Puerto Rico Corporate Resolution for Bank Account

Description

How to fill out Corporate Resolution For Bank Account?

If you need to complete, acquire, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and efficient search tool to locate the documents you require.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Every legal document template you obtain is yours for a long time.

You have access to every form you have acquired in your account. Click on the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Puerto Rico Corporate Resolution for Bank Account with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Puerto Rico Corporate Resolution for Bank Account with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to find the Puerto Rico Corporate Resolution for Bank Account.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

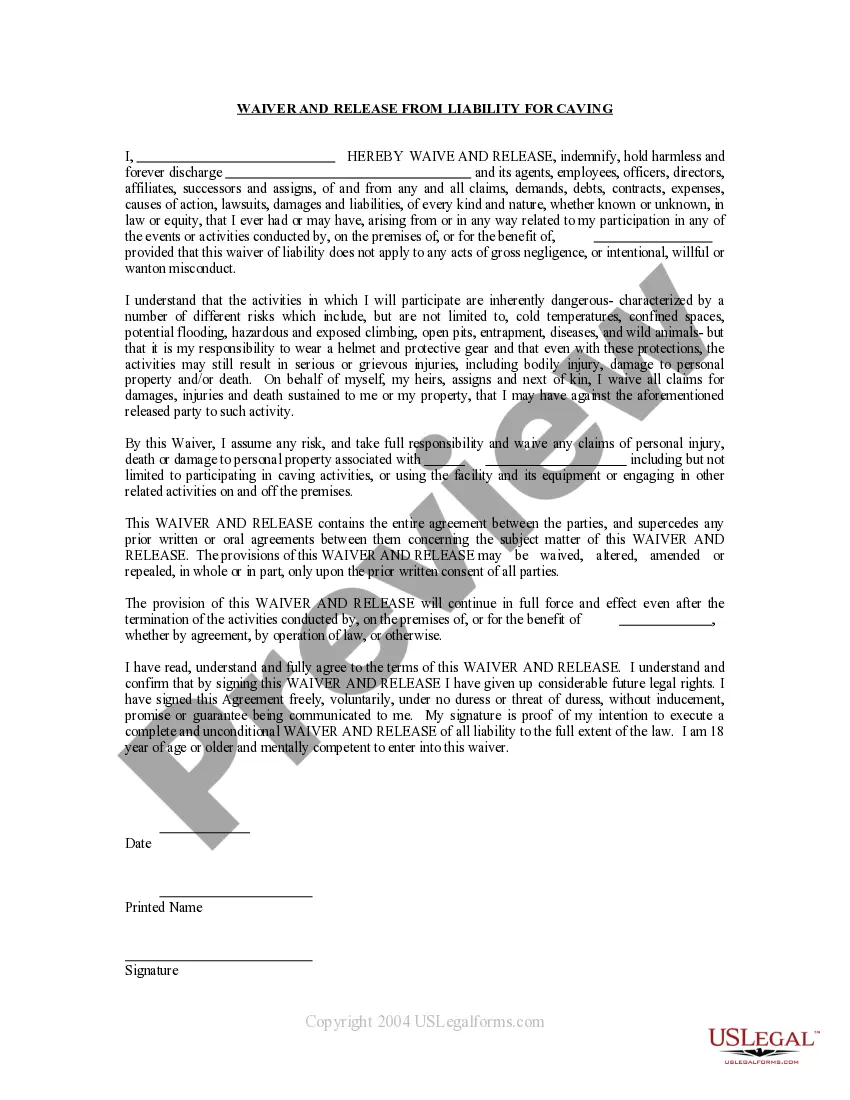

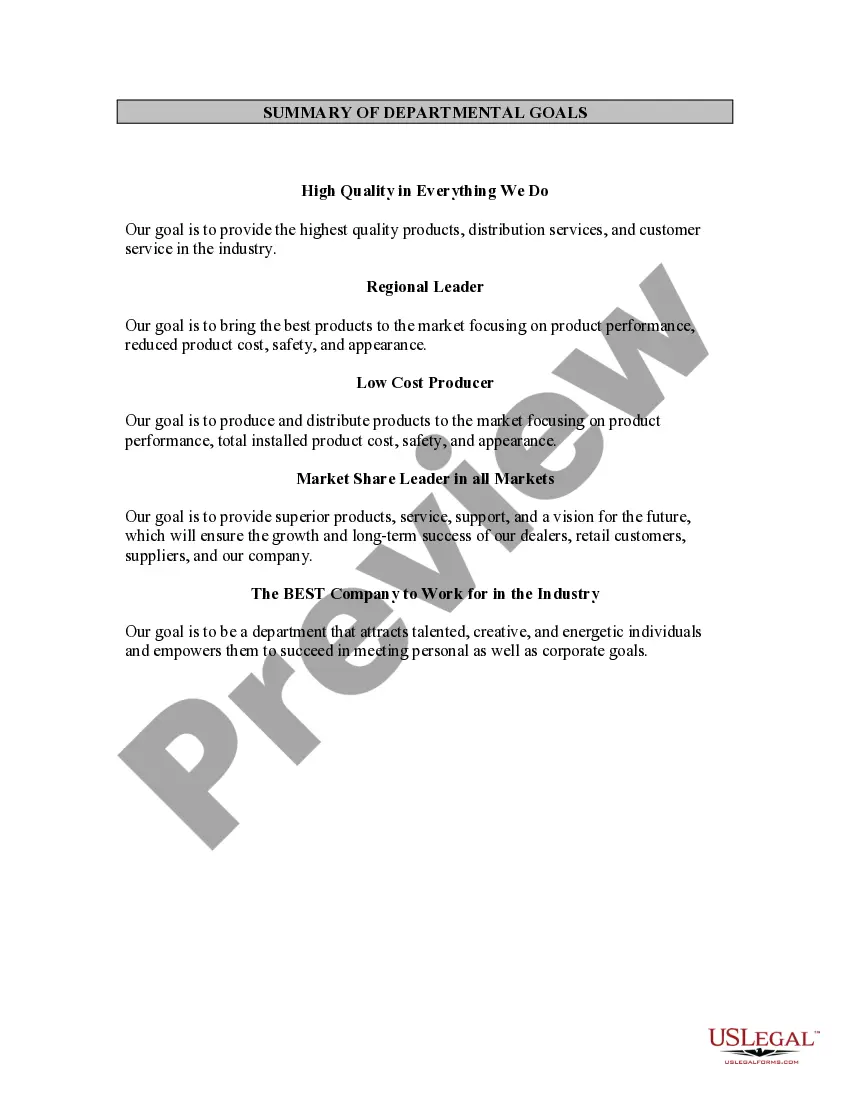

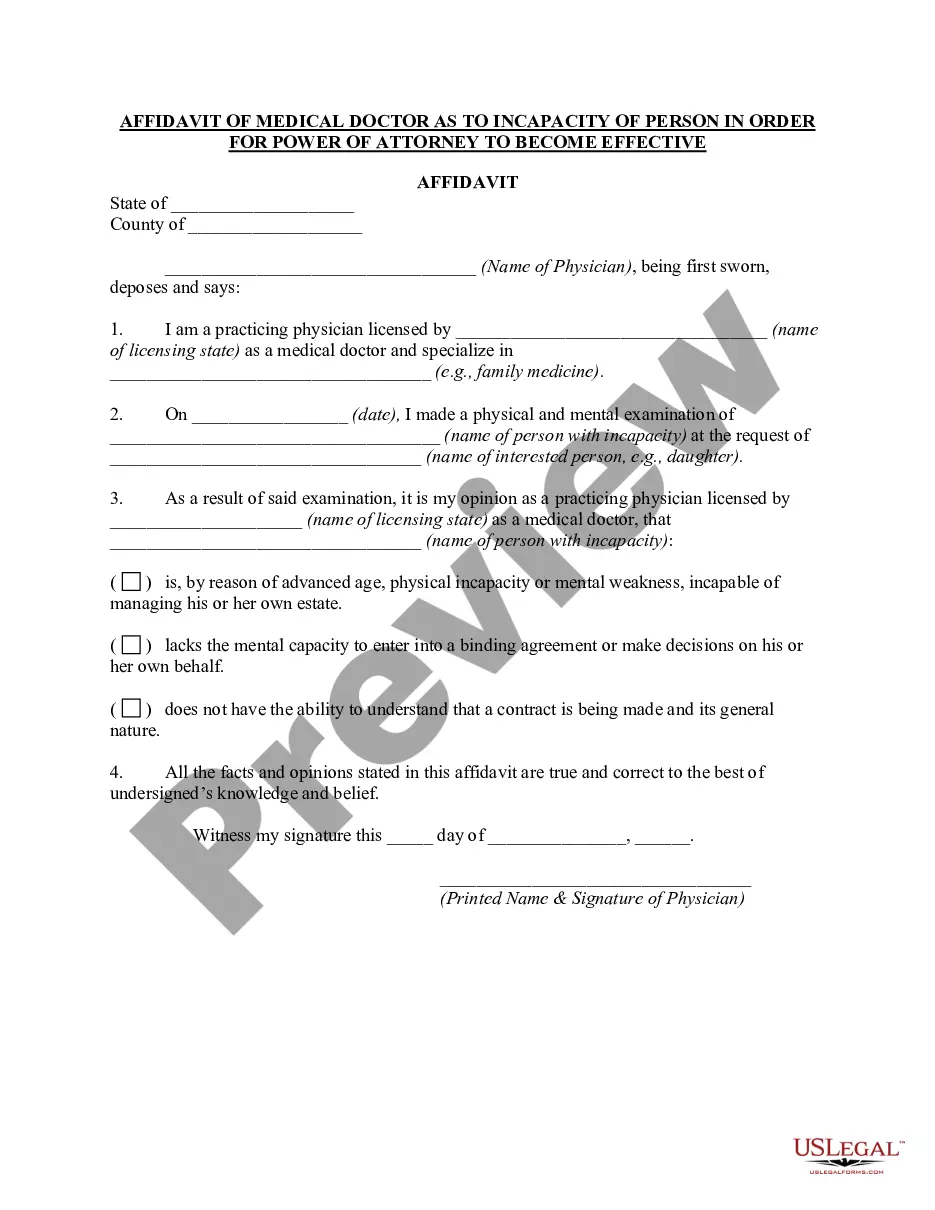

- Step 2. Use the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find other types of legal form templates.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and input your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Puerto Rico Corporate Resolution for Bank Account.

Form popularity

FAQ

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

A: A corporation is the business entity itself. Incorporation is the act of starting a corporate business entity. A corporation (Inc.), a limited partnership (LP), and a non-profit (non-stock) corporation are incorporated entities.

Commonwealth taxesAll federal employees, those who do business with the federal government, Puerto Rico-based corporations that intend to send funds to the US, and some others also pay federal income taxes (for example, Puerto Rico residents who earned income from sources outside Puerto Rico.

Domestic Corporations Are those created under the General Corporations Act of Puerto Rico. That is, these are corporations of Puerto Rico. Foreign Corporations Are those created under the laws of other countries and states of the United States.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.

Puerto Rican trade is facilitated by the island's inclusion in the U.S. Customs system, and Puerto Rico's most important trading partner, by far, is the United States. The island also carries on significant trade with Singapore, Japan, Brazil, and Ireland and other European countries.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.

As a protected U.S. Territory, Puerto Rico offers unique benefits to its corporation including: no U.S. taxes for selling products in the U.S., duty free importing of products from the U.S., low corporate tax rates, real estate and personal property taxes are exempt during the first year, one shareholder can form a

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

Puerto Rico offers businesses the security and stability to operate in a US jurisdiction, while providing an unmatched variety of tax incentives that make it an attractive destination for businesses, large and small.