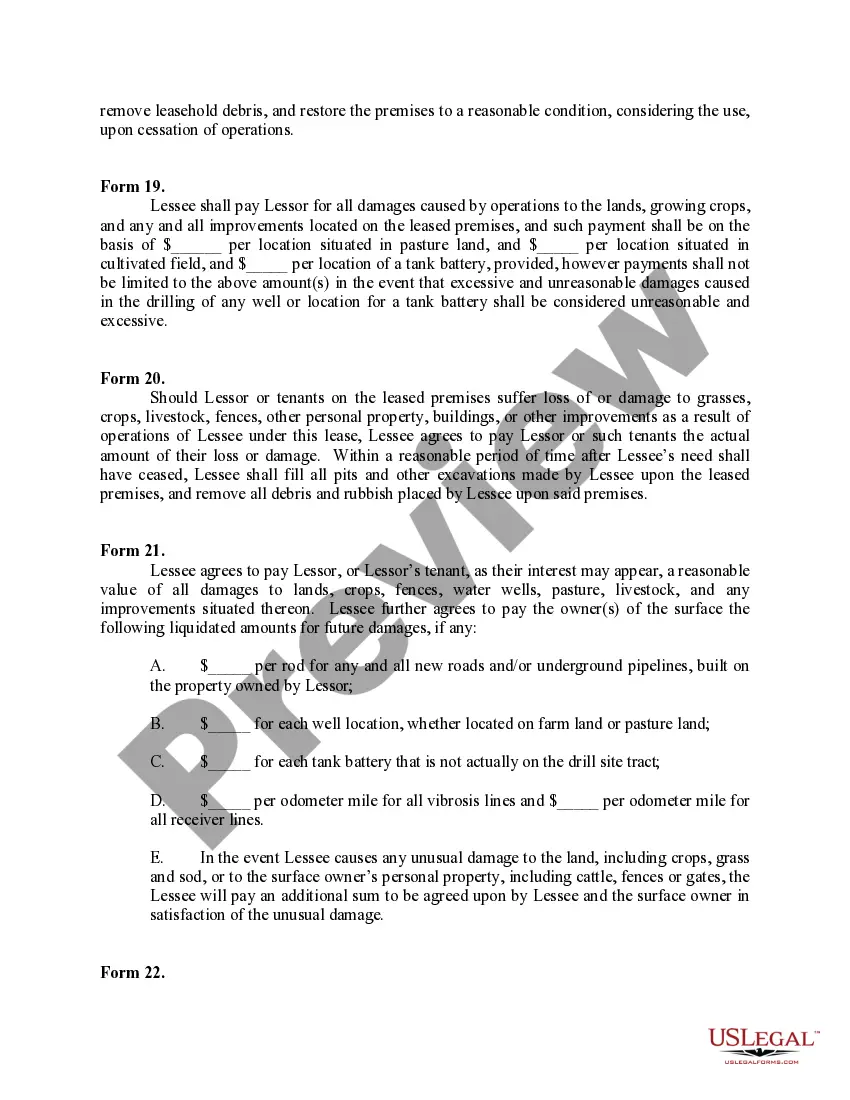

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Pennsylvania Surface Damage Payments

Description

How to fill out Surface Damage Payments?

Choosing the best legal papers format can be quite a battle. Of course, there are plenty of themes available on the Internet, but how would you obtain the legal form you need? Use the US Legal Forms internet site. The service provides thousands of themes, for example the Pennsylvania Surface Damage Payments, which can be used for business and personal requires. All of the kinds are checked out by specialists and satisfy federal and state requirements.

If you are currently authorized, log in to your accounts and click the Down load button to obtain the Pennsylvania Surface Damage Payments. Use your accounts to appear through the legal kinds you have purchased earlier. Check out the My Forms tab of your respective accounts and have one more duplicate of the papers you need.

If you are a new consumer of US Legal Forms, listed here are easy instructions for you to comply with:

- Initially, ensure you have selected the correct form for the town/county. You are able to examine the form utilizing the Preview button and read the form explanation to make sure this is basically the best for you.

- If the form will not satisfy your preferences, utilize the Seach discipline to get the correct form.

- When you are sure that the form is acceptable, go through the Purchase now button to obtain the form.

- Opt for the rates plan you would like and enter in the required info. Make your accounts and pay money for your order using your PayPal accounts or credit card.

- Select the data file formatting and obtain the legal papers format to your gadget.

- Total, change and printing and indicator the acquired Pennsylvania Surface Damage Payments.

US Legal Forms will be the most significant library of legal kinds where you can discover a variety of papers themes. Use the service to obtain expertly-manufactured papers that comply with condition requirements.

Form popularity

FAQ

This minimum royalty is guaranteed by Pennsylvania's Guaranteed Minimum Royalty Act (GMRA). Pursuant to the GMRA, an oil and gas lease is invalid unless it guarantees the landowner a production royalty of at least 12.5 percent.

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.

72 P.S. § 7303(a)(3). If a mineral rights estate owner sells the mineral rights, the consideration less the owner's basis in the mineral rights and other costs associated with the sale is taxable. The gain is reported on Schedule D of the PA-40.

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

Are Mineral Rights and Royalties Taxable? Any income you earn from the sale or lease of your land's mineral rights is taxable. Income, severance and ad valorem taxes are some of the taxes you might need to pay. Each type comes from a different entity.

72 P.S. § 7303(a)(3). If a mineral rights estate owner sells the mineral rights, the consideration less the owner's basis in the mineral rights and other costs associated with the sale is taxable. The gain is reported on Schedule D of the PA-40.

For a mineral rights sale, the capital gain would be determined based on the proceeds from the sale minus the basis assigned to the mineral rights when you purchased the land or inherited the minerals. If the value was ?0?, then the entire sales proceeds would be taxed as capital gains income.

The Internal Revenue Service (IRS) classifies all royalties earned from oil, gas, and mineral properties as taxable income. Most often, taxpayers will report royalty income on Schedule E, either as rents and royalties or working interest. Sometimes, they may opt to report it as both and do so on Schedule C.