Nevada Technical Writer Agreement - Self-Employed Independent Contractor

Description

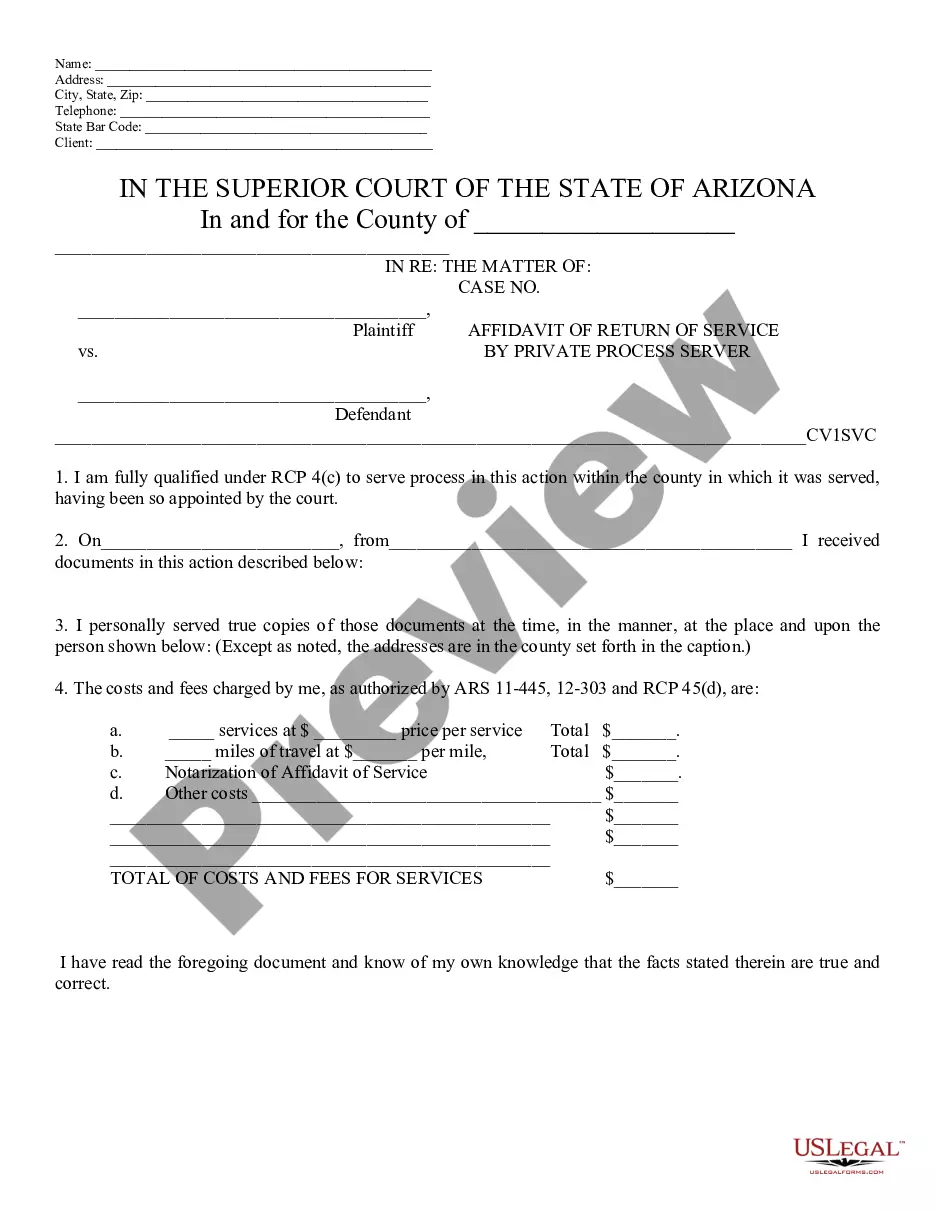

How to fill out Technical Writer Agreement - Self-Employed Independent Contractor?

If you need to obtain, acquire, or print sanctioned document templates, utilize US Legal Forms, the top selection of legal forms, which are available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need. Various templates for business and personal purposes are categorized by groups and states, or keywords.

Use US Legal Forms to obtain the Nevada Technical Writer Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Complete and acquire, and print the Nevada Technical Writer Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms user, sign in to your account and click the Acquire button to download the Nevada Technical Writer Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of legal document formats.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Nevada Technical Writer Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Filling out an independent contractor agreement requires you to enter specific information in designated sections. Begin with your personal details and the contractor's details. Next, specify the services provided, payment structure, and project timelines. For accuracy and legal protection, using a resource such as the Nevada Technical Writer Agreement - Self-Employed Independent Contractor from uslegalforms makes this process easy and reliable.

Writing an independent contractor agreement involves defining the scope of work, outlining payment terms, and setting deadlines for project completion. Start by clearly stating the roles and responsibilities of both parties. Then, include clauses related to confidentiality and dispute resolution. Using a template, like the Nevada Technical Writer Agreement - Self-Employed Independent Contractor, can simplify this process and ensure you cover all critical aspects.

To fill out an independent contractor form, first, gather all necessary information, including your name, address, and tax identification number. Next, provide details about the services you will offer and the compensation you expect in return. Additionally, be sure to specify the duration of the agreement. For a more streamlined process, consider using the Nevada Technical Writer Agreement - Self-Employed Independent Contractor from uslegalforms.

In Nevada, independent contractors may not need workers' compensation insurance unless they have employees. However, obtaining coverage is advisable to protect yourself from potential liabilities. Understanding your obligations is key, and drafting a Nevada Technical Writer Agreement - Self-Employed Independent Contractor can help clarify your insurance needs and responsibilities.

Nevada's independent contractor laws establish clear guidelines about how independent contractors operate, distinguishing them from employees. This includes issues of taxation, liability, and company obligations. Familiarizing yourself with these laws is important for compliance, and utilizing a Nevada Technical Writer Agreement - Self-Employed Independent Contractor can help ensure that your work aligns with legal requirements.

In Nevada, whether an independent contractor needs a business license depends on local regulations and the nature of their work. Many freelancers and independent contractors are required to obtain a business license to operate legally. Consulting local laws and having a comprehensive Nevada Technical Writer Agreement - Self-Employed Independent Contractor can guide you through the process.

Yes, a freelance writer qualifies as an independent contractor since they provide services to clients without being an employee. This means they have the freedom to choose projects and clients in a flexible manner. However, it is crucial to have a solid Nevada Technical Writer Agreement - Self-Employed Independent Contractor in place to define the working relationship and protect your interests.

While the terms are often used interchangeably, freelance work generally refers to individuals who offer services for various clients on a project basis. Independent contractors, on the other hand, can include freelancers, but they may also have longer-term contracts or specific agreements. Understanding this distinction can be important when drafting your Nevada Technical Writer Agreement - Self-Employed Independent Contractor.

Freelance writers may choose to establish an LLC to protect their personal assets and create a separate business identity. This choice can offer legal protection and tax advantages. However, it's not mandatory, especially for those starting their career. A Nevada Technical Writer Agreement - Self-Employed Independent Contractor can help clarify your business structure and responsibilities.

Creating a Nevada Technical Writer Agreement - Self-Employed Independent Contractor requires a few key steps. First, define the scope of work, including project details, deadlines, and payment terms. Next, include essential clauses such as confidentiality, ownership of work, and termination conditions. For ease and accuracy, consider using a platform like USLegalForms to access templates specifically designed for independent contractors in Nevada, ensuring your agreement is legally sound and tailored to your needs.