Puerto Rico Warehouse and Storage Agreement

Description

How to fill out Warehouse And Storage Agreement?

You can spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can download or print the Puerto Rico Warehouse and Storage Agreement from the service.

If you wish to find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Puerto Rico Warehouse and Storage Agreement.

- Every legal document template you purchase is yours to keep indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you're accessing US Legal Forms for the first time, follow the basic instructions outlined below.

- First, ensure you have selected the correct document template for your desired county/city.

- Review the form description to confirm you have the right template.

- If available, utilize the Preview button to review the document template as well.

Form popularity

FAQ

Numerous companies require warehouse space, from small local businesses to large corporations. Retailers preparing for seasonal sales and manufacturers needing to store raw materials often seek effective warehousing solutions. A Puerto Rico Warehouse and Storage Agreement can cater to diverse needs, offering flexible storage options that align with the businesses' logistical requirements.

Warehouses are typically used by businesses that deal with inventory management, including wholesalers, e-commerce retailers, and manufacturers. These entities utilize warehouses to store bulk products and streamline distribution processes. A Puerto Rico Warehouse and Storage Agreement enables these businesses to manage their goods efficiently while keeping costs under control.

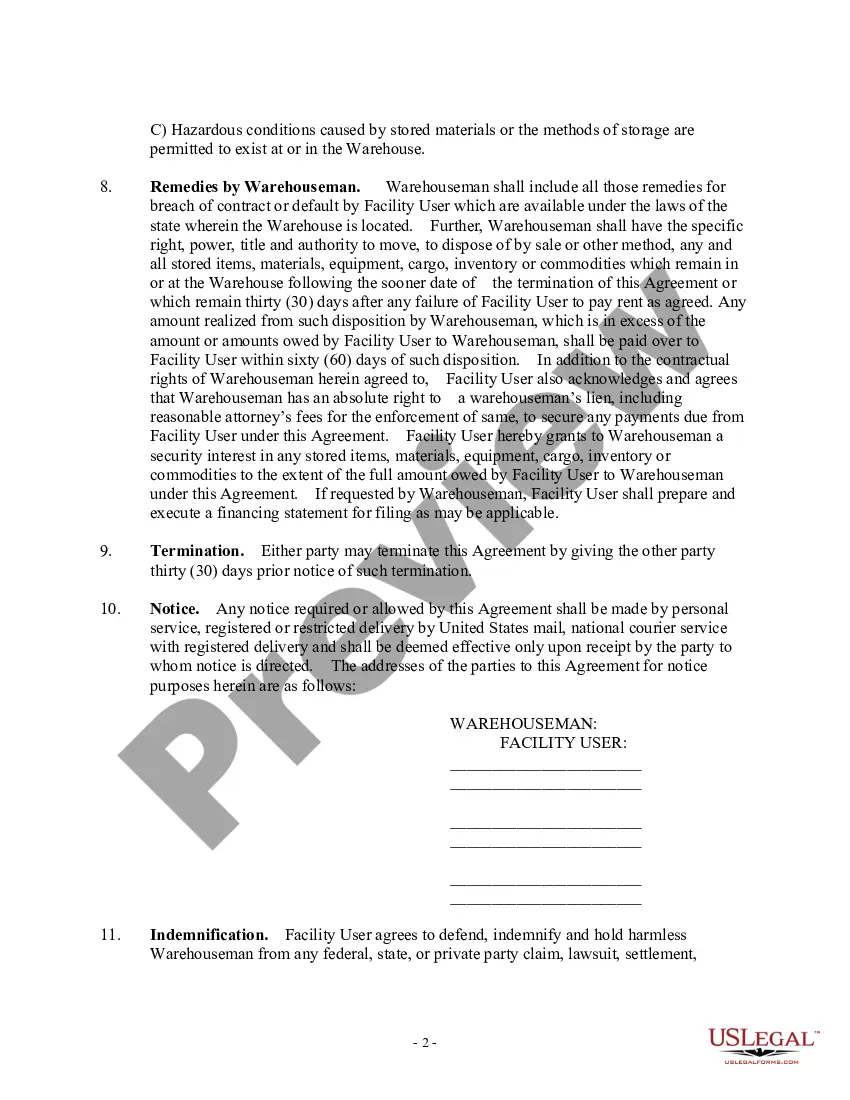

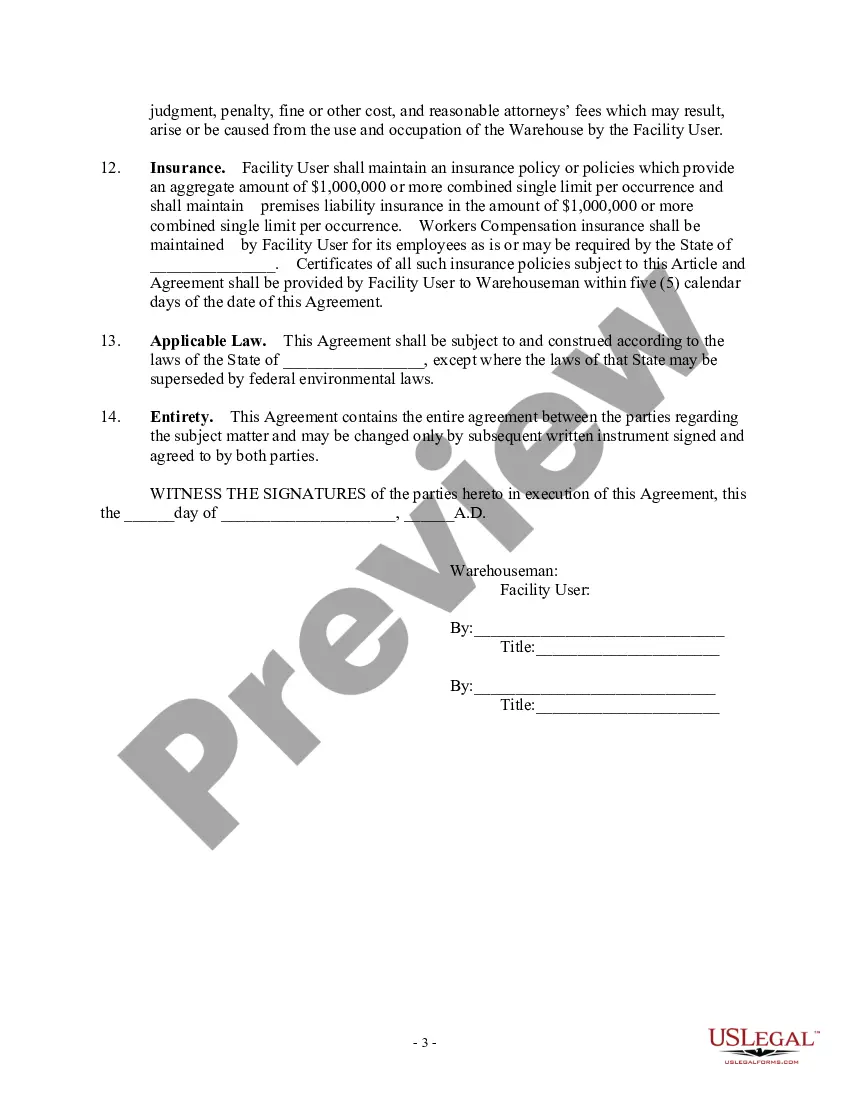

A warehousing agreement is a legally binding contract between a storage provider and a client. It outlines the terms under which goods are stored, including responsibilities, fees, and duration. Having a well-structured Puerto Rico Warehouse and Storage Agreement can safeguard both parties' interests, ensuring transparent and efficient arrangements.

Marketing warehouse space involves highlighting key features such as location, security, and capacity. Property owners can utilize digital platforms, social media, and local business networks to reach potential clients effectively. Leveraging a Puerto Rico Warehouse and Storage Agreement can be an appealing selling point, showcasing flexibility and tailored options for prospective tenants.

Various businesses require warehouse storage, including retailers, manufacturers, and distributors. Companies looking to optimize their supply chain and manage inventory levels often turn to warehousing solutions. A Puerto Rico Warehouse and Storage Agreement offers businesses in Puerto Rico a structured approach to secure storage, allowing them to thrive in a competitive market.

The demand for warehousing space has seen significant growth in recent years, driven by e-commerce and distribution needs. Businesses in Puerto Rico are actively looking for flexible storage solutions to accommodate seasonal inventory spikes. A Puerto Rico Warehouse and Storage Agreement can provide companies with the necessary space and resources to meet rising demands, ensuring efficient operations.

Contract warehousing is a situation where a business engages a third-party provider to manage storage and distribution of its products. For instance, a retailer in Puerto Rico may enter into a Puerto Rico Warehouse and Storage Agreement with a logistics company to store inventory. This partnership allows the retailer to focus on sales while ensuring their goods are securely stored and readily available.

Puerto Rico's sales tax, currently at 10.5%, is primarily driven by the government's need to fund essential services and programs. This rate is among the highest in the United States, reflecting both local economic conditions and fiscal needs. Understanding this while navigating a Puerto Rico Warehouse and Storage Agreement can enhance your financial planning and compliance with local regulations.

Setting up a company in Puerto Rico involves several steps, including choosing a business structure, registering with the Department of State, and obtaining necessary permits. Additionally, you'll need to consider local taxes, like the IVU, when drafting a Puerto Rico Warehouse and Storage Agreement. Platforms such as USLegalForms can simplify the paperwork and legal processes for establishing your business.

The IVU tax, or Impuesto de Ventas y Uso, is essentially a sales tax that funds various public services in Puerto Rico. Currently set at 10.5%, this tax applies to most transactions, making it crucial to consider when negotiating a Puerto Rico Warehouse and Storage Agreement. Being aware of this tax can help you manage costs effectively.