Puerto Rico Certificate of Trust for Successor Trustee

Description

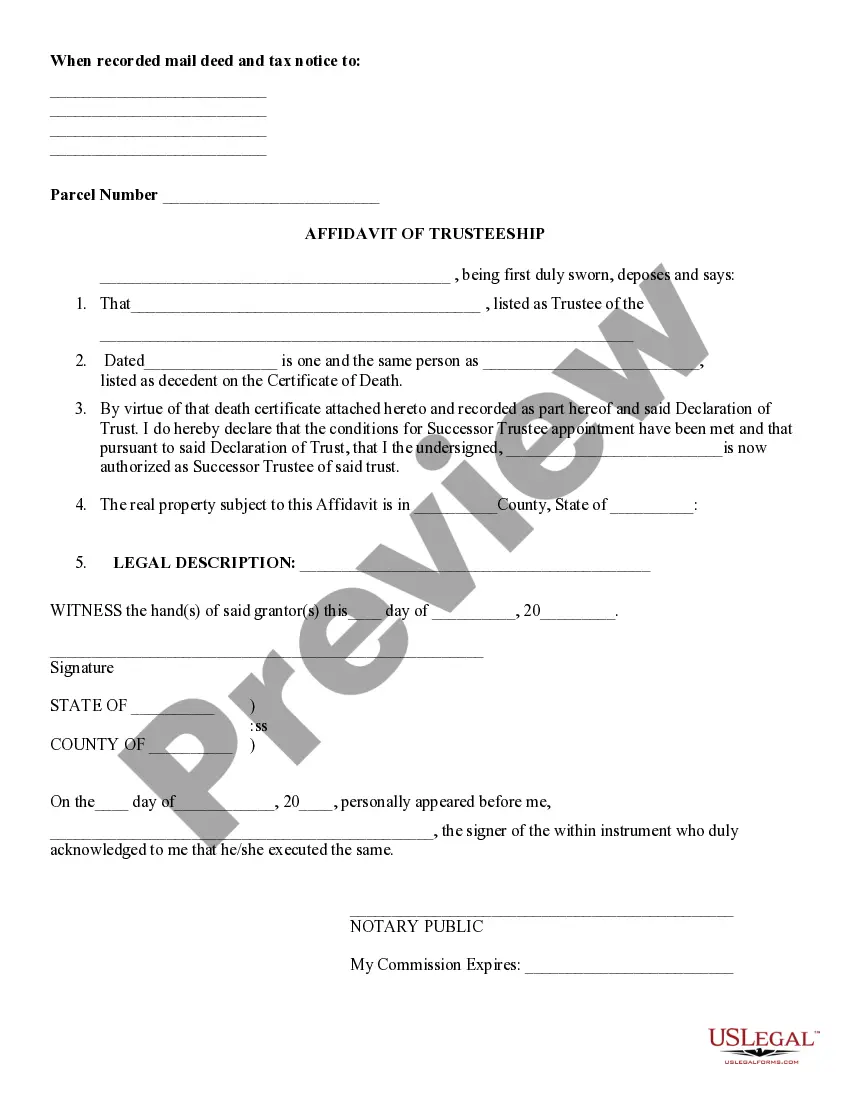

How to fill out Certificate Of Trust For Successor Trustee?

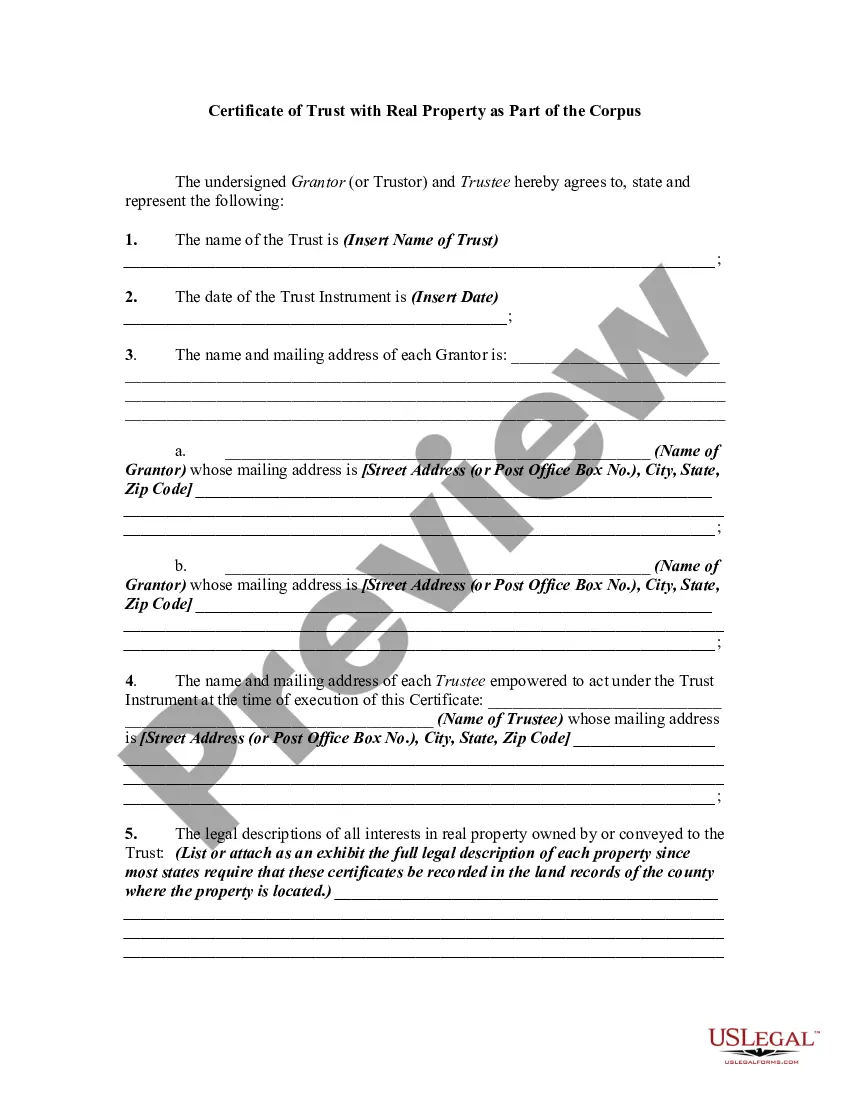

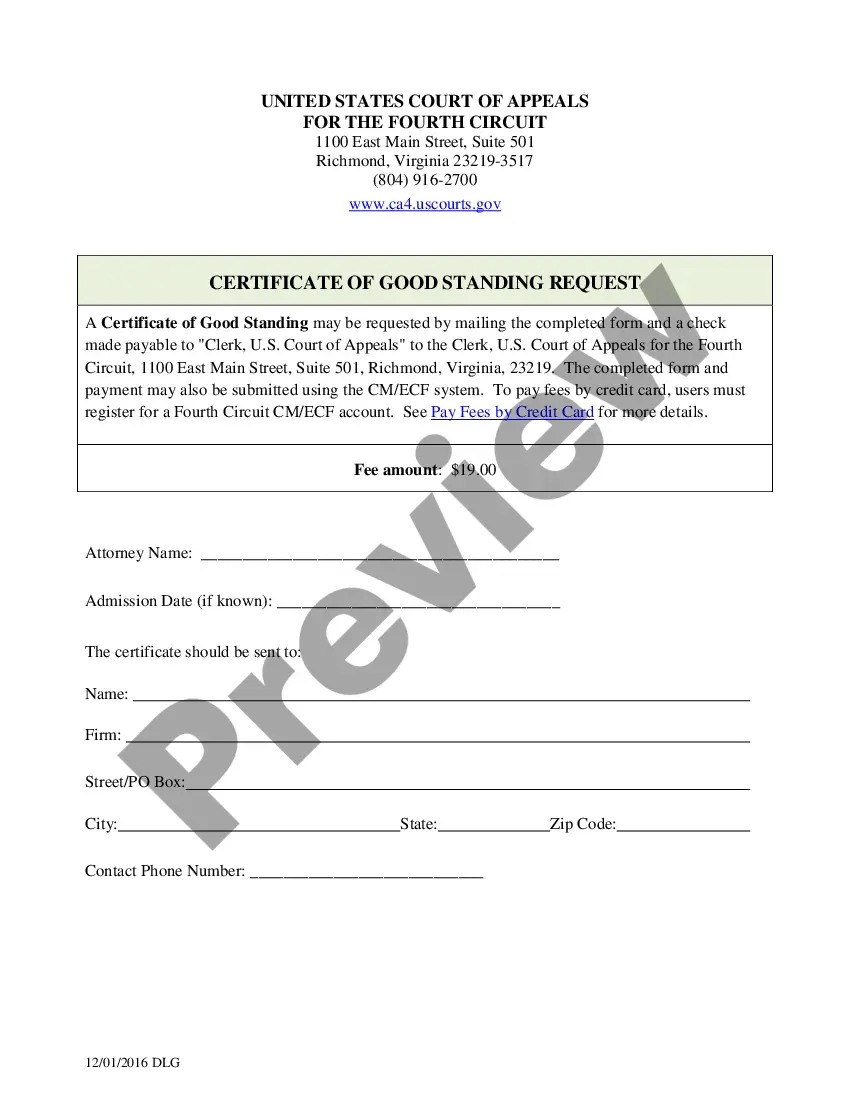

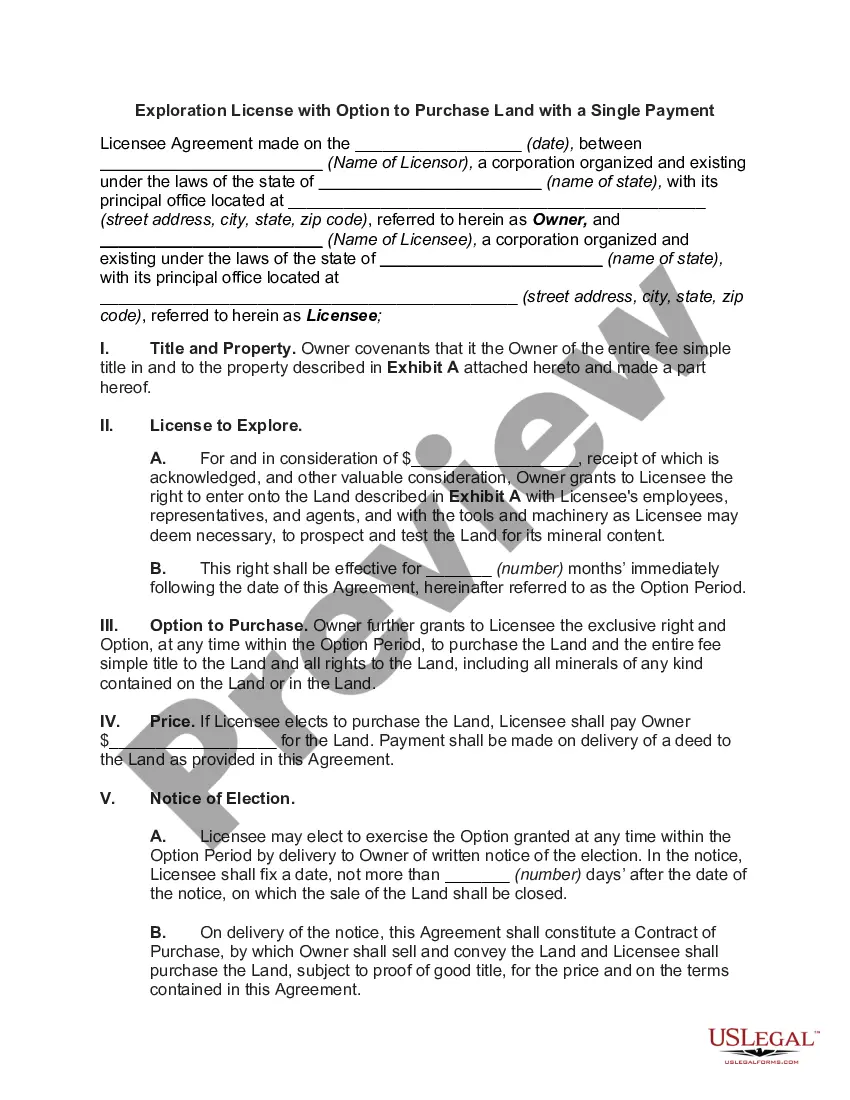

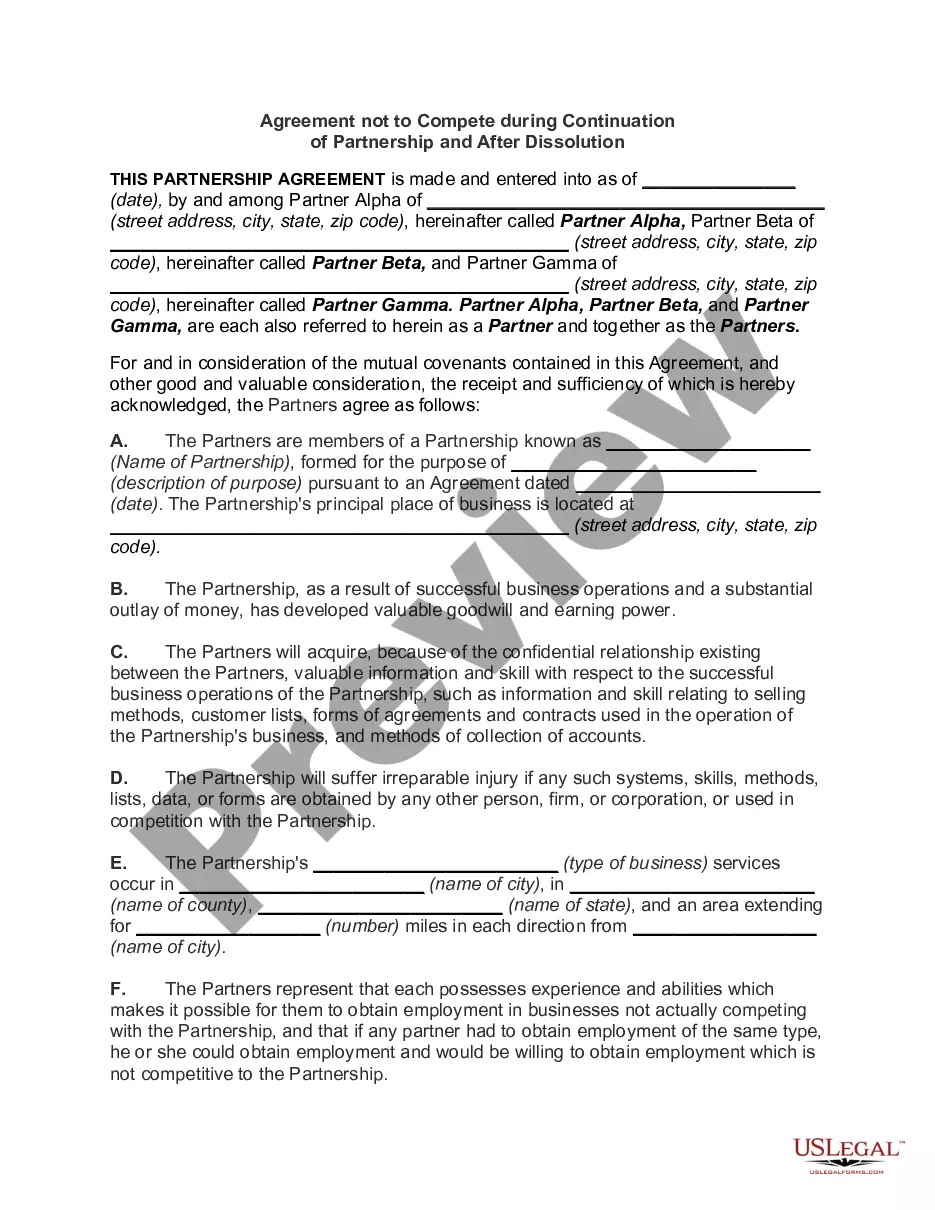

Are you presently in a placement where you require documents for sometimes organization or personal uses just about every day time? There are a lot of legitimate file layouts available on the Internet, but finding ones you can rely on is not effortless. US Legal Forms delivers thousands of develop layouts, such as the Puerto Rico Certificate of Trust for Successor Trustee, that happen to be composed in order to meet state and federal demands.

When you are previously informed about US Legal Forms web site and possess your account, merely log in. Next, you are able to obtain the Puerto Rico Certificate of Trust for Successor Trustee format.

If you do not come with an accounts and wish to start using US Legal Forms, abide by these steps:

- Get the develop you need and ensure it is for your correct area/area.

- Use the Preview button to check the shape.

- Look at the outline to ensure that you have chosen the proper develop.

- If the develop is not what you are searching for, take advantage of the Search field to discover the develop that meets your needs and demands.

- Whenever you obtain the correct develop, click on Get now.

- Select the costs prepare you need, fill out the required information and facts to generate your bank account, and purchase the transaction making use of your PayPal or credit card.

- Pick a convenient document formatting and obtain your duplicate.

Get every one of the file layouts you possess purchased in the My Forms food list. You can aquire a additional duplicate of Puerto Rico Certificate of Trust for Successor Trustee anytime, if possible. Just click the essential develop to obtain or print the file format.

Use US Legal Forms, the most considerable selection of legitimate varieties, to save lots of some time and stay away from blunders. The assistance delivers expertly created legitimate file layouts which can be used for a selection of uses. Make your account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

(a) A trustee shall keep the qualified beneficiaries of the trust reasonably informed about the administration of the trust and of the material facts necessary for them to protect their interests.

Revocation or amendment of revocable trust. (a) Unless the terms of a trust expressly provide that the trust is irrevocable, the settlor may revoke or amend the trust.

Can a trustee withhold money from a beneficiary. Can trustees withhold assets from beneficiaries? Trustees are bound by the trust's terms and cannot unreasonably withhold a beneficiary's share, even amid disagreements.

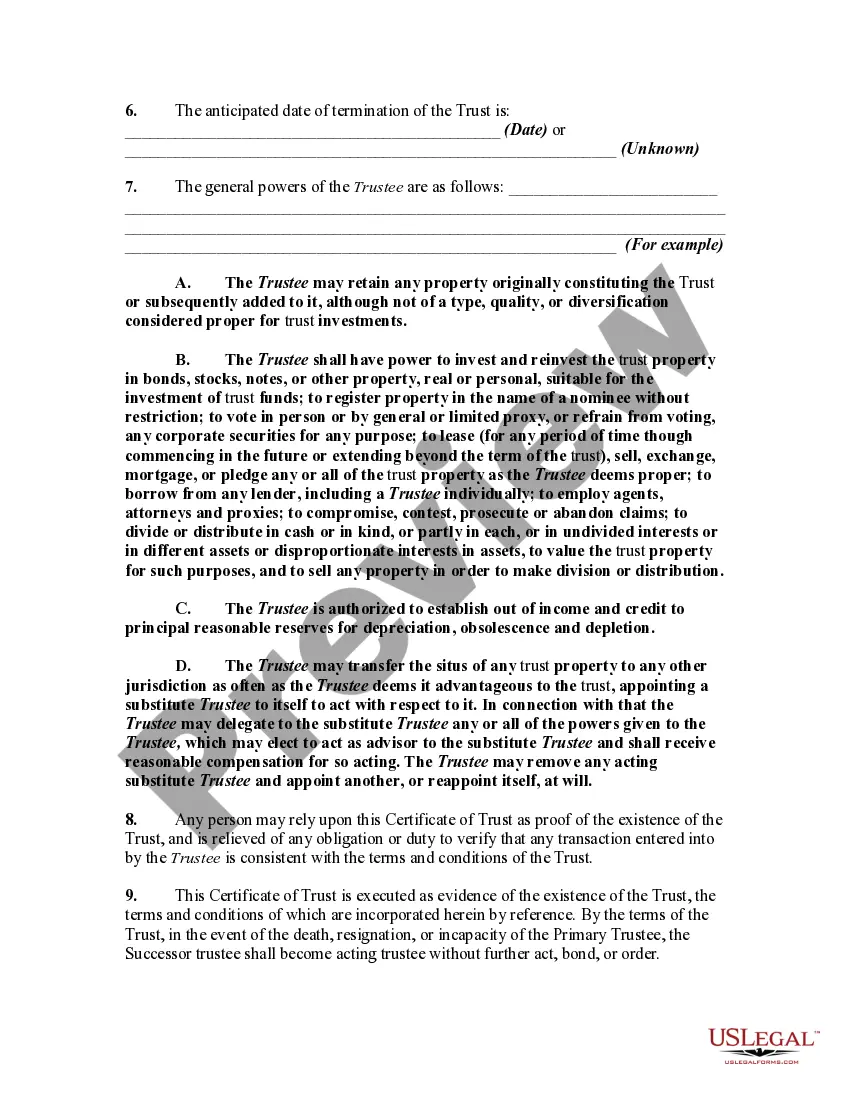

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated. The exact responsibilities of a successor trustee will vary depending on the instructions left by the creator of the trust (called the Grantor).

In general, it's unadvisable to name a non-U.S. citizen as successor trustee for your trust. Even if your spouse is your preferred successor trustee, if they are not a U.S. citizen, you're placing them in a potential terrible tax situation both during your lifetime and afterward.

SECTION 62-7-408. Trust for care of animal. (a) A trust may be created to provide for the care of an animal or animals alive or in gestation during the settlor's lifetime, whether or not alive at the time the trust is created.

The Estate Settlement Timeline: While there is no specific deadline for this in South Carolina law, it is generally best to do so within a month to prevent unnecessary delays in the probate process.

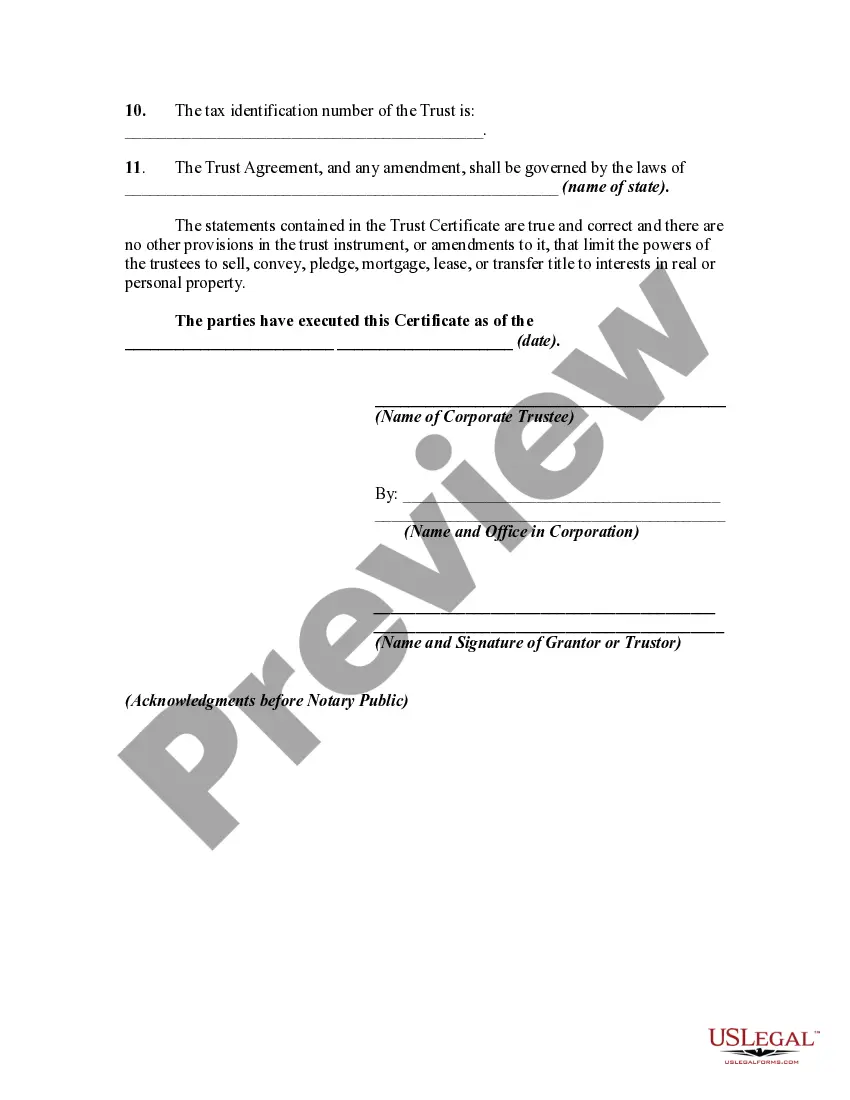

The certification of trust is codified at S.C. Code 62-7-1013 as part of the South Carolina Trust Code. A certificate of trust presents a summary of the trust to which it pertains, and verifies a trust's existence and the trustee's authority to act on behalf of the trust.