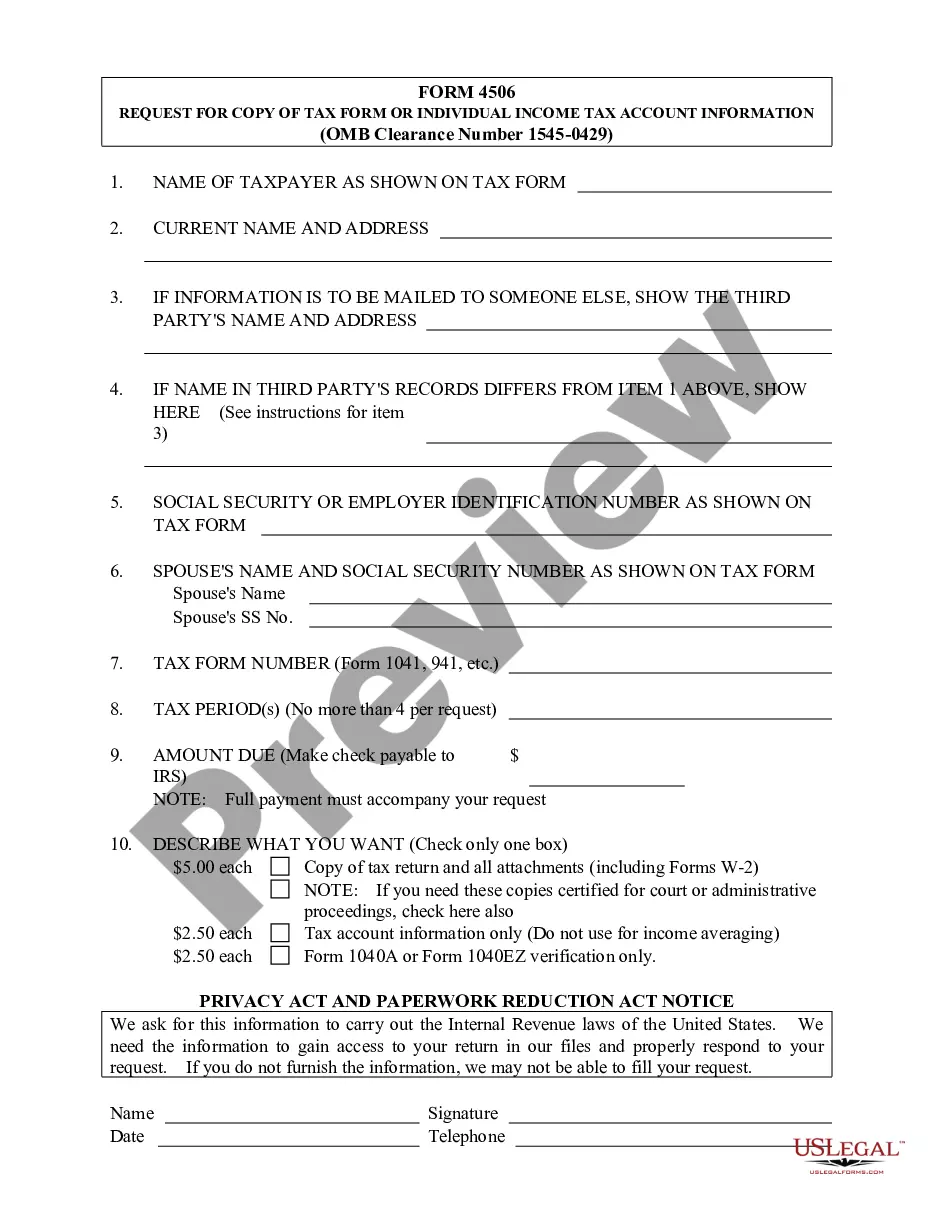

Pennsylvania Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Have you been in a position in which you will need papers for either organization or individual purposes virtually every time? There are a lot of legal record templates available on the net, but locating versions you can depend on isn`t simple. US Legal Forms offers 1000s of form templates, just like the Pennsylvania Request for Copy of Tax Form or Individual Income Tax Account Information, which can be created in order to meet federal and state demands.

If you are previously knowledgeable about US Legal Forms website and possess a free account, basically log in. After that, you are able to down load the Pennsylvania Request for Copy of Tax Form or Individual Income Tax Account Information design.

Unless you come with an bank account and need to start using US Legal Forms, abide by these steps:

- Obtain the form you require and ensure it is for your proper area/state.

- Use the Review button to examine the form.

- Look at the outline to actually have selected the right form.

- In the event the form isn`t what you are searching for, use the Look for discipline to obtain the form that fits your needs and demands.

- Whenever you find the proper form, just click Acquire now.

- Pick the pricing program you want, submit the desired details to create your money, and buy the transaction utilizing your PayPal or charge card.

- Select a handy document structure and down load your copy.

Get all the record templates you possess purchased in the My Forms menu. You may get a further copy of Pennsylvania Request for Copy of Tax Form or Individual Income Tax Account Information any time, if necessary. Just select the necessary form to down load or print out the record design.

Use US Legal Forms, probably the most comprehensive selection of legal forms, in order to save time as well as steer clear of faults. The assistance offers expertly created legal record templates which can be used for a selection of purposes. Make a free account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

Pennsylvania Tax Account Numbers If you are a new business, register online with the PA Department of Revenue to retrieve your account number and filing frequency. You can also contact the agency at 1-888-PATAXES (1-888-728-2937).

What is a Pennsylvania Tax ID? In Pennsylvania, your business does not have a single tax id, but rather an account number (also known as box number) for each tax account with the Pennsylvania Department of State.

Check the status of your Pennsylvania state refund online at . Services for taxpayers with special hearing and/or speaking needs are available by calling 1-800-447-3020 (TT). Your refund status will be updated daily.

To view licenses for sales tax or other tax types: Log in to myPATH . If you have access to more than one client or taxpayer, you must select the Name hyperlink to view correspondence for... Is my tax exempt number the same as my sale tax license number?

Tip: Get faster service: Online at .irs.gov, Get Your Tax Record (Get Transcript) or by calling 1-800-908-9946 for specialized assistance.

To schedule a call: Input your First Name. Input your Last Name. Input your Phone Number (U.S. Only) Select a Tax Type. Select Date and Time for your call from the available list (Reminder: If times do not appear for the date you selected, then there are no available appointments for that day) Confirm your selection.

You can request copies of your IRS tax returns from the most recent seven tax years. To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2023, the IRS charges $43 for each return you request.