Puerto Rico Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

If you are seeking thorough, download, or print legal document templates, utilize US Legal Forms, the largest array of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you require.

A selection of templates for business and personal needs is organized by categories and states or keywords.

Step 4. Once you have located the required form, click the Get now button. Choose your preferred payment plan and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Puerto Rico Covenant Not to Sue by Widow of Deceased Stockholder.

- Utilize US Legal Forms to obtain the Puerto Rico Covenant Not to Sue by Widow of Deceased Stockholder in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to access the Puerto Rico Covenant Not to Sue by Widow of Deceased Stockholder.

- You can also retrieve forms you previously downloaded from the My documents tab in your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the appropriate region/country.

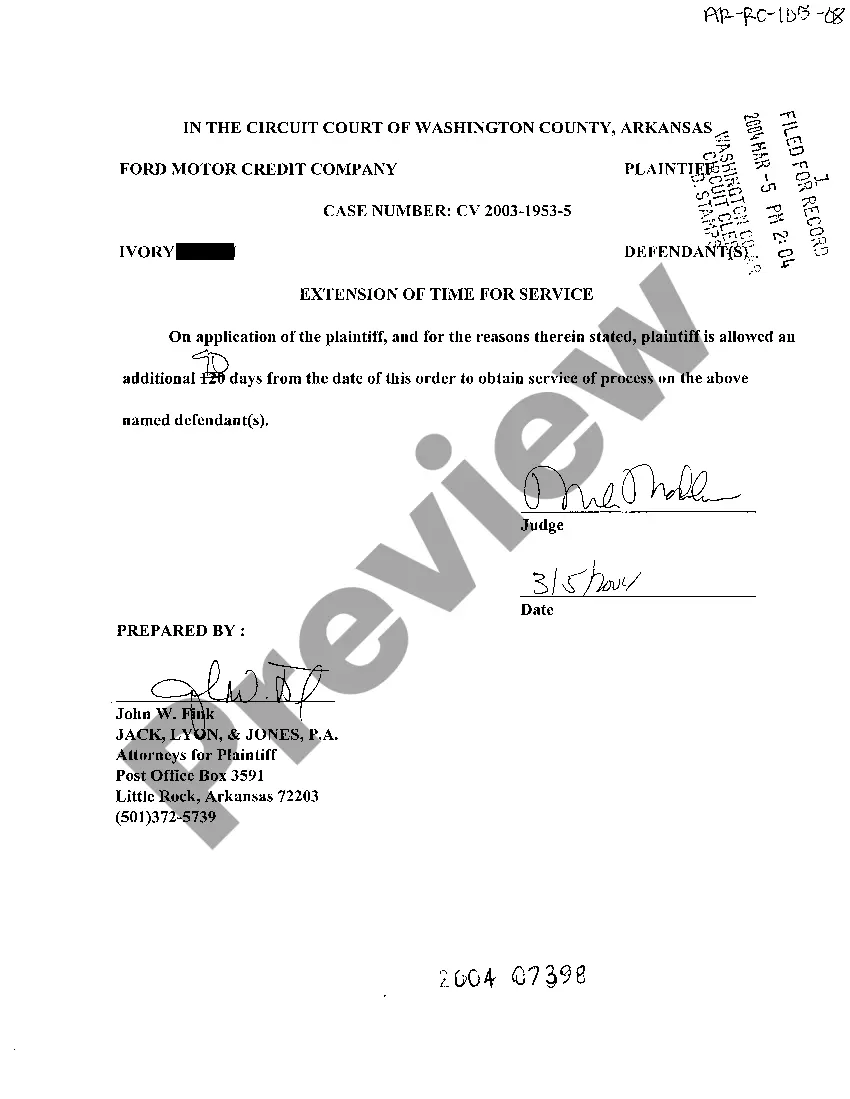

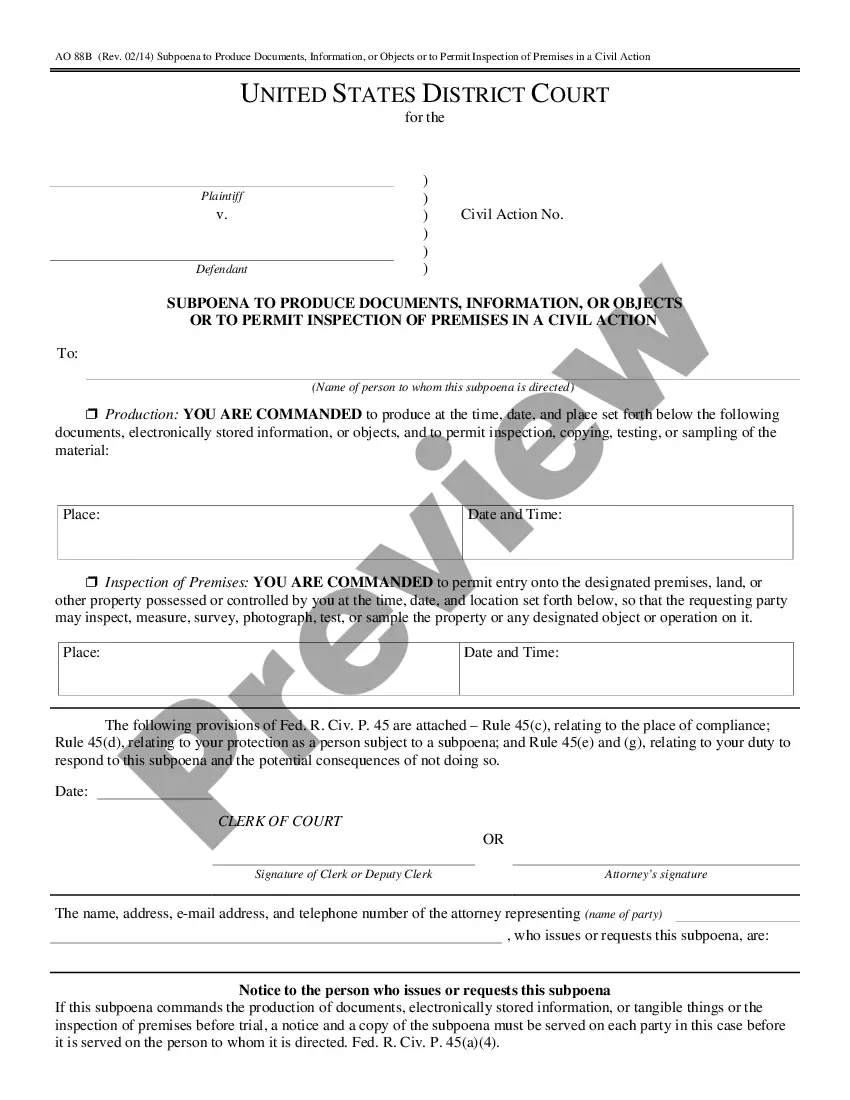

- Step 2. Use the Preview option to review the form's content. Always remember to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

After someone dies, someone (called the deceased person's 'executor' or 'administrator') must deal with their money and property (the deceased person's 'estate'). They need to pay the deceased person's taxes and debts, and distribute his or her money and property to the people entitled to it.

Which of following CANNOT inherit from or through a decedent? The decedent's stepchild who has been treated as the decedent's child since birth.

This means that the beneficiaries in order of preference are: the spouse of the deceased; the descendants of the deceased; the parents of the deceased (only if the deceased died without a surviving spouse or descendants); and the siblings of the deceased (only if one or both parents are predeceased).

BENEFICIARY - A person named to receive property or other benefits.

If the deceased person was married, the surviving spouse usually gets the largest share. If there are no children, the surviving spouse often receives all the property. More distant relatives inherit only if there is no surviving spouse and there are no children.

The aggregate of assets and liabilities of the deceased is termed the deceased estate. The deceased estate is not a juristic person. Consequently, the only legal person in connection with the estate is the executor in his representative capacity.

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

Generally, the heirs of the decedent are their surviving spouse and children, including all of decedent's biological children and adopted children.

Issue are any descendants, including children, grandchildren, etc. Ascendants are any ancestors, including parents, grandparents, etc.