Puerto Rico Invoice Template for Sole Trader

Description

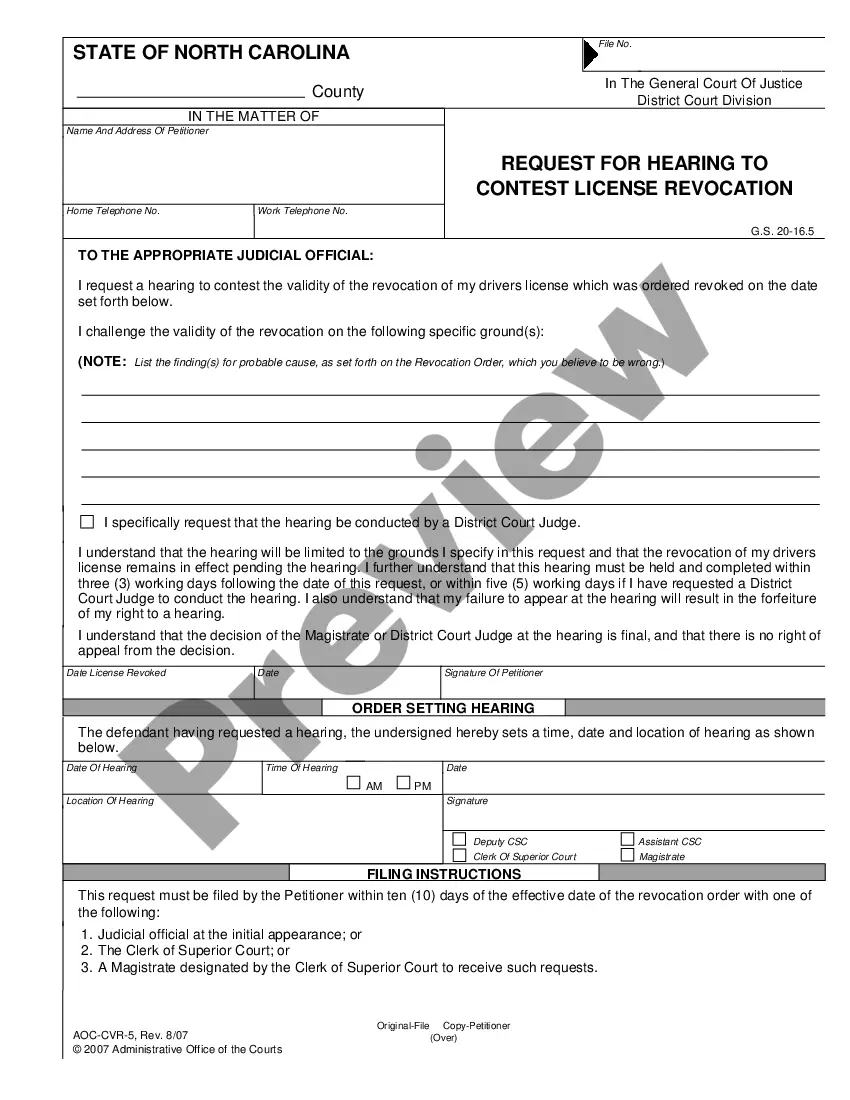

How to fill out Invoice Template For Sole Trader?

US Legal Forms - one of the most important repositories of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you will find thousands of forms for professional and personal purposes, categorized by type, state, or keywords. You can find the most recent versions of forms such as the Puerto Rico Invoice Template for Sole Trader in a matter of seconds.

If you possess a subscription, Log In and download the Puerto Rico Invoice Template for Sole Trader from the US Legal Forms library. The Download button will appear on every form you view.

- You can access all previously purchased forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple instructions to guide you.

- Ensure that you have selected the correct form for your locality/region.

- Click the Review button to examine the content of the form. Check the overview of the form to confirm that you have selected the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are happy with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to sign up for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the payment.

Form popularity

FAQ

Invoicing for a beginner starts with understanding the essential elements of an invoice. It's crucial to include your details, the client's information, a clear description of services, and payment terms. Using a Puerto Rico Invoice Template for Sole Trader helps beginners create professional invoices easily and accurately.

To complete an invoice for self-employed individuals, include your name and business details at the top. Then, detail the services or products offered, along with their prices. A Puerto Rico Invoice Template for Sole Trader simplifies this task, helping you stay organized and professional in your invoicing approach.

The correct format for an invoice typically includes your name, contact information, the client's details, invoice number, and date. Next, add a clear breakdown of the services provided, item quantities, and costs. Using a Puerto Rico Invoice Template for Sole Trader will help you adhere to this format consistently, ensuring your invoices look professional.

Filling out an invoice template simply requires you to provide crucial information in designated fields. Enter your business name, the client's name, and the transaction details, such as descriptions and amounts due. Utilizing a Puerto Rico Invoice Template for Sole Trader can streamline this process, ensuring consistency and professionalism.

To fill in an invoice template, start by entering your business details, including your name and contact information. Next, include the client's details, the invoice number, date, and payment terms. Ensure that you list the services or products provided, along with their prices, using a Puerto Rico Invoice Template for Sole Trader for clarity and effectiveness.

Creating an invoice as a sole proprietorship is straightforward. Begin with your name and contact information as the business owner, followed by details about the service provided, including dates and costs. Utilizing a Puerto Rico Invoice Template for Sole Trader can facilitate this process, allowing you to create professional invoices that include all necessary components and enhance your credibility with clients.

When you are self-employed, making an invoice involves capturing key elements like your business information and the services rendered. Itemize the services, add totals, and include payment details. A Puerto Rico Invoice Template for Sole Trader helps streamline this task by providing a well-structured format that you can customize and send to your clients efficiently.

To create invoices as a sole trader, start by outlining your business information, including your name, address, and contact details. Next, list the services or products you provided, including prices, quantities, and any applicable taxes. Using a Puerto Rico Invoice Template for Sole Trader can simplify this process, ensuring you include all necessary details and maintain a professional appearance.

Creating an invoice for an unregistered person requires capturing the same essential elements as any other invoice. Include your business information, a description of services, payment amount, and terms. You can effectively accomplish this by using the Puerto Rico Invoice Template for Sole Trader, which simplifies the billing process and helps ensure clarity for both parties.

You can generate an invoice for yourself as a sole trader, which is essential for tracking income. This invoice acts as a formal request for payment and should include all relevant details. By utilizing the Puerto Rico Invoice Template for Sole Trader, you can save time and ensure accuracy when crafting your invoices.