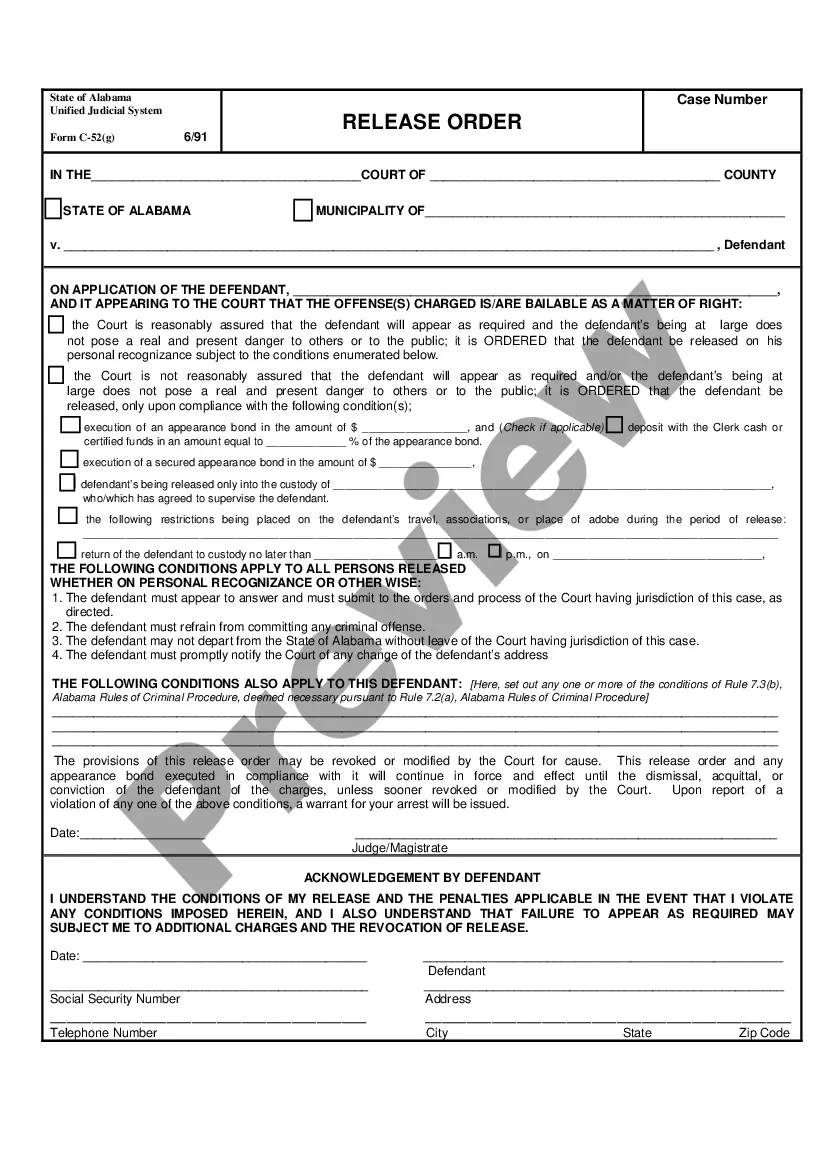

Form with which a shareholder who has granted another the right to vote on his/her behalf may revoke the granting of that right.

Puerto Rico Revocation of Proxy - Corporate Resolutions

Category:

State:

Multi-State

Control #:

US-0024-CR

Format:

Word;

Rich Text

Instant download

Description

How to fill out Revocation Of Proxy - Corporate Resolutions?

You can spend hours online attempting to locate the legal document template that fulfills the federal and state requirements you desire.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

It is easy to download or print the Puerto Rico Revocation of Proxy - Corporate Resolutions from the platform.

If available, use the Preview button to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Puerto Rico Revocation of Proxy - Corporate Resolutions.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the area/town of your choice.

- Review the document description to confirm you have chosen the right template.