Pennsylvania Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

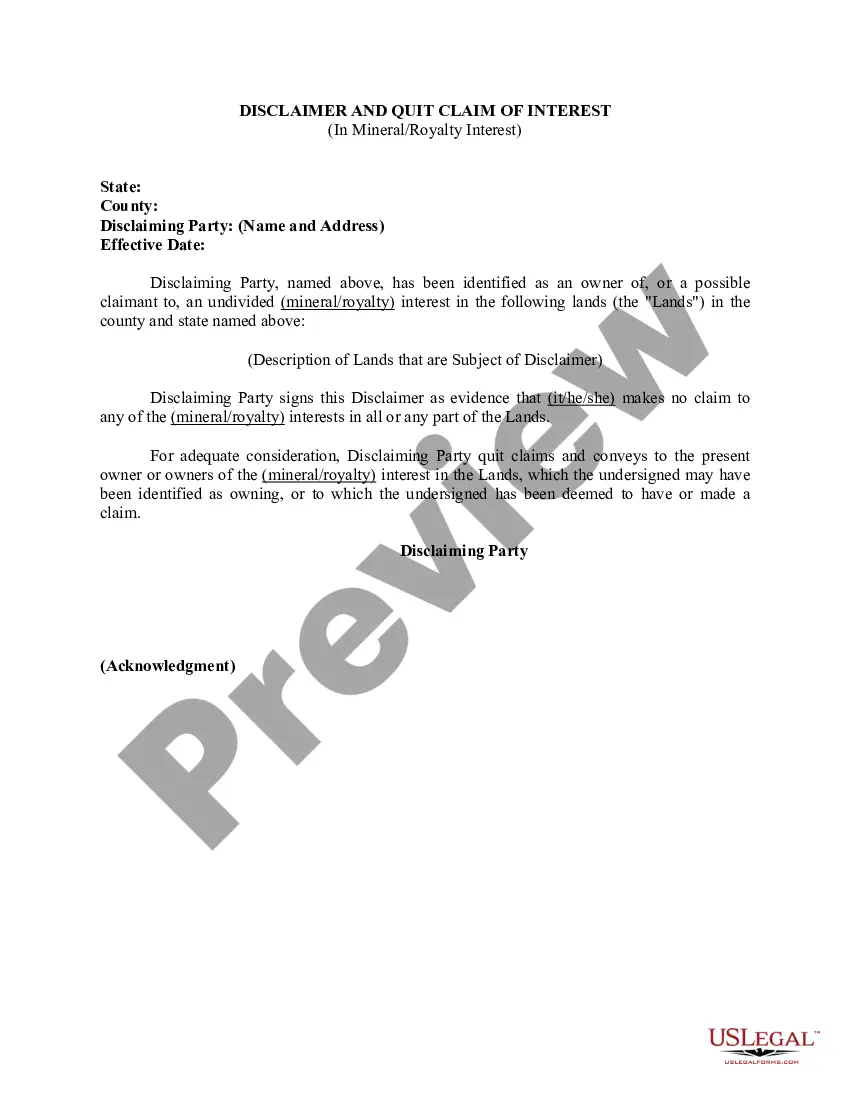

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

If you need to complete, acquire, or produce authorized file web templates, use US Legal Forms, the greatest selection of authorized types, that can be found on-line. Take advantage of the site`s basic and convenient lookup to get the files you want. Various web templates for business and personal functions are sorted by types and claims, or search phrases. Use US Legal Forms to get the Pennsylvania Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest with a few click throughs.

In case you are previously a US Legal Forms buyer, log in for your accounts and click the Acquire button to find the Pennsylvania Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest. You can even accessibility types you formerly acquired within the My Forms tab of the accounts.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the form for your appropriate area/country.

- Step 2. Use the Preview option to look through the form`s information. Never overlook to read through the information.

- Step 3. In case you are not satisfied with the type, utilize the Look for discipline near the top of the display screen to locate other versions of the authorized type format.

- Step 4. Upon having found the form you want, select the Purchase now button. Choose the costs program you favor and include your credentials to register for an accounts.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Select the file format of the authorized type and acquire it in your product.

- Step 7. Complete, revise and produce or signal the Pennsylvania Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest.

Each and every authorized file format you get is your own property for a long time. You possess acces to every single type you acquired in your acccount. Click on the My Forms area and decide on a type to produce or acquire once again.

Be competitive and acquire, and produce the Pennsylvania Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest with US Legal Forms. There are millions of skilled and condition-distinct types you can utilize for the business or personal requires.

Form popularity

FAQ

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed. Mineral Rights in Pennsylvania - Lease, Buy or Sell in PA pheasantenergy.com ? pennsylvania-mineral... pheasantenergy.com ? pennsylvania-mineral...

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate. mineral rights | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? mineral_rights cornell.edu ? wex ? mineral_rights

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated. Mineral Interest vs Royalty Interest | Texas Oil and Gas Lawyers lovell-law.net ? blog ? business-litigation lovell-law.net ? blog ? business-litigation

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage. Why Sell Your Mineral Rights - 6 Factors to Consider pheasantenergy.com ? why-sell-mineral-rights pheasantenergy.com ? why-sell-mineral-rights