Puerto Rico Limited Liability Partnership Agreement

Description

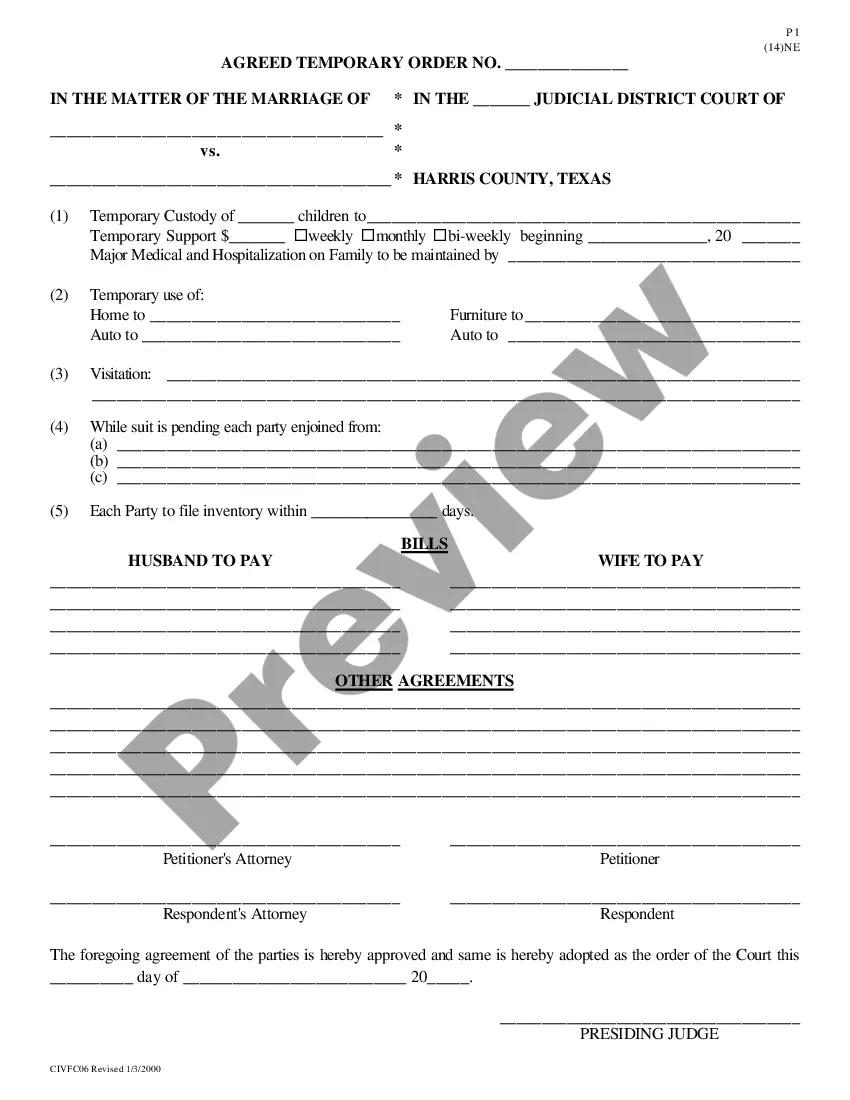

How to fill out Limited Liability Partnership Agreement?

Selecting the finest legal document template can be quite challenging.

Naturally, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Puerto Rico Limited Liability Partnership Agreement, that can be utilized for both business and personal purposes.

You can review the form using the Review button and read the form description to confirm it is the appropriate one for your needs.

- All of the forms are reviewed by experts and meet state and federal standards.

- If you are already registered, Log In to your account and click the Download button to acquire the Puerto Rico Limited Liability Partnership Agreement.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines to follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

If a corporation is formed in Puerto Rico and does business in the mainland United States, it is still considered a domestic corporation in Puerto Rico. However, when it operates outside Puerto Rico, it is viewed as a foreign corporation. Understanding these distinctions is vital for compliance and taxation. A Puerto Rico Limited Liability Partnership Agreement can help clarify your corporation's responsibilities and operations across different jurisdictions.

Filing your Puerto Rico annual report online is straightforward. You can access the Department of State's website and navigate to the business services section. By entering your LLC information and following the prompts, you can complete your filing efficiently. Using a service like uslegalforms can further streamline this process, ensuring your Puerto Rico Limited Liability Partnership Agreement is up-to-date.

The rules governing LLCs in Puerto Rico include having at least one member and designating a registered agent in the jurisdiction. You must also maintain proper records and file an annual report. Ensuring compliance with these regulations will keep your Puerto Rico Limited Liability Partnership Agreement in good standing and benefit your business.

A Puerto Rico LLC offers limited liability protection, which shields your personal assets from business risks. Additionally, it allows for fewer compliance requirements compared to corporations. The flexible structure of a Puerto Rico Limited Liability Partnership Agreement suits various business owners, from solo entrepreneurs to larger partnerships, enhancing overall operational efficiency.

The primary difference lies in their management and tax structures. A corporation requires a more rigid management hierarchy and is subject to double taxation. In contrast, a Puerto Rico Limited Liability Partnership Agreement allows for more flexibility and typically enjoys pass-through taxation, meaning profits are taxed only at the owner’s level, not at the business level.

A Puerto Rico Limited Liability Partnership Agreement offers several advantages. First, it protects your personal assets from business debts and liabilities. Second, it allows for flexible management structures and fewer formalities. Lastly, it provides potential tax benefits that can enhance your overall business profitability.

You can use your LLC in Puerto Rico, but it's advisable to review local requirements. Transitioning your LLC into a Puerto Rico Limited Liability Partnership Agreement can provide additional flexibility and benefits under local laws. This path can help you navigate the nuances of operating in Puerto Rico while maintaining your business's integrity.

Yes, US companies can operate in Puerto Rico and often find the process straightforward. They can leverage the benefits of the Puerto Rico Limited Liability Partnership Agreement to establish a local presence. This arrangement allows companies to access unique market opportunities while abiding by local business laws.

DBAs can be necessary based on your business structure and operations. Even if your partnership operates under the Puerto Rico Limited Liability Partnership Agreement, using a different trade name may require a DBA. This simple registration helps in branding efforts and establishes transparency with clients and stakeholders.

A DBA, or 'doing business as,' is often essential for businesses operating under a name different from their registered name. If you choose a name for your partnership that is distinct from your Puerto Rico Limited Liability Partnership Agreement, filing a DBA allows for proper recognition and avoids legal issues. It's a straightforward process that helps clarify your business identity.