28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

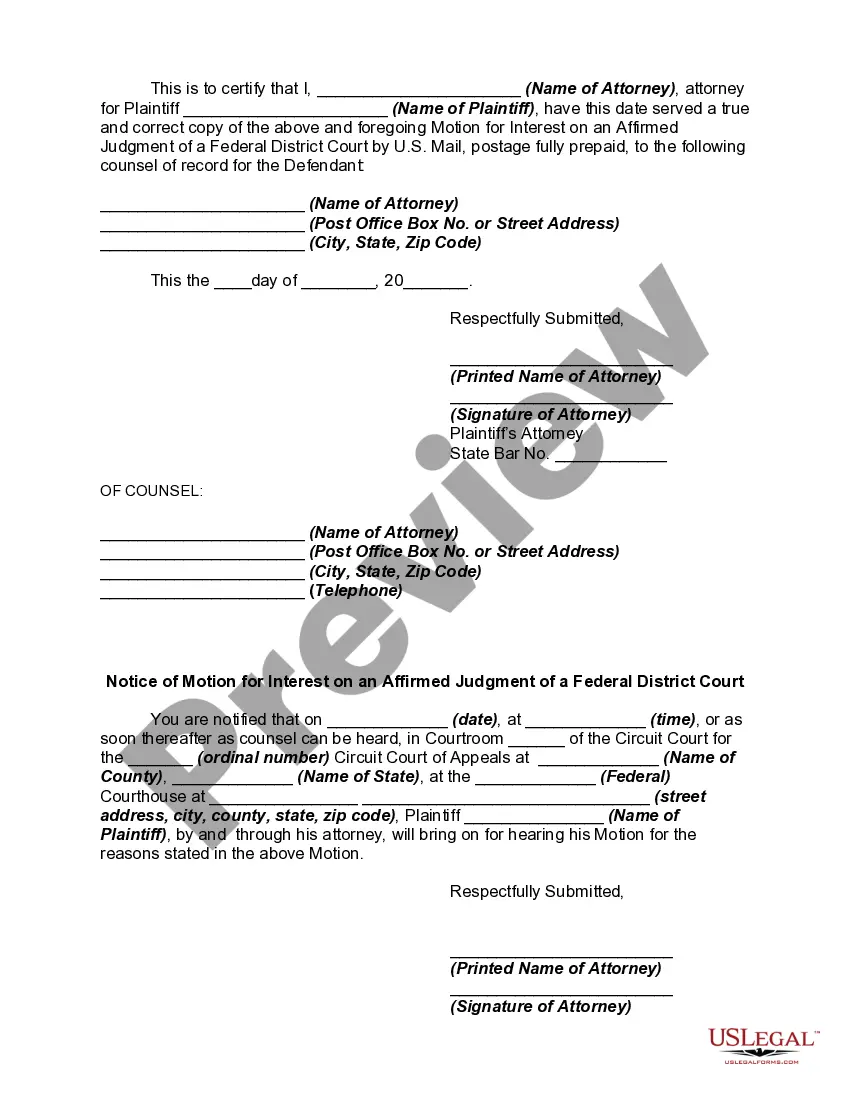

Puerto Rico Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

You may devote several hours on-line looking for the legal record web template that suits the state and federal needs you want. US Legal Forms gives a large number of legal varieties that happen to be analyzed by specialists. It is possible to obtain or print out the Puerto Rico Motion for Interest on an Affirmed Judgment of a Federal District Court from my service.

If you already have a US Legal Forms accounts, it is possible to log in and click the Down load switch. Following that, it is possible to full, modify, print out, or indication the Puerto Rico Motion for Interest on an Affirmed Judgment of a Federal District Court. Each and every legal record web template you purchase is the one you have eternally. To obtain another copy associated with a acquired kind, visit the My Forms tab and click the related switch.

If you are using the US Legal Forms web site for the first time, adhere to the easy guidelines below:

- First, ensure that you have chosen the best record web template for the region/area of your choice. See the kind description to ensure you have chosen the appropriate kind. If accessible, use the Preview switch to check from the record web template as well.

- If you would like get another edition in the kind, use the Search discipline to find the web template that meets your requirements and needs.

- Once you have found the web template you would like, click on Buy now to proceed.

- Pick the pricing strategy you would like, enter your credentials, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal accounts to fund the legal kind.

- Pick the formatting in the record and obtain it to the product.

- Make modifications to the record if possible. You may full, modify and indication and print out Puerto Rico Motion for Interest on an Affirmed Judgment of a Federal District Court.

Down load and print out a large number of record web templates utilizing the US Legal Forms website, which provides the biggest collection of legal varieties. Use professional and state-distinct web templates to tackle your organization or specific needs.

Form popularity

FAQ

The deadline to file a reply is 14 days before the motion hearing date. You may not file a response to a reply without permission from the Court. Federal Pro Se Clinic ? Roybal Courthouse ? 255 East Temple Street, Suite 170 ? Los Angeles, CA 90012 ? (213) 385-2977 ext.

Interest on a court judgment that a creditor, usually the plaintiff in the case, can collect from the debtor, usually the defendant, from time the judgment is entered in the court clerk's record until the judgment is paid.

The details of this arrangement (e.g. the precise interest, whether the interest is simple or compound, etc) will depend on what jurisdiction your case is in. In California, for example, post-judgment interest is 10% simple per year, as specified in California Code of Civil Procedure section 685.010(a).

Post-judgment interest rate: 10.10% (the amount of post judgment interest is set by Rule 36.7 of the Uniform Civil Procedure Rules 2005).

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

Puerto Rico has one federal district court, which is known as the U.S. District Court for the District of Puerto Rico.

To calculate your own pre-judgment interest, count the number of days between the 180th day after you notified your defendant of a pending lawsuit or the date you filed the lawsuit, and multiply the number of days by the appropriate rate.