an account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Act 22 of 2012 ?also known as the Act to Promote the Relocation of Investors to Puerto Rico (Spanish: Ley para Incentivar el Traslado de Inversionistas a Puerto Rico)? is an act enacted by the 16th Legislative Assembly of Puerto Rico that exempts local taxes on certain passive income generated by individuals that ...

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

As has been widely reported, Puerto Rico's Act #20 and Act #22 provides incentives for high net worth U.S. citizens to move to Puerto Rico and potentially reduce their 39.6% federal income tax (plus any applicable state tax) to a 0% ? 4% Puerto Rico income tax rate.

What Is Act 60? Act 60 (formerly known as Acts 20 and 22) allows certain people to avoid both federal and state income taxes on their income. With a few changes in your life, you could be one of those people.

Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012. They need to buy a residency on the island and live there at least half of the year.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.