Puerto Rico Rental Application for Married Couple

Description

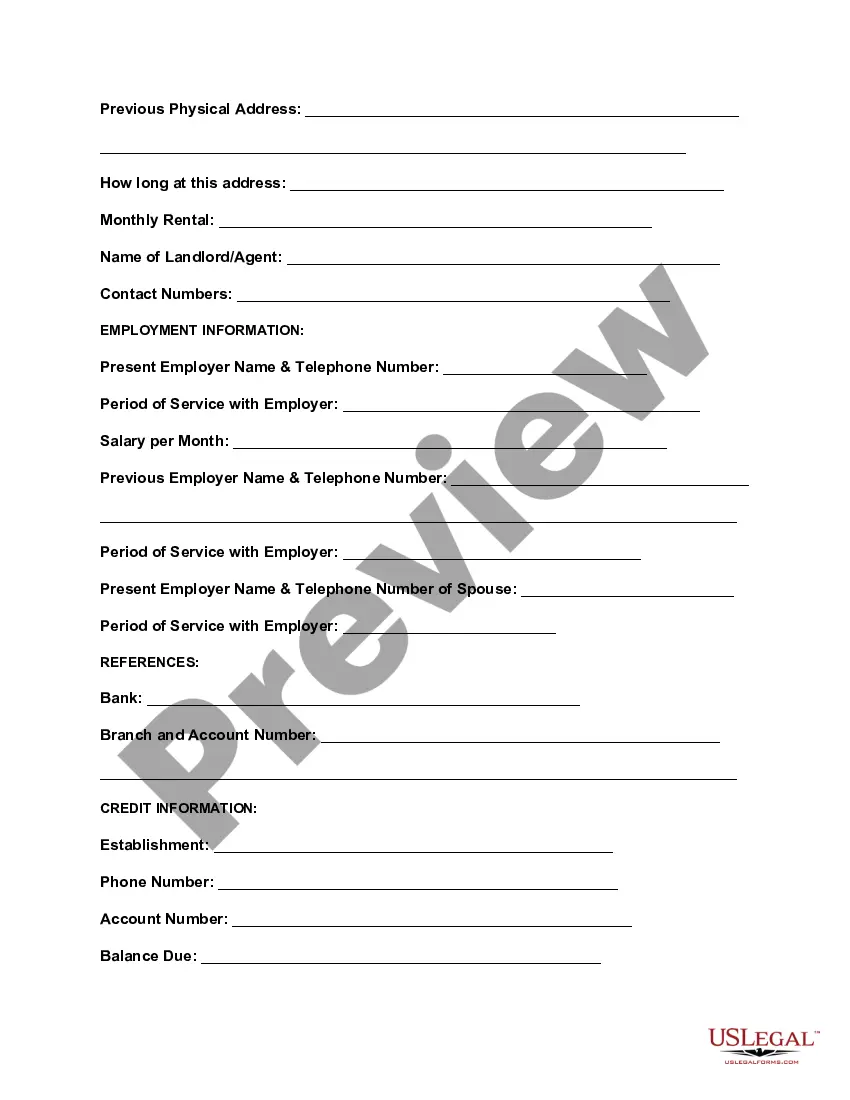

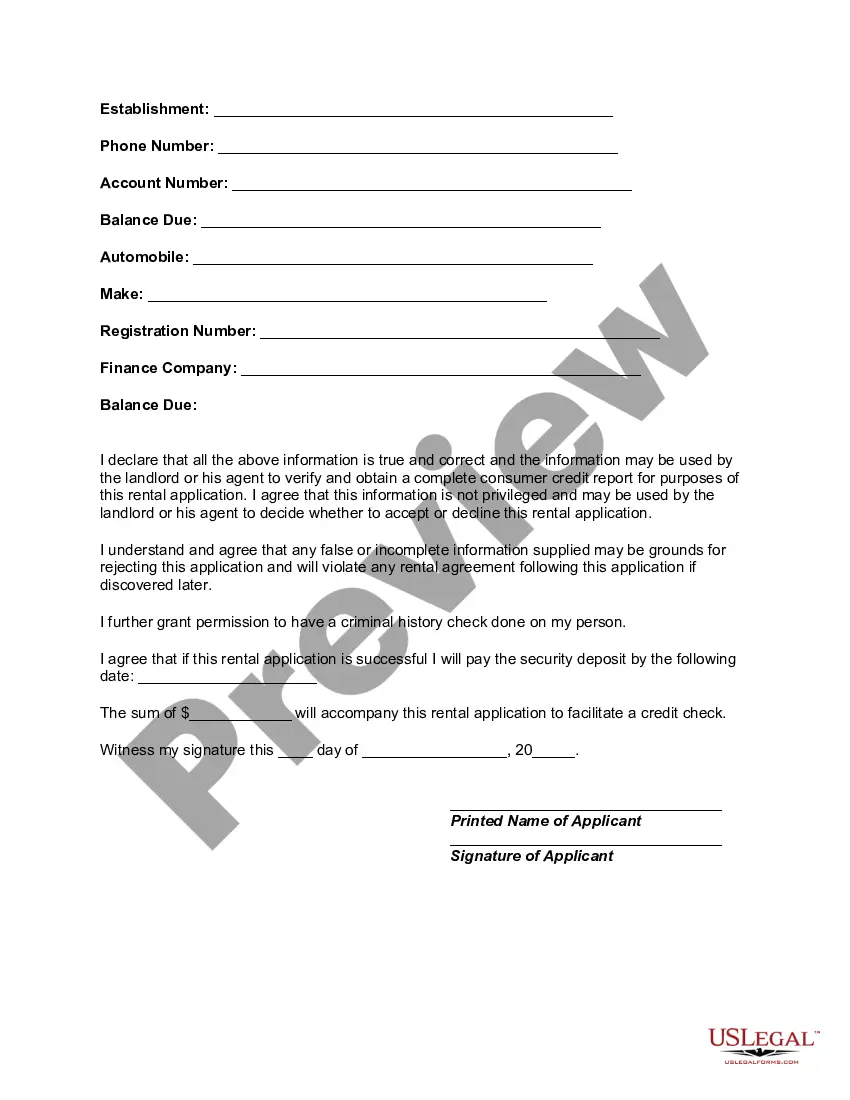

How to fill out Rental Application For Married Couple?

You can dedicate time online looking for the proper legal document template that meets the state and federal requirements you need.

US Legal Forms provides a wide range of legal forms that are reviewed by professionals.

You can download or print the Puerto Rico Rental Application for Married Couple from my service.

If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and press the Acquire button.

- Subsequently, you can fill out, edit, print, or sign the Puerto Rico Rental Application for Married Couple.

- Every legal document template you obtain is yours for a lifetime.

- To retrieve another copy of any document you have procured, visit the My documents section and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- Initially, ensure that you have selected the correct document template for the state/city of your choice.

- Examine the document details to ensure you have chosen the right form.

Form popularity

FAQ

Choosing to claim 0 or 1 on your W-4 form affects the amount of tax withheld from your paycheck. Claiming 0 typically results in a larger tax withholding, possibly leading to a refund. When completing your Puerto Rico Rental Application for Married Couple, it may be wise to factor these financial implications into your budgeting decisions.

Separated couples can file as married filing jointly or married filing separately, depending on their situation. If legally separated, they may need to file as single or head of household if eligible. Knowing your options is vital when managing your finances and preparing a Puerto Rico Rental Application for Married Couple.

For married couples not living together, the options are to file as married filing jointly or married filing separately. The chosen filing status impacts tax rates and eligibility for credits. Thus, understanding this status is beneficial when submitting a Puerto Rico Rental Application for Married Couple as it may affect financial evaluations.

Individuals who earn income in Puerto Rico or who are residents must file a tax return. This includes married couples who earn jointly or separately. Understanding tax obligations is crucial when filling out a Puerto Rico Rental Application for Married Couple, as landlords may ask for this documentation during the rental process.

Married couples should consider filing separately if they have significant medical expenses, if one spouse has high unreimbursed business costs, or in cases of separation. Filing separately could sometimes reduce tax liability. Think about how this decision influences your Puerto Rico Rental Application for Married Couple as some renters may require proof of finances.

The best way for married couples to file taxes often depends on their unique financial situation. Filing jointly usually maximizes tax benefits and simplifies the process, making it favorable for many couples. When considering a Puerto Rico Rental Application for Married Couple, keeping your tax filing information organized can enhance your application credibility.

If you are married but not living together, you can still choose to file as married, either jointly or separately. Filing separately may result in higher taxes, so it’s crucial to evaluate your financial situation. When completing a Puerto Rico Rental Application for Married Couple, clarity on your tax status can assist landlords in assessing your applications.

Married couples generally file a joint tax return, which benefits from tax deductions and credits. However, if circumstances warrant, they may choose to file separately. In the context of a Puerto Rico Rental Application for Married Couple, understanding your filing options can help you make informed decisions about your finances.

Generally, both individuals are encouraged to apply when completing a Puerto Rico Rental Application for Married Couple. This creates a comprehensive view of your combined financial standing, which can positively impact approval chances. However, some landlords may allow one partner to apply, especially if one has a significantly stronger credit score or rental history.

Your husband can submit a Puerto Rico Rental Application for Married Couple on your behalf, as long as all parties involved agree to the arrangement. It is essential to be open about this dynamic with the landlord, ensuring they understand both applicants' financial situations. However, ideally, both of you should be present to review and sign the lease, as this strengthens your application.