Under the Fair Credit Reporting Act, a person may not procure or cause to be prepared an investigative consumer report on any consumer unless: (1) it is clearly and accurately disclosed to the consumer that an investigative consumer report, including information as to character, general reputation, personal characteristics, and mode of living, whichever is or are applicable, may be made, and such disclosure: (a) is made in a writing mailed, or otherwise delivered, to the consumer not later than three days after the date on which the report was first requested; and (b) includes a statement informing the consumer of the right to request additional disclosures from the person requesting the report and the written summary of rights of the consumer prepared pursuant to ?§ 1681g(c) of the Act; and (2) the person certifies or has certified to the consumer reporting agency that the person has made the proper disclosures to the consumer as required under the Act.

Puerto Rico Disclosure That Investigative Consumer Report May Be Made

Description

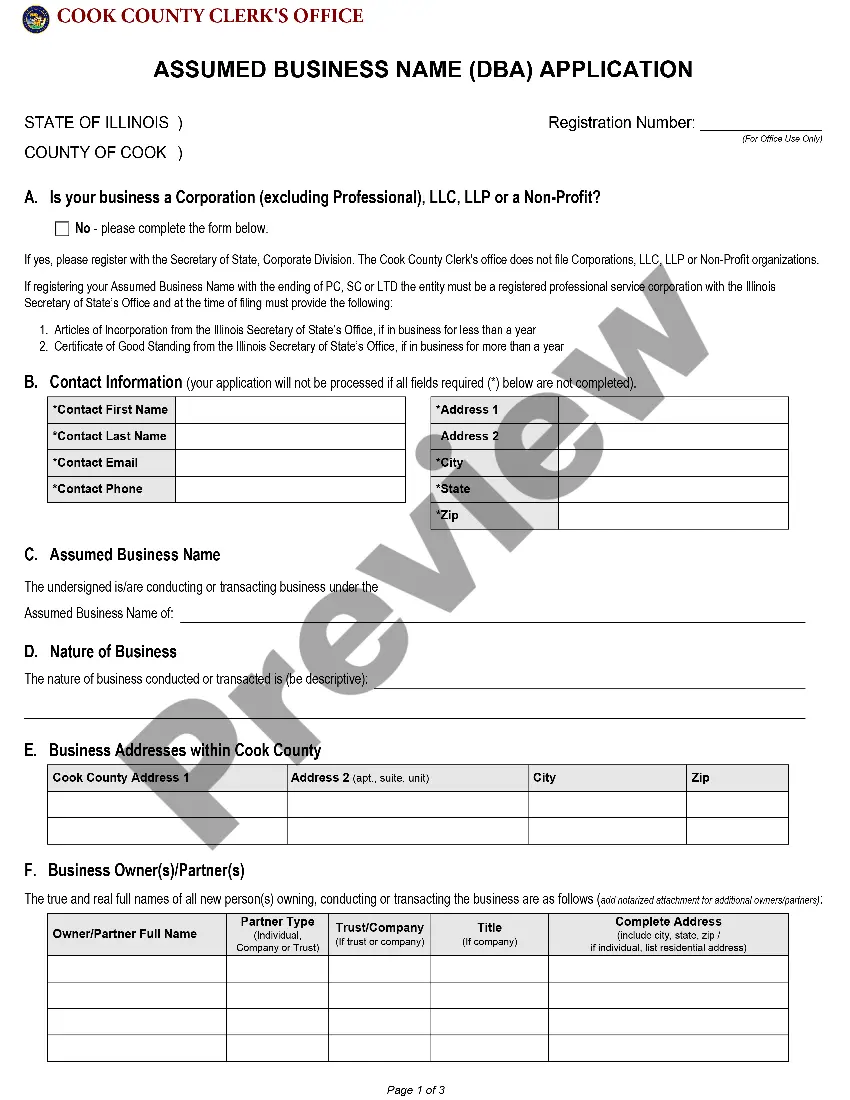

How to fill out Disclosure That Investigative Consumer Report May Be Made?

Are you currently in the position that you need paperwork for possibly organization or individual reasons almost every time? There are tons of lawful document templates available on the Internet, but getting kinds you can rely on is not simple. US Legal Forms gives thousands of form templates, just like the Puerto Rico Disclosure That Investigative Consumer Report May Be Made, which are written to satisfy federal and state specifications.

When you are previously familiar with US Legal Forms web site and get an account, just log in. Afterward, you can download the Puerto Rico Disclosure That Investigative Consumer Report May Be Made web template.

Unless you have an account and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is to the appropriate town/area.

- Take advantage of the Preview switch to analyze the shape.

- See the information to actually have selected the right form.

- In case the form is not what you`re looking for, use the Lookup industry to get the form that fits your needs and specifications.

- Once you discover the appropriate form, just click Buy now.

- Pick the pricing program you desire, fill in the necessary information to produce your bank account, and pay for the transaction using your PayPal or charge card.

- Decide on a handy file structure and download your duplicate.

Find every one of the document templates you might have bought in the My Forms menus. You can get a additional duplicate of Puerto Rico Disclosure That Investigative Consumer Report May Be Made anytime, if necessary. Just click the necessary form to download or produce the document web template.

Use US Legal Forms, by far the most extensive variety of lawful forms, in order to save efforts and avoid blunders. The assistance gives appropriately manufactured lawful document templates which you can use for a range of reasons. Generate an account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

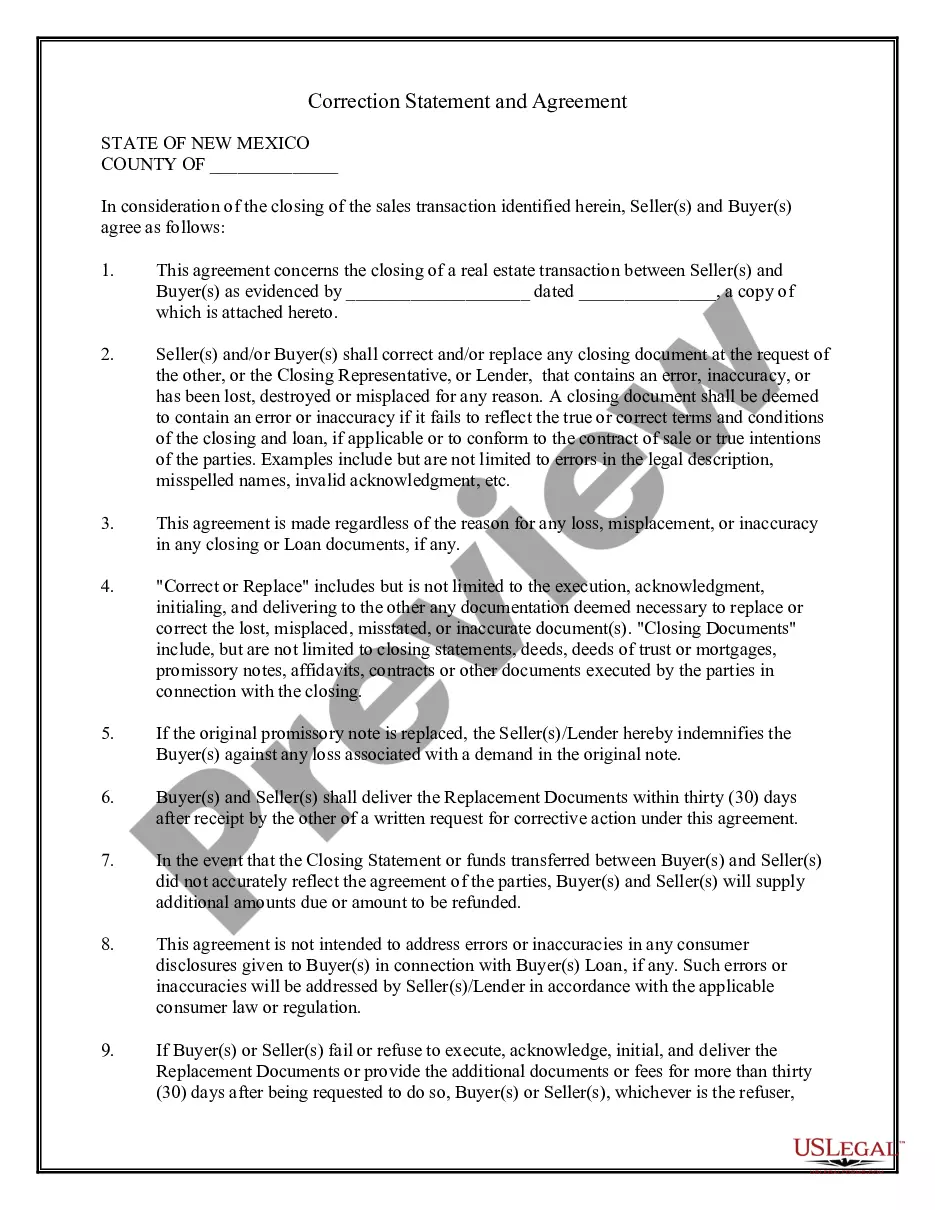

Investigate the dispute and review all relevant information provided by the CRA about the dispute; report your findings to the CRA; provide corrected information to every CRA that received the information if your investigation shows the information is incomplete or inaccurate; and.

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report.

Consumer Financial Protection Bureau.

Investigative consumer reports contain information on a consumer's character, general reputation, personal characteristics, or mode of living but are obtained through personal interviews with neighbors, friends, or associates of the consumer.

A credit report or another type of consumer report to deny your application for credit, insurance, or employment ? or to take another adverse action against you ? must tell you, and must give you the name, address, and phone number of the agency that provided the information.

The Fair Credit Reporting Act (FCRA) governs how credit bureaus can collect and share information about individual consumers. Businesses check credit reports for many purposes, such as deciding whether to make a loan or sell insurance to a consumer. Employers may check them, too.