Puerto Rico Sample Letter for Judgment Confirming Tax Title

Description

How to fill out Sample Letter For Judgment Confirming Tax Title?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal document templates that you can download or print. By utilizing the website, you can access thousands of documents for both business and personal use, organized by categories, states, or keywords. You can find the most recent editions of documents such as the Puerto Rico Sample Letter for Judgment Confirming Tax Title within moments.

If you hold a subscription, Log In and download the Puerto Rico Sample Letter for Judgment Confirming Tax Title from the US Legal Forms repository. The Download button will be visible on each form you examine. You have access to all previously acquired documents from the My documents section of your account.

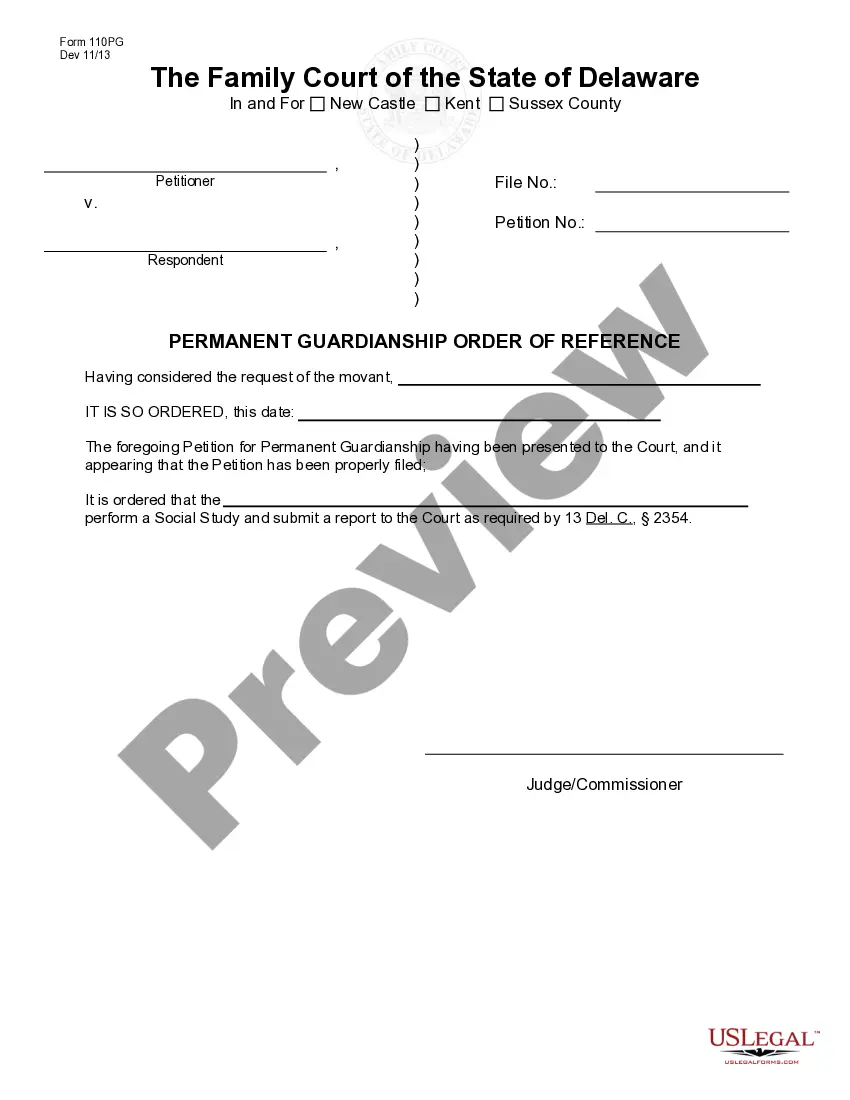

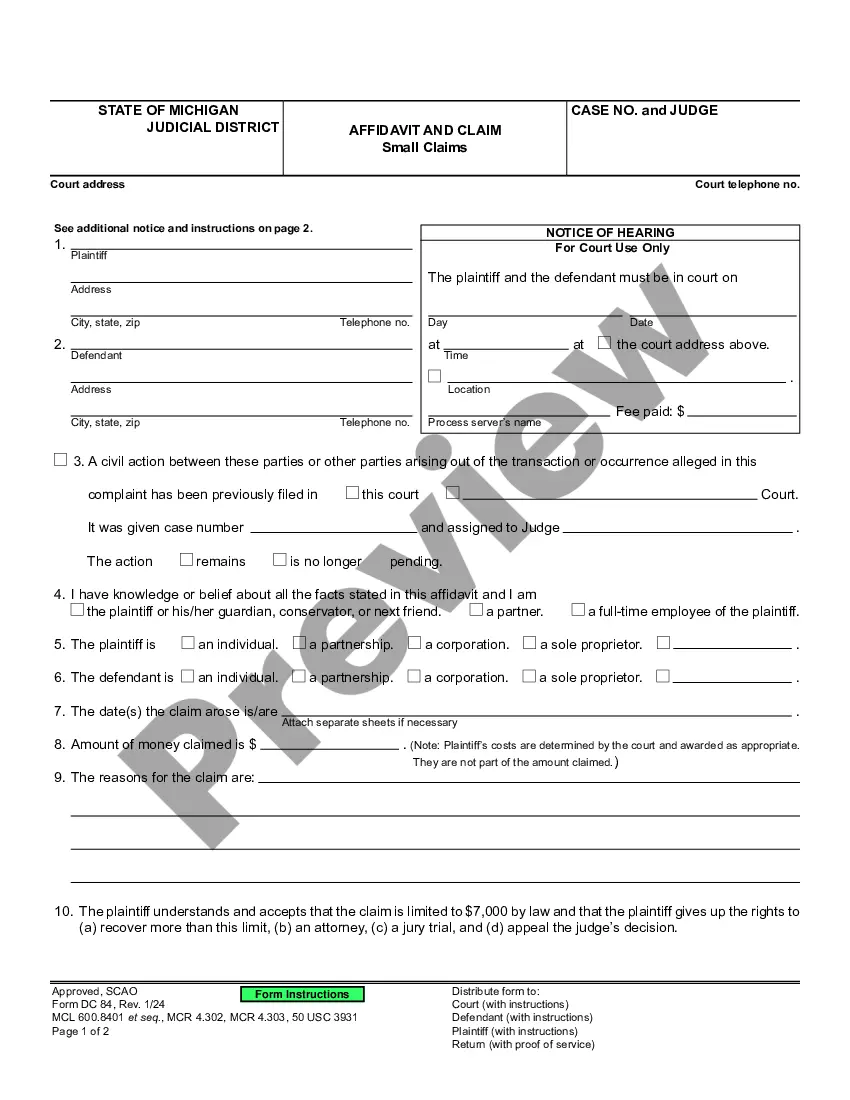

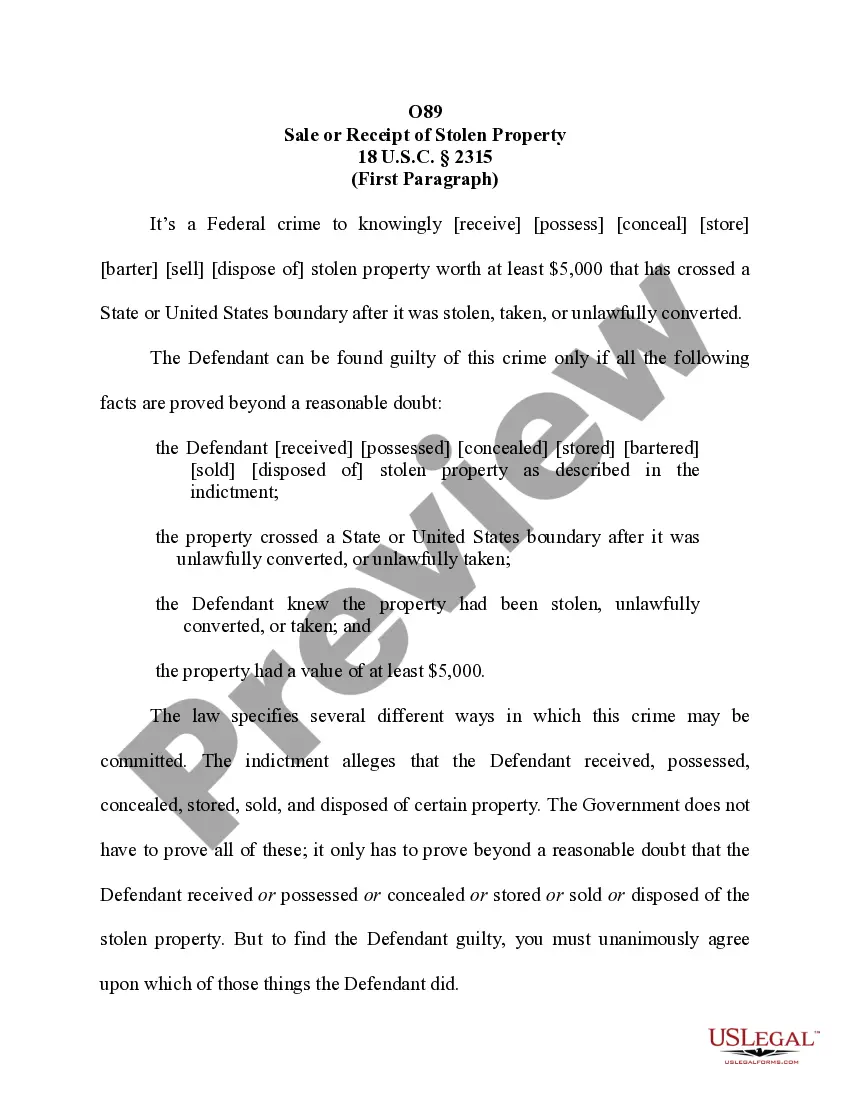

If you want to utilize US Legal Forms for the first time, here are straightforward instructions to assist you in getting started: Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Read the form description to confirm that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does. Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Puerto Rico Sample Letter for Judgment Confirming Tax Title. Every template you added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Puerto Rico Sample Letter for Judgment Confirming Tax Title with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal demands and requirements.

Form popularity

FAQ

Since 2012, Puerto Rico has offered investors ? primarily mainland Americans ? one of the most attractive deals in the world: move to the commonwealth and pay no taxes on interest, dividends or capital gains, all while living on a balmy and culturally vibrant Caribbean island without having to surrender US citizenship.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.

Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012. They need to buy a residency on the island and live there at least half of the year.

Once you live in Puerto Rico, your passive income is now ?Puerto Rico source income,? and Section 933 of the Internal Revenue Code says you don't have to pay federal taxes on Puerto Rico source income. Act 60 says you don't have to pay Puerto Rico taxes on passive income.

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

Act 22, now Chapter 2 of the Puerto Rico Incentives Code 60, offers lucrative tax incentives to high-net-worth individuals, empty nesters, retirees, and investors.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.