Puerto Rico Proof of Residency for Credit Card

Description

How to fill out Proof Of Residency For Credit Card?

Are you within a placement where you will need papers for both organization or specific functions almost every time? There are a lot of lawful document themes available on the Internet, but finding ones you can depend on is not simple. US Legal Forms offers a large number of form themes, like the Puerto Rico Proof of Residency for Credit Card, which can be written to satisfy federal and state specifications.

In case you are currently acquainted with US Legal Forms site and also have your account, basically log in. Next, it is possible to obtain the Puerto Rico Proof of Residency for Credit Card template.

If you do not provide an account and would like to start using US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for the proper city/county.

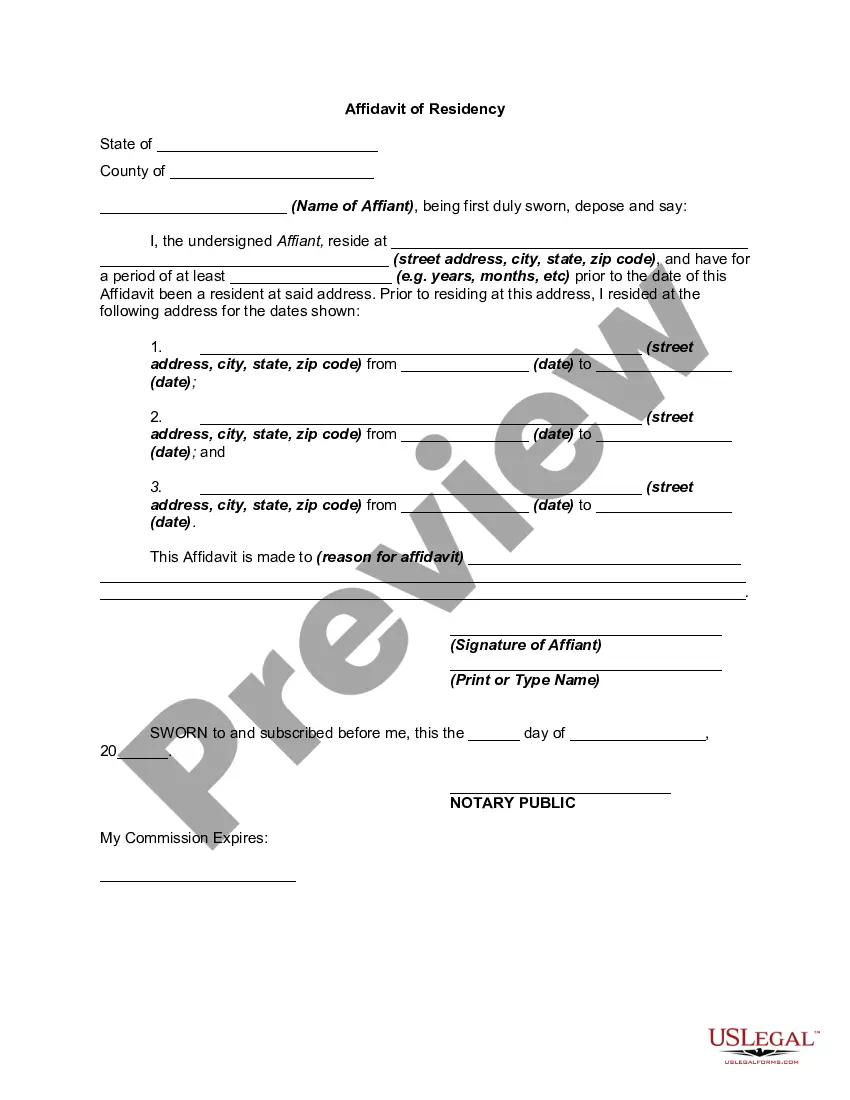

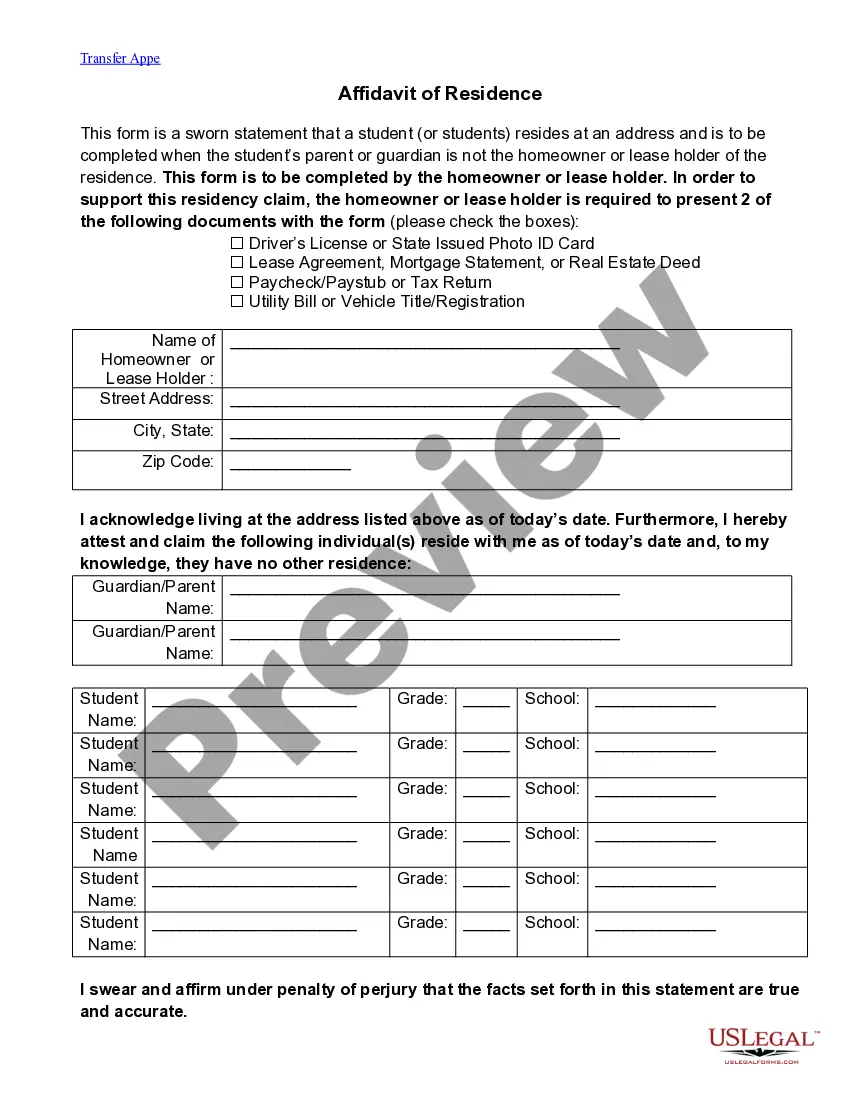

- Use the Preview option to review the form.

- Browse the description to actually have selected the correct form.

- When the form is not what you`re seeking, use the Lookup area to find the form that meets your needs and specifications.

- Once you obtain the proper form, click Acquire now.

- Pick the prices plan you would like, complete the required information to generate your account, and pay money for your order with your PayPal or credit card.

- Select a hassle-free file formatting and obtain your copy.

Find every one of the document themes you have purchased in the My Forms menus. You may get a additional copy of Puerto Rico Proof of Residency for Credit Card any time, if necessary. Just select the required form to obtain or printing the document template.

Use US Legal Forms, one of the most substantial selection of lawful varieties, to save lots of efforts and steer clear of mistakes. The services offers skillfully made lawful document themes which can be used for an array of functions. Generate your account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

Using your credit card in Puerto Rico works just like it does in your home country.

Visa and MasterCard are accepted most widely throughout Puerto Rico. Note: This information was accurate when it was published, but can change without notice. Please be sure to confirm all rates and details directly with the companies in question before planning your trip.

The first requirement has to do with time spent in Puerto Rico. Individuals are expected to spend 183 days a year in the territory. Further, they must spend at least 549 days in a three-year period. Also, they are not permitted to be present in the US for more than 90 days in any year.

Physical presence in Puerto Rico for a minimum period of 183 days during the taxable year will create a presumption of residence in Puerto Rico for Puerto Rico income tax purposes.

You must become a resident of Puerto Rico, and you must reside there for at least 183 days a year, or meet one of several other tests that are less clear cut. Perhaps the hardest overall test to meet?which comes as a kind of overlay on everything else?is the closer connections test.

No need for work permits or visas if you decide to relocate. In other words, living in Puerto Rico is almost like living abroad, but without either the paperwork hassle or the immigration concerns. Because it's a U.S. territory, Puerto Rico also uses the U.S. dollar, which makes banking and finances simple.

The first requirement has to do with time spent in Puerto Rico. Individuals are expected to spend 183 days a year in the territory. Further, they must spend at least 549 days in a three-year period. Also, they are not permitted to be present in the US for more than 90 days in any year.

To qualify as a bona fide resident of Puerto Rico for any tax year, a person must satisfy each of three distinct tests: (1) the ?Presence Test?; (2) the ?Tax Home Test?; and (3) the ?Closer Connection Test?. [4] It is not enough merely to be present in Puerto Rico for 183 days in a given tax year.