Puerto Rico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate

Description

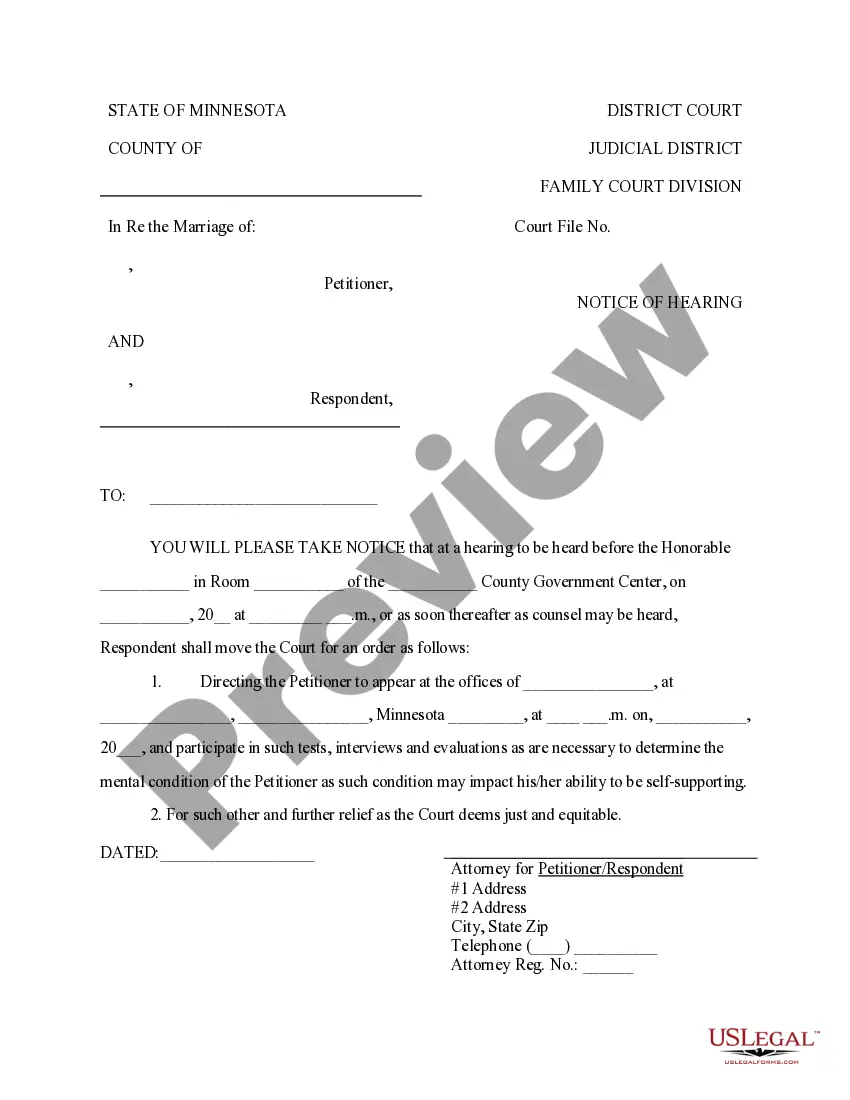

How to fill out Sample Letter For Discharge Of Debtor And Order Approving Trustee's Report Of No Distribution And Closing Estate?

If you have to complete, obtain, or print out legal document web templates, use US Legal Forms, the most important selection of legal kinds, which can be found on the Internet. Utilize the site`s simple and easy convenient lookup to obtain the files you need. Various web templates for enterprise and specific functions are sorted by classes and claims, or search phrases. Use US Legal Forms to obtain the Puerto Rico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate within a couple of mouse clicks.

Should you be already a US Legal Forms consumer, log in in your account and then click the Down load option to obtain the Puerto Rico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate. You may also access kinds you formerly acquired within the My Forms tab of your own account.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate area/land.

- Step 2. Take advantage of the Preview option to examine the form`s content material. Don`t forget about to read through the description.

- Step 3. Should you be not happy using the develop, use the Research discipline on top of the screen to find other versions in the legal develop design.

- Step 4. When you have discovered the shape you need, click on the Get now option. Opt for the pricing prepare you choose and add your accreditations to sign up to have an account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal account to complete the financial transaction.

- Step 6. Select the structure in the legal develop and obtain it on the system.

- Step 7. Complete, revise and print out or indicator the Puerto Rico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate.

Every legal document design you acquire is the one you have for a long time. You have acces to every develop you acquired inside your acccount. Select the My Forms segment and pick a develop to print out or obtain once again.

Contend and obtain, and print out the Puerto Rico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate with US Legal Forms. There are many specialist and condition-particular kinds you can use for the enterprise or specific demands.

Form popularity

FAQ

Filers are usually hoping to get a bankruptcy discharge. That's the order that wipes out certain debts and gives you a fresh start. A dismissal is very different. It means your case has been stopped before the court granted a discharge.

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

Though Chapter 7 stays on your report for up to 10 years, the debt you discharge may go away sooner. That's because most negative accounts fall off your report seven years or so after any final payment or activity. But some Chapter 13 debts may show up on your report after the bankruptcy drops off.

Closed Without a Discharge Cases are closed without discharge when the debtor does not complete the required debtor education required as a condition of discharge. The court may also close your case without discharge if you failed the last step for getting rid of debt. Your filing may not have been filed timely.

While it's not possible to remove a legitimate bankruptcy from your credit report, its impact wanes over time until it finally leaves your report after seven to 10 years. In the meantime, you can file a dispute with the credit bureaus if your bankruptcy contains any inaccurate information.

To remove the bankruptcy before the seven or ten years elapse, you'll have to prove that the bankruptcy was placed on your report by mistake or that the bankruptcy has remained on your credit report past the statutory timeline as defined by the Fair Credit Reporting Act (FCRA).

This requirement protects consumers from having any inaccurate information on their reports that would unfairly harm their credit. But this also prevents information from being removed when it is correct. So when you have a bankruptcy case on your credit report and it's accurate, it can't be removed early.

Accurate items in your record can't be removed before the term set by law expires, which is seven years for most negative items. For example, if you missed payments on your credit card, your dispute to remove that information will be denied.