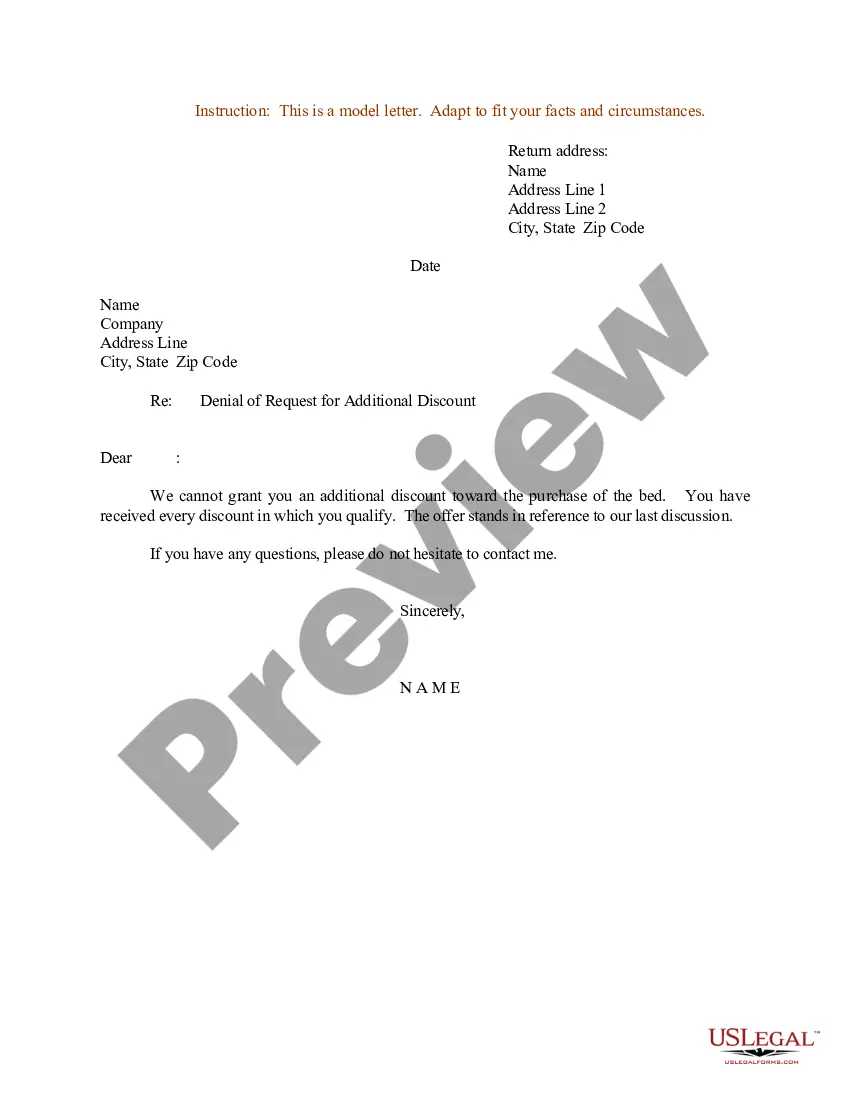

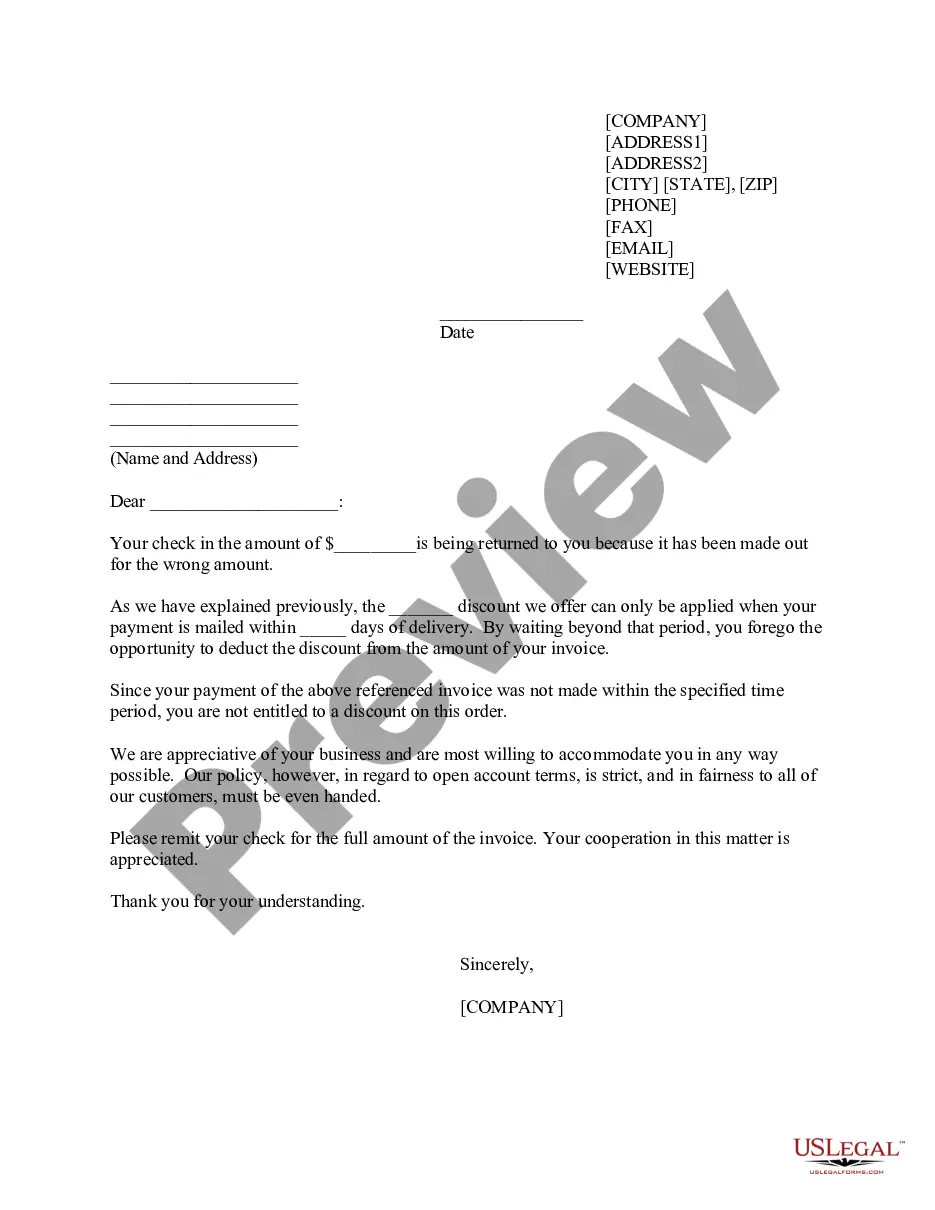

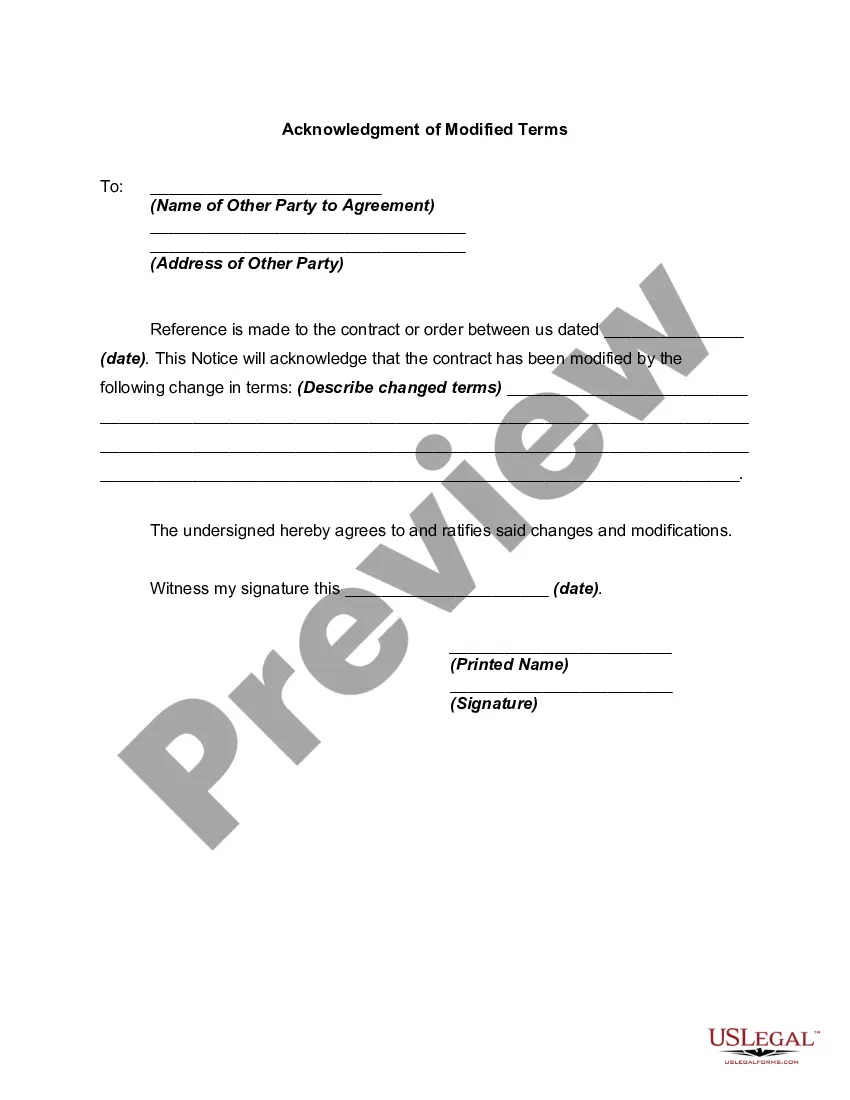

Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount

Description

How to fill out Sample Letter For Return Of Late Payment And Denial Of Discount?

US Legal Forms - one of the largest collections of official forms in the United States - offers a variety of official document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest editions of documents such as the Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount in just seconds.

Check the form information to confirm that you have selected the right form.

If the form does not meet your needs, use the Lookup field at the top of the screen to find one that does.

- If you already have an account, Log In to download the Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount from the US Legal Forms library.

- The Obtain button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some basic instructions to get started.

- Ensure that you have selected the correct form for your area/county.

- Choose the Preview option to review the form's details.

Form popularity

FAQ

Whether you need to file a federal tax return from Puerto Rico depends on your income level and residency status. Generally, bona fide residents of Puerto Rico do not need to file federal returns for income earned in Puerto Rico. If you have questions regarding your filing status, consulting a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount can provide insights and useful templates.

The IRS letter 105C generally refers to correspondence regarding tax issues that may require your attention. This could involve a notice about document requests or discrepancies. For clarity and guidance, you can refer to a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount to help draft your response.

The 105 C tax code usually relates to tax provisions that affect certain individuals or entities. It can detail specific tax treatment applicable to your situation. If you need to respond to issues related to this tax code, consider using a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount to help structure your letter effectively.

A C notice is a written communication from the IRS that outlines specific issues with your tax account or return. It typically details information that requires clarification or correction. Understanding these notices is essential, and a reference to a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount can help you respond appropriately.

A 106C letter from the IRS usually pertains to a tax adjustment or notice about a refund. This letter serves as an official communication regarding your tax status. To navigate any complexities after receiving this letter, you might find value in creating a response using a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount.

A letter from the IRS typically informs you about a change or request for additional information regarding your tax return. It may indicate an adjustment to your account or errors that need your attention. It is crucial to read the letter carefully and, if needed, consult a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount to formulate a response.

The IRS may adjust your refund for several reasons, including mistakes on your tax return, changes in your reported income, or unreported income. Sometimes, the IRS may also apply adjustments if they discover discrepancies. Understanding these adjustments can be complex, so referencing a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount may help you address any issues effectively.

Yes, Puerto Rico counts toward the substantial presence test, but it functions differently than the states. When calculating your presence, you may exclude days spent in Puerto Rico if you are a bona fide resident there. This is important for understanding your tax obligations. For detailed insights, consider using a Puerto Rico Sample Letter for Return of Late Payment and Denial of Discount, which can clarify your tax status.