Puerto Rico Invoice Template for HR Manager

Description

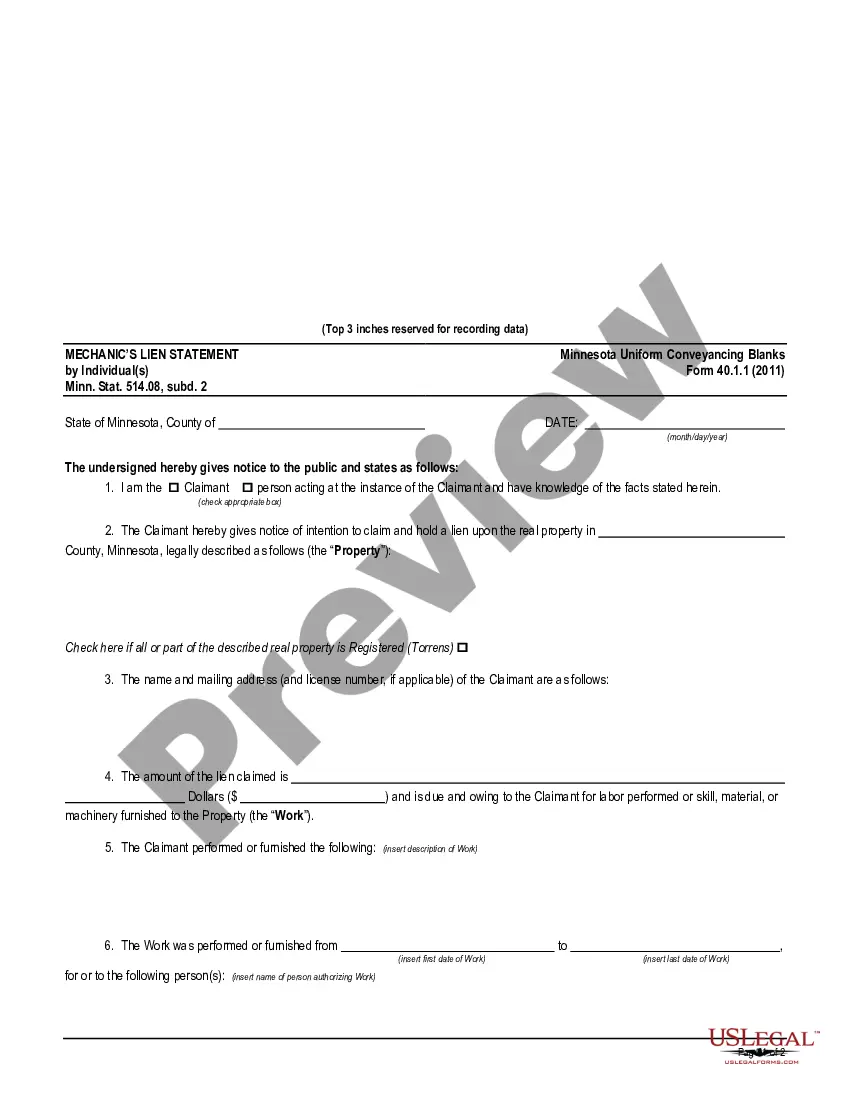

How to fill out Invoice Template For HR Manager?

Finding the suitable valid document format can be a challenge.

Of course, there are numerous templates accessible online, but how can you locate the correct one you need.

Utilize the US Legal Forms website. The service provides a multitude of templates, such as the Puerto Rico Invoice Template for HR Manager, which you can employ for both professional and personal purposes.

You can review the form using the Preview button and check the form details to ensure it is suitable for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Acquire now button to obtain the form. Choose the pricing plan you wish and enter the required information. Create your profile and process the payment using your PayPal account or credit card. Select the file format and download the legal document to your device. Complete, modify, print, and sign the acquired Puerto Rico Invoice Template for HR Manager. US Legal Forms is the leading repository of legal documents where you can find various document templates. Utilize this service to obtain professionally crafted documents that adhere to state regulations.

- All documents are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Puerto Rico Invoice Template for HR Manager.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple tips you can follow.

- First, make sure you have selected the correct form for your area/county.

Form popularity

FAQ

Indeed, Jobber includes invoicing features that can be highly beneficial for managing your financial processes. With its user-friendly interface, you can generate professional invoices using a Puerto Rico Invoice Template for HR Manager. This integration helps you to save time and reduce errors, making your invoicing process seamless and effective.

Yes, Jobber offers invoicing capabilities to streamline your billing process. It allows you to create and send invoices quickly and efficiently, eliminating manual effort. When combined with a Puerto Rico Invoice Template for HR Manager, you can easily manage client information and track payments, enhancing your overall workflow.

Creating an invoice to receive payment involves clearly itemizing the services provided along with their respective costs. Use a template, such as the Puerto Rico Invoice Template for HR Manager, to ensure you include all necessary details. Specify the payment methods accepted and set a due date, which encourages timely payments and maintains good relationships with clients.

To send an invoice to your manager, first ensure it is correctly filled out using a reliable tool, like a Puerto Rico Invoice Template for HR Manager. You can choose to send it via email as a PDF attachment, which preserves the formatting, or print it out if hard copies are required. Make sure to provide a clear subject in your email and include a polite message to enhance professionalism.

The best format for an invoice is a clear and organized layout that includes essential elements such as your business name, the client's name, a unique invoice number, and payment terms. A Puerto Rico Invoice Template for HR Manager facilitates this by offering a structured format that automatically incorporates these details, ensuring that invoices are consistent and professional. This helps improve communication and increases the likelihood of receiving timely payments.

When considering the best office program for invoices, many users find that Microsoft Excel or Google Sheets works well. They provide templates, including a Puerto Rico Invoice Template for HR Manager, which helps create professional invoices easily. Additionally, both programs allow you to customize your invoices to meet specific needs, making your invoicing process smooth and efficient.

Filling out an invoice for work can be straightforward if you follow a structured format. With the Puerto Rico Invoice Template for HR Manager, enter your contact information at the top, followed by your employer’s details. Clearly state the services rendered, number of hours worked, hourly rate, and total due to create a comprehensive invoice.

To write an invoice to your employer, use the Puerto Rico Invoice Template for HR Manager to ensure a polished appearance. Start with your information followed by your employer's details. Clearly outline the work completed, hours worked, and total payment amount to facilitate smooth processing of your payment.

Writing an invoice for hours worked is an essential task for HR managers. Begin with a professional header that includes your information and the employer's details. Next, list the services provided, hours worked, and the total due in the Puerto Rico Invoice Template for HR Manager, ensuring each element reflects your professionalism.

Filling out an invoice template involves several key steps. With the Puerto Rico Invoice Template for HR Manager, start by placing your contact information and your employer's details in the designated areas. Then, include a description of the work completed, hours billed, and the total amount, making sure each entry is clear and easy to understand.