Puerto Rico Direct Deposit Form for Employees

Description

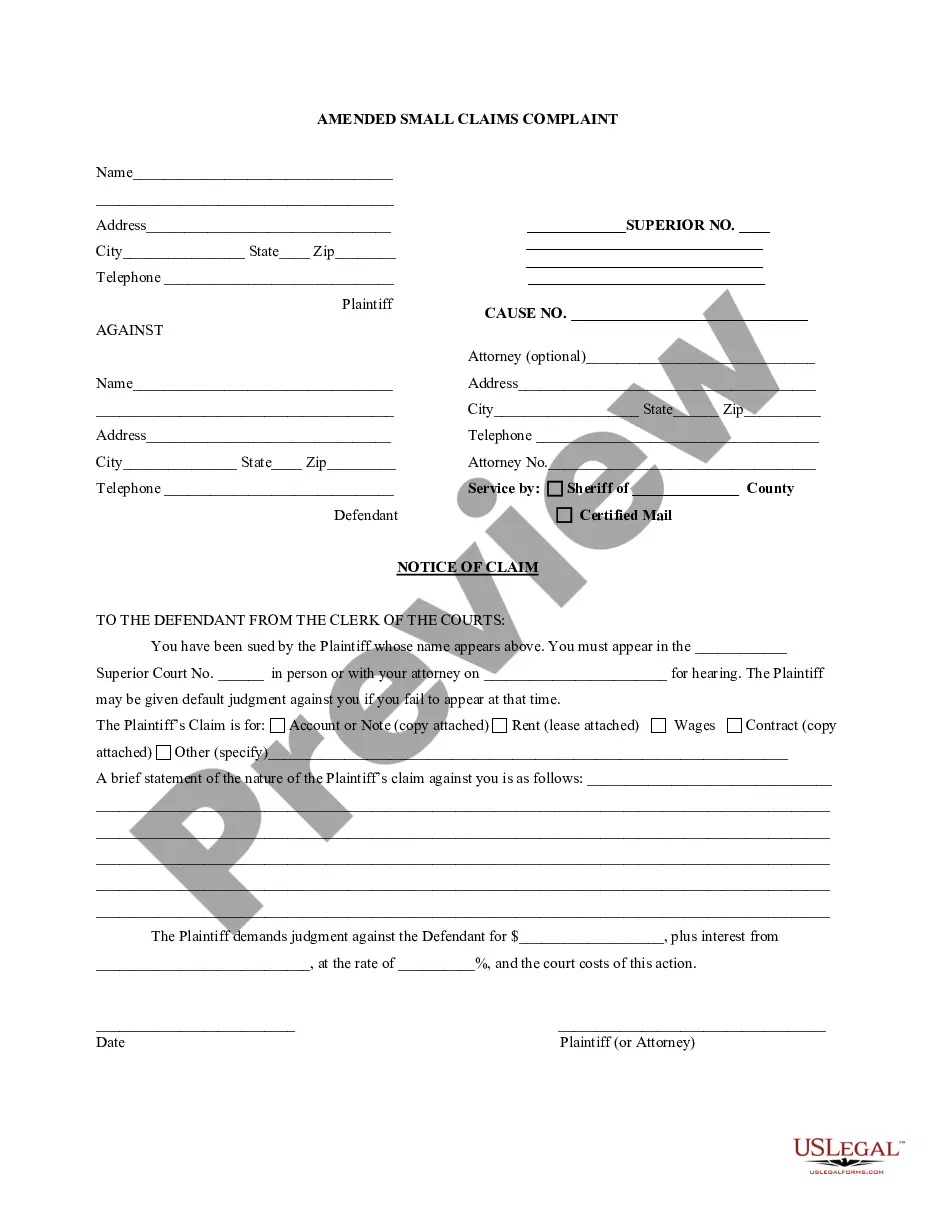

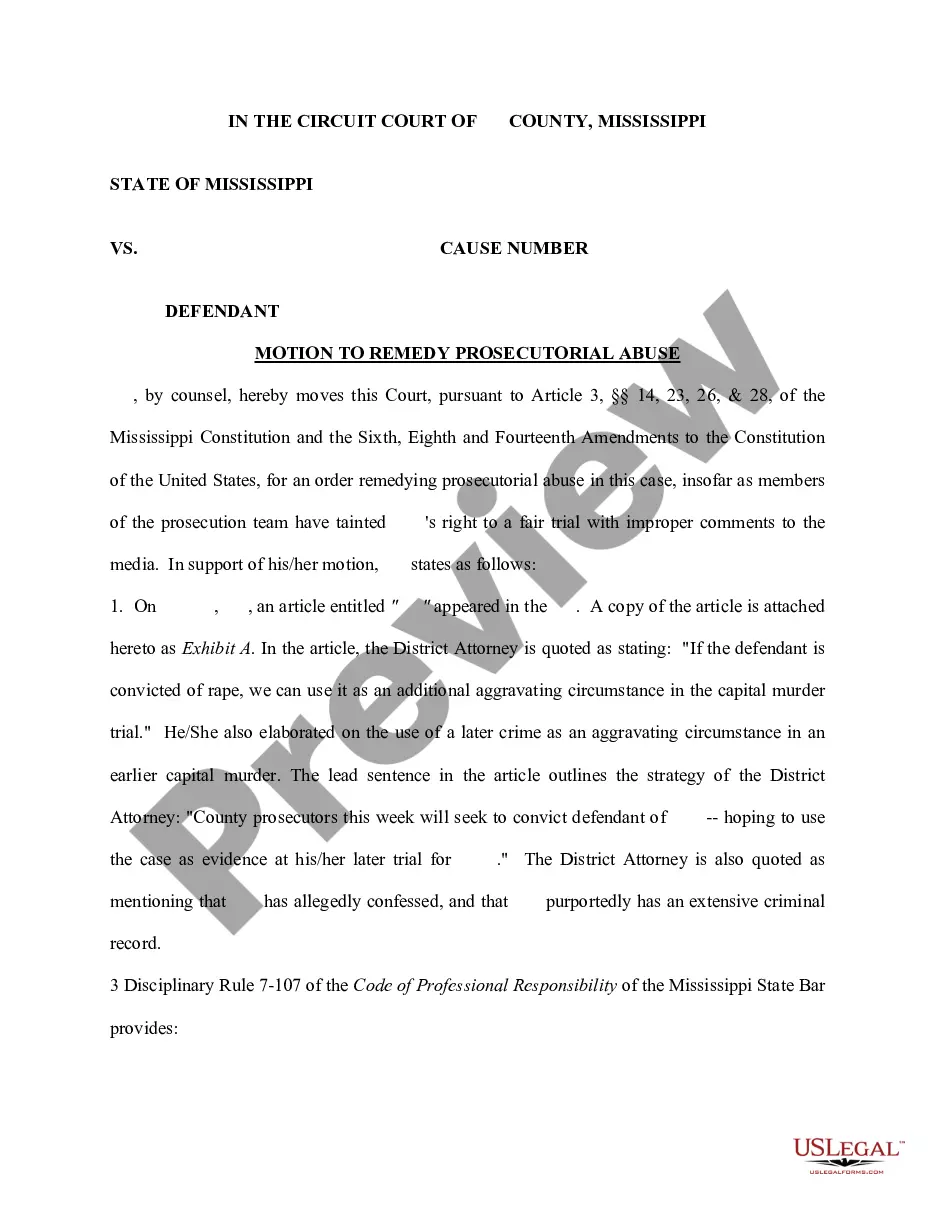

How to fill out Direct Deposit Form For Employees?

If you wish to finalize, retrieve, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online. Take advantage of the site’s straightforward and user-friendly search feature to find the documents you need. Various templates for business and personal purposes are organized by categories and titles, or keywords.

Use US Legal Forms to obtain the Puerto Rico Direct Deposit Form for Employees with just a few clicks. If you are currently a US Legal Forms user, Log In to your account and click the Download button to acquire the Puerto Rico Direct Deposit Form for Employees. You can also access forms you previously obtained from the My documents section of your account.

If you are using US Legal Forms for the first time, refer to the steps below: Step 1. Ensure you have chosen the form for the correct city/state. Step 2. Use the Review feature to examine the form’s details. Don’t forget to read the information. Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template. Step 4. Once you have located the form you want, click on the Purchase now button. Select the pricing plan you prefer and input your credentials to register for an account. Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the transaction. Step 6. Choose the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Puerto Rico Direct Deposit Form for Employees.

- Every legal document template you obtain is yours indefinitely.

- You have access to every form you acquired within your account.

- Click on the My documents section and select a form to print or download again.

- Be proactive and download, and print the Puerto Rico Direct Deposit Form for Employees with US Legal Forms.

- There are millions of professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

Yes, you can print out a direct deposit form, including the Puerto Rico Direct Deposit Form for Employees. Most online resources, such as US Legal Forms, allow you to download and print the necessary documents directly from their site. This flexibility makes it convenient for you to complete the form and provide it to your employer. By having a physical copy, you can ensure that all details are accurately filled in before submission.

Employers need the Puerto Rico Direct Deposit Form for Employees to set up direct deposit for their team members. This form collects essential information, such as the employee's bank account details and authorization for the deposit. By using this standardized form, employers can ensure a smooth and efficient payment process. Additionally, you can easily find this form on platforms like US Legal Forms, which simplifies the entire setup.

Steps on How to Set Up Direct Deposit for Your Employees Decide on a payroll provider. If you don't have one set up already, you'll need a payroll provider that offers direct deposit services. ... Connect with your bank. ... Collect information from your employees. ... Create a payroll schedule. ... Run payroll.

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

I hereby authorize [Company Name] to directly deposit my pay in the bank account(s) listed below in the percentages specified. (If two accounts are designated, deposits are to be made in whole percentages of pay to total 100%.)

One of the options you can use to pay unbanked employees is to use Pay Cards. Pay cards work like debit cards. Like direct deposit, payroll cards are a form of electronic payment. Each payday, the employee's net wages are deposited directly into the pay card.

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

Direct deposit (also called "electronic funds transfer") is how businesses can send an employee's or contractor's paycheck directly into their bank account. This can be set to run automatically to your custom pay periods: weekly, biweekly, or monthly.

Steps for Direct Deposit Setup Choose A Payroll Service Provider. ... Establish A Company Payroll Account. ... Send A Direct Deposit Authorization Form To Employees. ... Verify Correct Account Information. ... Run standard payroll process.

Direct Deposit Authorization Form Company Information. Employee Information. Bank Account Information. ?I hereby authorize?? Statement. Employee Signature and Date. Space for Attached Physical Check (Optional)